USD boosted by Fed pushback against March rate cut

USD: Fed signals rate cuts are coming but unlikely as soon as March

The US dollar has continued to trade at modestly stronger levels overnight following the latest FOMC meeting which has resulted in EUR/USD falling back below the 1.0800-level. The main trigger for the stronger US dollar was the pushback from the Fed against expectations for the first rate cut being delivered as early as at the next FOMC meeting in March. Fed Chair Powell stated clearly that “I do not think it is likely that the Committee will reach a level of confidence by the time of the March meeting” to begin cutting rates. In light of the comments, the US rate market has pared back expectations for a March rate cut. Prior to last night’s FOMC meeting the US rate market was pricing in around a 50:50 probability of a March rate cut and is now pricing in around 9bps of cuts which is to just over a 1 in 3 probability. The US rate market has not gone further to more fully price out a March rate cut given that Chair Powell also added the caveat “that it is to be seen” that Fed is unlikely to have the level of confidence to begin cutting rates by March. He added that if the Fed saw an “unexpected weakening” in the labour market that would “certainly weigh” in the direction of cutting rates sooner than current plans. The comments will place even more importance on the releases of labour market data in the coming months starting with the January nonfarm payrolls report tomorrow.

The updated FOMC statement emphasized that the Fed does not expect it will be “appropriate” to reduce the target range until it has “greater confidence that inflation is moving sustainably” toward their 2.0% target. The sharp slowdown in inflation in the second half of last year which saw the core PCE deflator increase by an annualized rate of 1.9% has shifted the Fed’s assessment of meeting its employment and inflation goals that are now judged as “moving into better balance”, but Chair Powell noted the Fed wants “greater confidence” slower inflation can be sustained. The Fed just wants to see more of the same inflation data in the coming months to be confident that the slowdown in 2H of last year are “sending us a true signal”. On other hand he did not sound too concerned that the economy has not slowed more in response to higher rates. He noted that we don’t look at solid growth as a problem implying it would not derail their plans to cut rates this year. In light of all the comments, the Fed appears on track to begin cutting rates in Q2 in either May or June. A slighter later start than expected to the Fed’s rate cut cycle supports our view for a stronger US dollar in Q1 (click here).

One other focus at last night’s FOMC meeting were the Fed’s plans for quantitative tightening. Chair Powell confirmed that the Fed discussed QT at the January meeting, but indicated that updated plans for QT will only be released at the next meeting in March. The Fed is expected to announce plans to slow the current QT pace of USD95 billion/month from around the middle of this year. When asked about the ONRRP, Chair Powell said that “we wouldn’t be taking a position it has to go to zero if it were to stabilize at a different level”. At the margin a slower pace of QE would be US dollar negative development later this year.

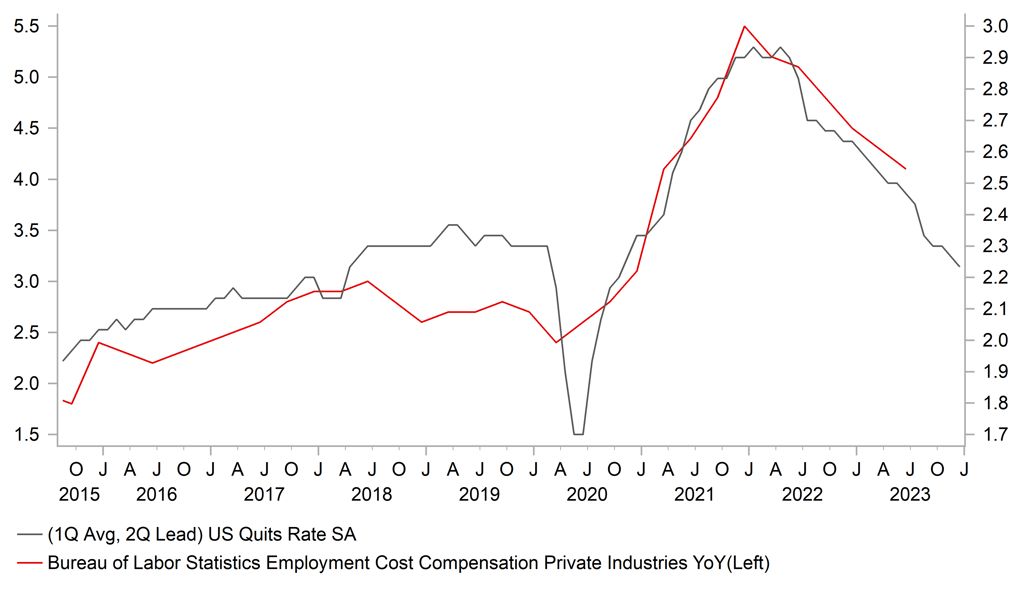

SLOWING WAGE GROWTH IS OPENING THE DOOR FOR FED CUTS

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Less hawkish BoE policy but may disappoint expectations for May cut

The Bank of England will the next major central bank to provide a policy update today. Ahead of the MPC meeting, cable has dropped back below 1.2650 driven by the stronger US dollar leg while EUR/GBP continues to trade just above support at the 0.8500-level that held last year. The BoE is expected to present a less hawkish policy update today. Firstly, we expect the hawkish dissenters at recent MPC meetings to drop their votes for a rate hike in light of slower inflation and wage data at the end of last year. It is even possible that there will be the first dissenter today in favour of a rate cut sending a signal that the path of policy is pivoting towards lower rates in the year ahead. Secondly, we expect the updated inflation forecasts to show significantly lower inflation in the near-term. Headline inflation is now expected to fall back to the BoE’s target as soon as Q2 of this year driven mainly by lower energy prices when the Ofgem cap is lowered again in April although we still expect the BoE to indicate caution over persistent inflation risks more evident in the core and services measures.

Thirdly, the improved inflation outlook is likely to prompt the BoE to drop or soften their current forward guidance that signals “further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures”. In contrast, it appears less likely that the BoE will adjust their judgement that “monetary policy is likely to need to be restrictive for an extended period”. Overall, we expect the BoE to signal that it is more confident that the rate hike cycle has ended and they are beginning to consider lowering rates in the year ahead. The UK rate market is currently pricing in around 17bps of cuts by the May MPC meeting. It is likely too soon for the BoE to send a strong signal that the first cut will be delivered in May especially with the Budget released on 6th March. It poses some modest upside risk for the pound.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

Manufacturing PMI |

Jan |

46.6 |

44.4 |

!! |

|

UK |

09:30 |

Labour Productivity |

Q3 |

-0.2% |

0.7% |

!! |

|

UK |

09:30 |

Manufacturing PMI |

Jan |

47.3 |

46.2 |

!!! |

|

US |

10:00 |

OPEC Meeting |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

CPI (YoY) |

Jan |

2.7% |

2.9% |

!!! |

|

EC |

10:00 |

EU Leaders Summit |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Unemployment Rate |

Dec |

6.4% |

6.4% |

!! |

|

EC |

11:30 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

UK |

12:00 |

BoE Interest Rate Decision |

Jan |

5.25% |

5.25% |

!!! |

|

UK |

12:00 |

BoE MPC Meeting Minutes |

-- |

-- |

-- |

!!! |

|

UK |

12:30 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

US |

12:30 |

Challenger Job Cuts |

Jan |

-- |

34.817K |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

213K |

214K |

!!! |

|

US |

13:30 |

Nonfarm Productivity (QoQ) |

Q4 |

2.4% |

5.2% |

!! |

|

US |

13:30 |

Unit Labor Costs (QoQ) |

Q4 |

1.3% |

-1.2% |

!! |

|

EC |

13:45 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

14:45 |

Manufacturing PMI |

Jan |

50.3 |

47.9 |

!!! |

|

US |

15:00 |

Construction Spending (MoM) |

Dec |

0.5% |

0.4% |

!! |

|

US |

15:00 |

ISM Manufacturing PMI |

Jan |

47.2 |

47.4 |

!!! |

|

CA |

16:30 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg