USD selling subsides after largest drop in a year

USD: Hard for USD selling to persist without slower growth

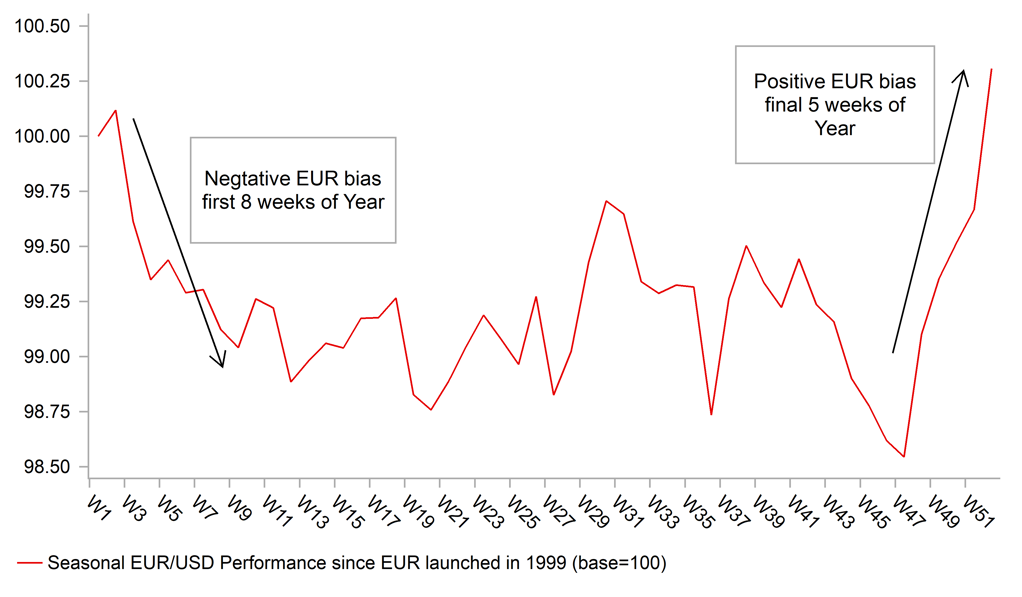

The US dollar depreciation has been substantial – we have entered the final month of 2023 and in November, like in November 2022, we had a sharp drop for the US dollar of 3.0%. In 2022 the drop in November (5.0%) was followed by a 2.3% drop in December. We can’t read too much into price action yesterday – it was month-end and often that flow is detached from the fundamental backdrop or trend – the dollar did correct modestly stronger with yields in the US higher. There is a seasonal bias that is quite compelling for EUR/USD in December – 14 Decembers from the last 20yrs have seen a higher EUR/USD with an average gain over those 14 occasions an impressive 2.6%. If we exclude December 2008 (+10.1%), the average gain over the other 13 occasions was still substantial at 2.0%. Furthermore in 8 of the 11 occasions when EUR/USD moved higher in November it was followed by a December gain.

But this doesn’t mean we can ignore the fundamentals and certainly the prospects of that seasonal bias being evident in December 2023 would be helped if we began to see US economic activity slow. Without that, investors optimism over the recent inflation declines may not persist. The jobs report next Friday will therefore be important.

The Beige Book released this week certainly contained some evidence that the economy is indeed slowing and that this could start to become more evident in the data going forward. You may recall our text analysis of the last Beige Book revealed the worst sentiment (positive references minus negative references) in regard to the US consumer since the onset of the pandemic in 2020. That indicator improved slightly in this week’s Beige Book but remained at weak levels. Our overall index (combining all our key word sentiment indicators) worsened back to levels from January this year when inflation was still weighing considerably on sentiment.

But this week’s Beige Book revealed a sharp drop in the net sentiment in regard to overall “demand” conditions, to the worst level since November last year. The net sentiment indicator in relation to housing fell to the worst since January this year while references to the labour market, which had improved through the last four Beige Books worsened sharply to the worst level since April. The labour market is possibly the most telling development here. It has certainly been the strong justification for hiking in the latter end of the tightening cycle and if we are about to see a clearer deterioration in labour market conditions that would help fuel a further bull steepening of the 2s10s US Treasury curve that tends to coincide with dollar depreciation.

AVERAGE MOVE IN EUR/USD SINCE EUR TRADING BEGAN IN 1999

Source: Macrobond

GBP: Greene stays hawkish

The shift in global sentiment in regard to inflation has not had much impact on MPC member Megan Greene who spoke yesterday and remained firmly biased in favour of having to lift the BoE’s key policy rate further. In a speech in Leeds, Greene stated that “doing too little might be a greater risk” given that inflation could persist for longer and then the BoE might have to hike even more in order to bring inflation down. Greene is also concerned that the monetary stance may not be as restrictive as assumed.

It’s hard to argue against those concerns when you consider the level of core and services inflation in the UK. While the headline rate has now dropped to a less alarming rate of 4.6%, services inflation remains very elevated at 6.6%. The BoE has cited that level as more reflective of domestically generated inflation that is more linked to the labour market. New ONS data on the labour market saw the unemployment rate drop to 3.5% which would help explain the still elevated level of wages – the 3mth annual growth rate stands at 7.9%, down only marginally from the recent peak of 8.5%.

Yesterday, the BoE released its Decision Marker Panel survey that revealed inflation expectations in 12mths at 4.4% while in 3yrs expectations were at 3.2%, both modestly lower but still elevated. Wages in the survey were estimated to grow by 5.1% over the next 12mths. The BoE are likely to remain much more concerned over domestically generated inflation than in either the US or the euro-zone. Catherine Mann recently stated that services inflation would “have to go from 6%-plus down to 3%” to get overall inflation back under control.

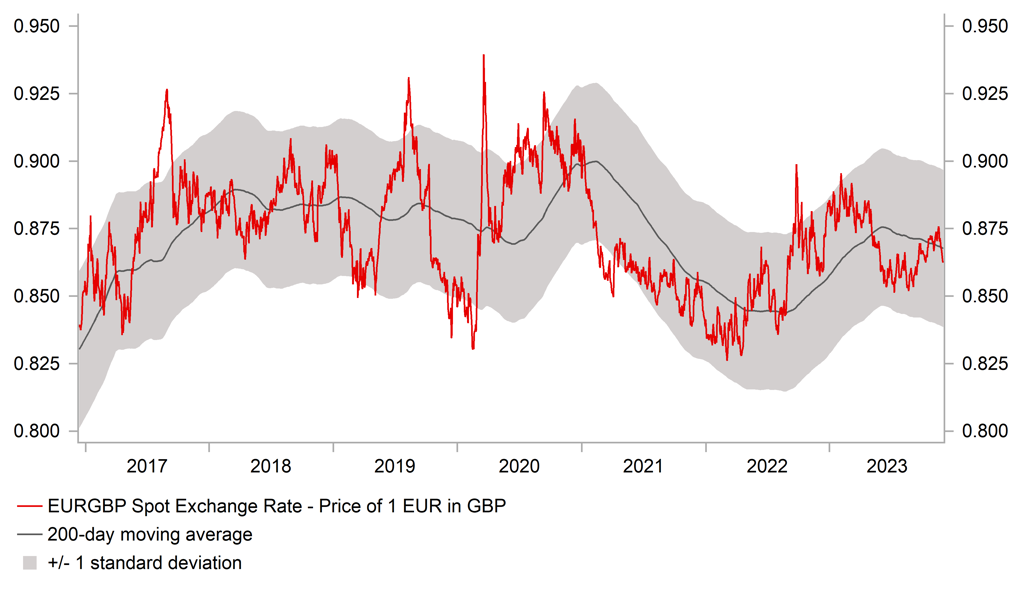

The market is now priced for the BoE to cut by 25bps in August next year which is later than both the ECB and the Fed. The shift in thinking on the ECB given the recent evidence of faster declines in inflation does leave EUR/GBP open to further falls as a divergence in inflation and therefore policy expectations widens further. EUR/GBP has dropped through its 50-day, 100-day and 200-day moving averages in the last five trading days and risks are skewed to the downside for now.

EUR/GBP VS 200-DAY MOVING AVERAGE

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

GDP (YoY) |

Q3 |

-- |

0.5% |

!! |

|

SZ |

08:00 |

GDP (QoQ) |

Q3 |

0.0% |

0.0% |

!! |

|

FR |

08:50 |

French Manufacturing PMI |

Nov |

42.6 |

42.8 |

!! |

|

GE |

08:55 |

German Manufacturing PMI |

Nov |

42.3 |

40.8 |

!! |

|

IT |

09:00 |

Italian GDP (QoQ) |

Q3 |

0.0% |

-0.4% |

! |

|

NO |

09:00 |

Manufacturing PMI |

Nov |

-- |

47.9 |

! |

|

NO |

09:00 |

Unemployment Change |

Nov |

-- |

67.78K |

! |

|

EC |

09:00 |

Manufacturing PMI |

Nov |

43.8 |

43.1 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

Nov |

46.6 |

44.8 |

!!! |

|

EC |

10:00 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

EC |

11:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

EC |

11:30 |

ECB's Enria Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

Avg hourly wages Perm. employee |

Nov |

-- |

5.0% |

! |

|

CA |

13:30 |

Employment Change |

Nov |

14.0K |

17.5K |

!!! |

|

CA |

13:30 |

Unemployment Rate |

Nov |

5.8% |

5.7% |

!! |

|

CA |

14:30 |

Manufacturing PMI |

Nov |

-- |

48.6 |

! |

|

US |

14:45 |

Manufacturing PMI |

Nov |

49.4 |

50.0 |

!! |

|

US |

15:00 |

Construction Spending (MoM) |

Oct |

0.4% |

0.4% |

! |

|

US |

15:00 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

ISM Manufacturing Index |

Nov |

47.6 |

46.7 |

!!! |

|

US |

15:00 |

ISM Manufacturing Prices |

Nov |

46.2 |

45.1 |

!!! |

|

US |

16:00 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!!! |

|

US |

16:30 |

Atlanta Fed GDPNow |

Q4 |

2.1% |

2.1% |

!! |

Source: Bloomberg