Trade de-escalation optimism after UK-US deal ahead of US-China talks

USD: Trade optimism lifts sentiment and the dollar

The confirmation yesterday that the US and the UK have reached a trade deal that will see the UK auto-sector benefit from a reduction in the tariff rate from 27.5% to 10% according to the UK government website. The quota of 100k auto exports to the US is almost the total exported to the US last year. The UK has also done well with steel & aluminium tariffs reduced from 25% to zero percent. There will also be a new reciprocal market access for beef and adds to the positive sentiment after the UK-India trade deal was announced. The details of this US deal still need to be agreed but investors have certainly taken this as the start of a number of trade deals, which in turn will reduce the risks associated to the end of the suspended reciprocal tariff rates due to go live again on 9th July. The bigger development may well end up being Trump’s signal that a deal could be reached with China and that he thinks “it’s going to be substantive”. The US trade delegation will meet with China over the weekend so there is a good prospect for this better risk sentiment, higher equities and a stronger US dollar could extend into the close of the week.

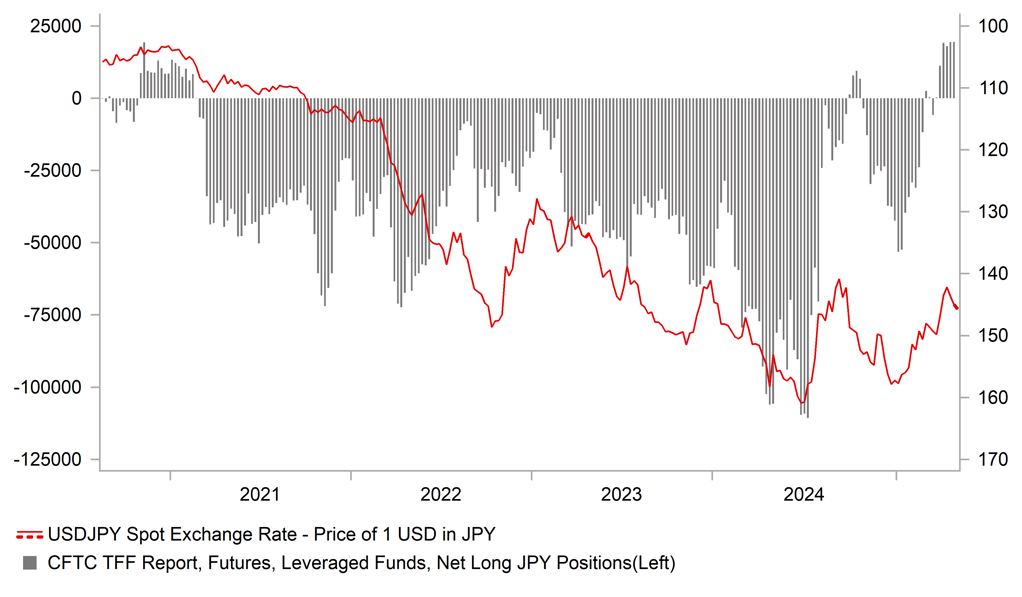

In terms of broader G10 FX performance, the moves we have had on increased optimism of trade tariff de-escalation is exactly as you would expect. JPY and CHF were the worst performers yesterday while GBP, AUD and NZD were the next best performers after the US dollar. High-beta global growth sensitive currencies like trade tariff de-escalation and with the 2-year UST bond yield up 10bps yesterday and the S&P 500 up by 0.6%, the underperformance of the yen is no surprise although it has rebounded modestly today.

But it is not all good news in relation to trade and hence we wouldn’t be surprised for this market move to peter out relatively soon. Trump yesterday spoke of 10% being “probably” the lowest tariff rate for the UK but some countries “will be much higher because they have massive trade surpluses”. So that certainly points to plenty of countries having to deal with increases from the 9th July, including the EU, which would mean an increase to 20%. A reduction for China even to 60% and others at a rate in between that and the 10% floor for all other countries is still more like worst case scenarios prior to 2nd April.

The aftermath of the FOMC meeting certainly also played a role in this move given the caution expressed over lowering rates in a climate of trade uncertainty. Trump’s words yesterday may have indicated we are moving to a better place for global and US growth but his words also suggested trade uncertainty would remain high. That means, in our view, that there will be limits to this US dollar recovery with damage to the US economy likely to become more evident in US economic data.

JPY LONG POSITIONING GIVES SCOPE FOR RENEWED DEPRECIATION

Source: Bloomberg, Macrobond & MUFG GMR

CNY: Trade data shows plunge in exports to US

China released trade data for April today and there was an impressive 8.1% YoY increase in exports while imports fell a modest 0.2%. As a result, China continued to run a large trade surplus, totalling USD 96.2bn, down from USD 102.6bn in March. Year-to-date, China’s trade surplus totalled USD 369bn, some 45% higher than in the same period last year. Within the data we saw clear evidence of the impact of Trump’s tariffs on China with exports to the US down a huge 21%. Tariffs on US imports into China resulted in a 14%. But given the overall increase in exports China has managed to lift export growth in many other countries. Exports to Asean countries jumped by 20% while exports to the EU jumped by 8%. This data only captures the very early stages of the trade war and hence we are likely to see more pronounced declines in exports to the US over the coming months.

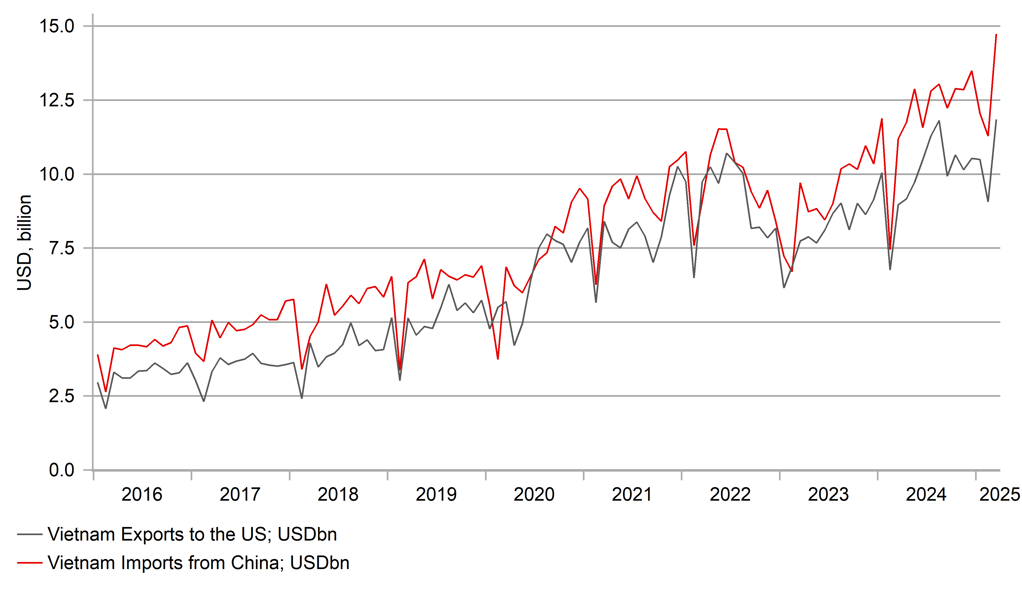

The data showing this shift in exports from China will no doubt have been noted in Washington and it certainly reinforces the prospect of the reciprocal tariff plans going live on 9th July for some countries. Vietnam’s surging imports from China and exports to the US leaves it a prime target for reciprocal tariffs. The latest data from Vietnam shows a record USD 14.7bn of imports from China in March and in addition a record total for exports to the US of USD 11.85bn. The Trump administration proposed a reciprocal tariff rate of 46% for Vietnam.

The other potential consequence going forward if the shift in trade flows seen in April was to continue could be for monetary policy in the euro-zone. The initial evidence does appear to back up the case that for the euro-zone there could be a deflationary hit from an increase in the supply of goods as exporters are forced to shift away from the US. Of course how the EU retaliates if on 9th July the 20% reciprocal tariff rate is implemented will be important as well but an increase in the supply of goods from Asia certainly seems more plausible now. That raises the prospect of the ECB meeting our call of cutting to 1.50% by year-end.

China’s ability to shift trade flows quickly if it continues is also supportive for CNY. That record size trade surplus can act as a key supportive flow for CNY at a time when trade uncertainty is high. The CFETS RMB index is now down close to 6% since the start of the year which will also act to help China compete in foreign markets.

VIETNAM IMPORTS FROM CHINA VERSUS VIETNAM EXPORTS TO THE US

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Mar |

0.4% |

-0.9% |

! |

|

UK |

09:40 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!!! |

|

CH |

10:00 |

M2 Money Stock (YoY) |

Apr |

-- |

7.0% |

! |

|

CH |

10:00 |

New Loans |

Apr |

-- |

3,640.0B |

!! |

|

CH |

10:00 |

Outstanding Loan Growth (YoY) |

Apr |

-- |

7.4% |

! |

|

CH |

10:00 |

Chinese Total Social Financing |

Apr |

-- |

5,890.0B |

! |

|

US |

11:15 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

|

US |

11:45 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

!! |

|

UK |

12:15 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!!! |

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

Apr |

-- |

0.6% |

!! |

|

US |

13:00 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

Avg hourly wages Permanent employee |

Apr |

-- |

3.5% |

! |

|

CA |

13:30 |

Employment Change |

Apr |

4.1K |

-32.6K |

!!! |

|

CA |

13:30 |

Unemployment Rate |

Apr |

6.8% |

6.7% |

!! |

|

US |

15:00 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

US |

16:30 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

US |

16:30 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Investing.com