USD vulnerable to further weakness after NFP fails to provide lasting support

USD: Higher US yields post-NFP fail to provide support for stronger USD

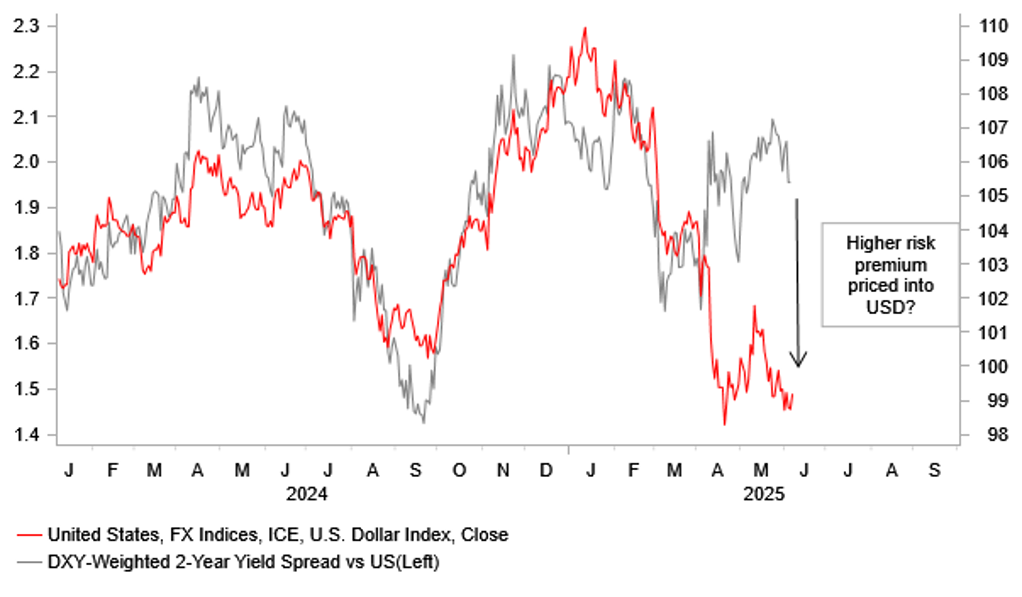

The US dollar has started the week on a softer footing giving back some the gains recorded at the end of last week following the release of the stronger than expected nonfarm payrolls report. The dollar index initially rose to a high of 99.357 following the release of the nonfarm payrolls report for May but has dropped back below the 99.000 where it was trading prior to the release. In contrast, short-term US yields continue to trade at higher levels highlighting again that the traditional relationship between yield spreads and US dollar performance has broken down recently. The 2-year US Treasury yield rose initially by around 13bps after the nonfarm payrolls report was released and remains around 10bps higher. Market participants have pared back expectations for Fed rate cuts after the nonfarm payrolls report revealed that the US labour market is not loosening sufficiently at the current juncture to make the Fed seriously consider resuming rate cuts at upcoming FOMC meetings in June and July. There are now only around 4bps of cuts priced in by the July FOMC meeting and 18bps by the September FOMC meeting.

The hawkish repricing was triggered by the nonfarm payrolls report revealing that the US economy added 139k jobs in May although that was offset by further downward revisions to employment growth in prior months totalling -95k. In the first five months of this year the US economy has added on average 124k jobs/month compared to 144k/month in 2024. Employment growth is slowing in response to trade disruption and heightened policy uncertainty but is not yet judged likely to prompt he Fed to resume rate cuts soon. Even as employment growth has been slowing this year, the unemployment rate has continued to remain stable between 4.0% and 4.2% as it has done since the middle of last year indicating that the labour market is not loosening enough to offset upside risks to inflation in the near-term from higher tariffs. Tighter immigration policies at the start of Trump’s second term could be slowing labour supply growth and setting a higher bar for the unemployment rate to rise in the near-term. The tighter immigration policies have also triggered social unrest over the weekend in Los Angeles which could contribute to a further loss of confidence in the US dollar. Overall, we still expect the US labour market to weaken further opening the door for the Fed to resume rate cuts in the 2H of this year and supporting our forecasts for further US dollar weakness (click here). However, it appears more likely that the Fed will wait at least until September to resume rate cuts unless the release of the nonfarm payrolls report for June reveals a much sharper slowdown in employment growth.

RELATIONSHIP BETWEEN YIELD SPREADS & USD HAS BROKEN DOWN

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Will recent yen weakness persist amidst improvement in risk sentiment?

The move higher in US yields and ongoing improvement in global investor risk sentiment initially helped to lift USD/JPY back above the 145.00-level although it has since dropped back towards the 144.00-level. So far this month it has been one of the weakest G10 currencies alongside the other traditional safe haven currency of the Swiss franc reflecting building investor optimism that the hit to the global economy from trade disruption will be less than initially feared. The delayed implementation of higher “reciprocal” tariffs including on goods imported from China, and recent judgement from the US Court of International trade that the “reciprocal” and fentanyl tariffs are illegal have boosted investor risk sentiment. It has helped to lift MSCI’s ACWI global equity index to record highs over the past week extending its advance since the low in April after President Trump’s Liberation Day tariffs announcement to almost 24%.

Yen selling at the end of last week could also have been encouraged by reports that the BoJ is considering reducing the pace of reduction in monthly purchases to a level between JPY 200bn-400bn at next week’s BoJ policy meeting. While this is possible we could see the BoJ maintain the pace but communicate a greater willingness to be flexible – the key according to Governor Ueda was that cuts balanced “predictability and flexibility”. Any communication by the BoJ could emphasise the bias to slow the pace if required. In any case, market participants also see the MoF as another avenue for helping rectify the supply/demand imbalance in super-long JGBs. The MoF in issuance plans already published revealed a JPY 1.2trn cut in issuance for both 30yr and 40yr JGB issuance with 5-year issuance increased along with t-bill issuance. Further adjustments could be made. Foreign investors have been key buyers in super-long JGBs and after four weeks of selling of total JGBs, weekly MoF data yesterday revealed a notable return to buying last week, totalling JPY 1,165bn.

We see the BoJ as likely turning more hawkish if global financial market conditions remain more favourable after the notable improvement following the de-escalation of trade tensions. The US Treasury has called on Japan to run a tighter monetary stance in order to strengthen the undervalued yen. Scott Bessent has consistently cited the BoJ as the reason for yen undervaluation. While that alone would unlikely result in a shift in BoJ policy, the inflation backdrop likely increasingly will. Household spending fell 0.1% YoY in April with the breakdown indicating higher cost of living is eroding non-essential spending. While food inflation has slowed it remained at 6.5% YoY in April with rice prices up 98.4%. YoY Services PPI also remains elevated at 3.1%. The BoJ will also not want to see JPY depreciation given the risks of an FX move feeding further super-long JGB instability that in turn would lead to possible complaint by the US. We see current USD/JPY levels post-NFP data as close to peaking with scope building for another sustained move back toward the 140.00-level. Please see our latest FX Weekly (click here) for more details.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:40 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

CH |

16:46 |

FX Reserves (USD) |

May |

-- |

3.282T |

! |

Source: Bloomberg & Investing.com