Political uncertainty is impacting euro and yen

JPY: Initial losses triggered by PM Ishiba’s resignation are quickly reversed

The yen has strengthened overnight resulting in USD/JPY falling back below the 147.00-level and moving back closer to the low from Friday after the release of the weak NFP report at 146.82. The quick reversal of the yen’s initial losses after Prime Minister Ishida’s resignation over the weekend supports our decision to maintain our short USD/JPY trade recommendation in our latest FX Weekly report (click here). We remain unconvinced that political uncertainty in Japan will prevent USD/JPY from moving lower alongside the dovish repricing of Fed rate cut expectations. Short-term yields in the US have adjusted sharply lower and are trading close to year to date lows after the NFP report for August reinforced expectations for the Fed to resume rate cuts this month. At the same time, the yen has derived some support overnight from media reports in Japan that the LDP is considering holding a full-scale leadership election on 4th October including the participation of just over 1 million rank-and-file party members according to broadcasters NHK and TBS. NHK reported that LDP officials see a need to sound out all its members and not just members of the Diet.

Holding a full-scale election would potentially help to dampen downside risks for the yen given pro-reform Agriculture minister Shinjiro Koizumi is more popular among LDP supporters than one of his main rivals to be the next LDP leader, Sanae Takaichi according to recent media surveys. A recent Yomiuri Shimbun survey from 25th August revealed that Koizumi (31%) was more popular amongst LDP supporters than Takaichi (12%) who was less popular than Ishiba (23%). She reportedly has stronger backing from lawmakers and some heavyweights within the LDP party according to Bloomberg. Apart from political uncertainty potentially delaying the timing of the BoJ’s next rate hike, the other main downside risk for the yen would be if Sanae Takaichi won the leadership vote given her strong preference for loose fiscal and monetary policies. The new LDP leader would still have to work with other parties given the government ahs lost its majority in both the upper and lower houses. Opposition parties were campaigning for looser fiscal policy in the Upper House elections so there appears to be less resistance to looser fiscal policy. A full-scale leadership election would give each of the 295 LDP parliamentary lawmakers one vote each and allocate an equal numbers of votes to party members for a total of 590 ballots. In contrast in an abridged version, lawmakers would get one vote each, while each prefectural branch would get three for a total of 436 ballots. To take part in the leadership contest, potential candidates will need to secure the backing of 20 other lawmakers.

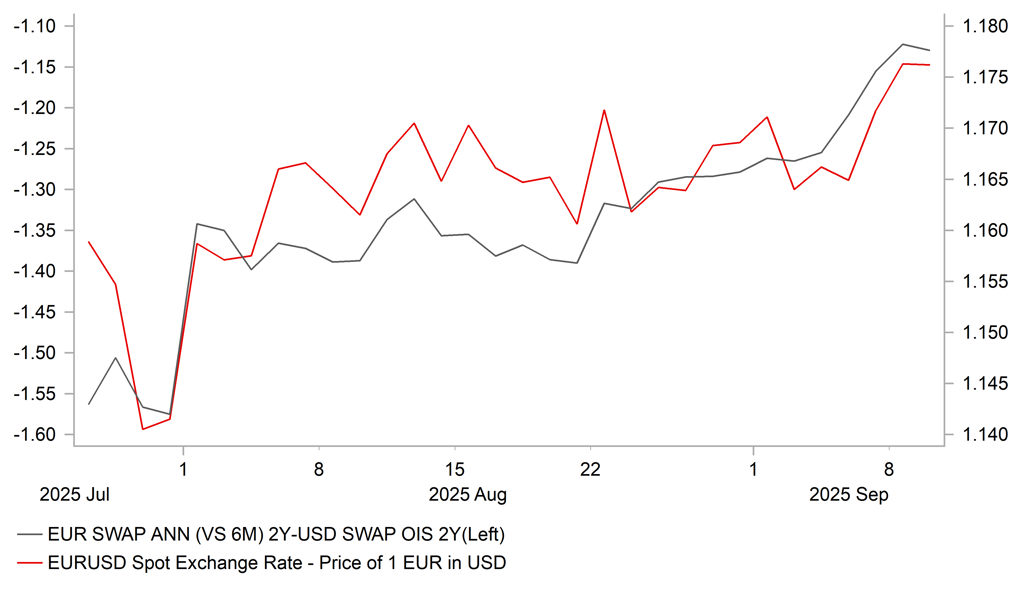

ECB & FED POLICY DIVERGENCE IS DRIVING EUR/USD

Source: Bloomberg, Macrobond & MUFG GMR

EUR: French government collapses but limited negative impact on euro

The other main development yesterday was the collapse of the French government after they lost a vote of confidence adding to political uncertainty. There were 364 votes against the government compared to only 194 votes in favour. However, the financial market impact has been muted as the defeat for the government was widely expected. The 10-year yield spread between French and German government bonds has widened by around 6bps but is still around 5bps below the high from late last year just before the Barnier government collapsed. In the FX market, there has been no negative spill-overs for the euro which has continued to strengthen against the US dollar resulting in EUR/USD moving closer to the year to date high of 1.1829 from 1st July.

President Macron now has the sole responsibility for picking the new premier, and there is no constitutional time limit for a decision. For comparison, it took President Macron two month to appoint former Prime Minister Michel Barnier and just over a week to name current Prime Minister Francois Bayrou. President Macron is now seeking his fifth prime minister in less than two years. Reports suggest that President Macron is reluctant to call a snap parliamentary election to break the deadlock. According to Bloomberg, that leaves President Macron with a number of options including: i) picking another centrist like PM Bayrou such as Defence Minister Sebastien Lecornu, ii) picking from the left such as Socialist leader Olivier Faure and ii) picking a technocrat such as French central bank governor Francois Villeroy de Galhau. While the political uncertainty is an unfavourable development we continue to believe that it is unlikely to be sufficient on its own to trigger a weaker euro.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

11:00 |

NFIB Small Business Optimism |

Aug |

100.5 |

100.3 |

!! |

|

GE |

12:30 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

SZ |

12:50 |

SNB Vice Chairman Schlegel Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Payrolls Benchmark, n.s.a. |

-- |

-- |

-598.00K |

!!! |

|

UK |

16:15 |

BoE Breeden Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com