Copper tariff signalled underlining rising risks in coming weeks

USD: Copper tariff raises inflation risks

Copper futures in the US surged 13.5% yesterday as President Trump turned his attention to tariffs on copper and possibly pharmaceuticals. It was a record jump and a record closing high underlining the potential feed-through into inflation going forward. As is often the case with announcements from Trump, there is a lack of detail in terms of what form of copper would this cover and how quickly this tariff would be implemented. Details will of course follow but this scale of increase (50%) is above market expectations and we don’t believe we have seen the full impact of this yet. Market participants will be reluctant to trade the inflation implications of this until further details are made available. Pharma tariffs could also be coming while President Trump yesterday indicated on Truth Social that 7 additional reciprocal tariff letters would be sent early today with more letters later today.

So Trump is not letting up and while Trump has thread a little more carefully on implementing his reciprocal tariff plans, he has been more willing to act aggressively on sector-specific trade policies. These investigations on copper and pharma were done under Section 232 and hence the Trump administration will be on stronger legal ground implementing these tariffs. A 50% tariff will be most impactful on Chile and Canada – those two countries make up a little over 75% of all imported copper to the US. Approximately 45% (US geological survey) of copper consumption in the US is imported underlining the inability to shift away from imported and soon to be highly tariffed imported copper. This will be a negative for US industry and for US consumers with inflation creeping into products in many sectors – including construction, electronics and autos. The US Treasury market has not yet seen much move higher in yields but the risks are certainly skewed that way.

These tariff steps being taken are coming at the same time as criticism of Fed Chair Powell is increasing. Trump stated that Powell is “whining like a baby” about inflation and that he should cut rates. He also added that Powell should resign if he misled Congress over renovation works at the Federal Reserve. The Head of the Federal Housing Finance Agency, Bill Pulte, has called for Congress to formally investigate Powell over the allegations.

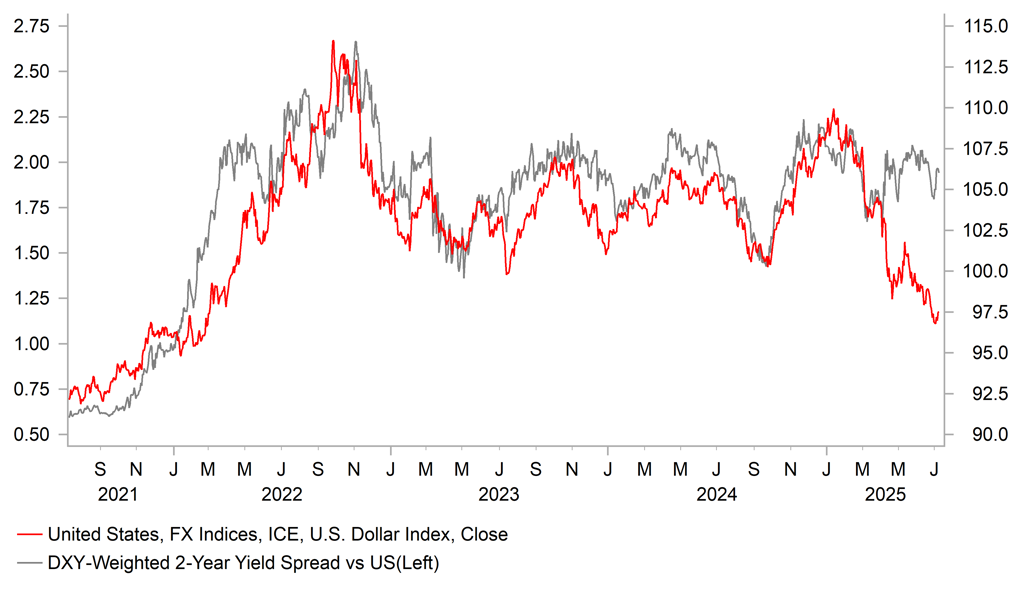

These developments are all factors that have been undermining investor confidence over recent months. The US dollar had its worst H1 performance on record so the lack of reaction in FX to these developments does suggest for now at least that markets are much better positioned than at the start of this year. It’s why we are forecasting a far more modest dollar decline in H2 (-2%) than the 10.7% drop in H1.

WORST US DOLLAR PERFORMANCE IN H1 ON RECORD (-10.7%)

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Fiscal risks building says OBR

We suspect the performance of the pound could be turning and believe the outlook has worsened with increased risks of a period of underperformance ahead. The pound is showing signs of lagging and is currently the third worst performing G10 currency in July. We will start to see an increase in the monthly flow of UK economic data from Friday when we have the GDP data for May along with manufacturing activity and trade. The 0.3% GDP contraction in April along with the 109k plunge in PAYE employment plus a much weaker retail sales report underline the prospect of a sharp slowdown in Q2 GDP after the 0.7% Q/Q gain in Q1. The 6-3 vote to maintain an unchanged policy at the June MPC meeting also shows the BoE could be more open to a faster pace of rate cuts if the current weak momentum continues.

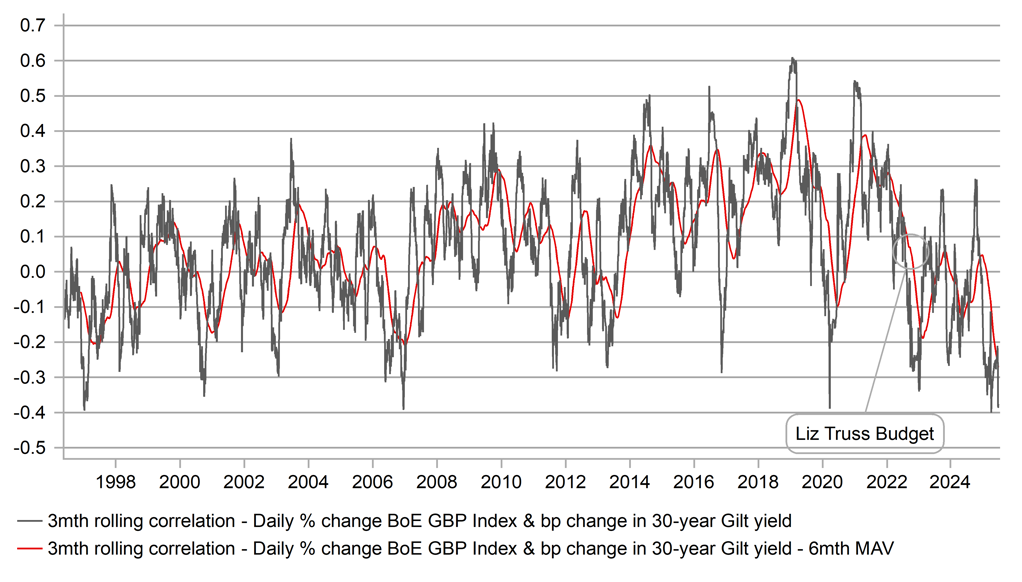

There has also been signs of instability in the Gilt market and we have highlighted before (chart above), there has been a steady negative correlation between GBP performance and the direction of long-term Gilt yields underlining the negative investor sentiment toward the Gilt market.

That won’t have been helped by the release yesterday of the Office of Budget Responsibility (OBR) report on the annual Fiscal Risks and Sustainability. Each year the OBR address certain themes impacting fiscal sustainability risks and this year one aspect looked at was the changing pension industry that are a negative for the Gilt market. The executive summary opens with some grim facts that underline the potential for further market disruptions given the sensitivity of investors to any bad news on the fiscal outlook. At 5.7% of GDP at the end of 2024, the UK’s budget deficit was 4.0ppts higher than the advanced-economy average and was the fifth highest (after only France, Slovakia, the US and Israel). With the 10-year Gilt yield at 4.5% at the end of H1 2025, the UK government faces the third highest borrowing costs of any advanced economy after New Zealand and Iceland. One of the conclusions related to the pension industry is that the shift from Defined Benefit schemes to Defined Contributions will mean over time that pension holdings of Gilts will drop from around 30% of GDP to about 10% in the 2070s.

Nearer term, the UK government has got itself into a fiscal mess. The election promise not to raise taxes on “working people” meaning no tax increases on income, national insurance or VAT was a big mistake in hindsight and will likely be broken in order to fill the estimated GBP 25bn fiscal hole. Without a credible big step measure (a wealth tax and/or a freeze on income tax thresholds are rumoured) a credibility gap will persist and risk further dangerous market disruptions. Sharp Gilt sell-offs, like recently, will be pound negative and potentially very disruptive. Action to address the fiscal hole will ultimately prove pound negative also but will be less disruptive and more palatable. In that scenario big tax increases into an already slowing economy will encourage a faster pace of rates cuts from the BoE. Either way, the risks for the pound are shifting and the outlook is worsening – we see long EUR/GBP as a good way to position for this scenario – as was highlighted in our latest FX Weekly (here).

GBP / 30-YEAR GILT YIELD CORRELATION HAS NEVER BEEN SO NEGATIVE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

10:30 |

10-Year Treasury Gilt Auction |

-- |

-- |

4.588% |

!!! |

|

UK |

10:30 |

BoE Financial Stability Report |

-- |

-- |

-- |

!! |

|

UK |

10:30 |

BoE FPC Meeting Minutes |

-- |

-- |

-- |

! |

|

EC |

11:45 |

ECB's Lane Speaks |

-- |

-- |

-- |

!!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

2.7% |

! |

|

EC |

12:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Wholesale Inventories (MoM) |

May |

-0.3% |

0.1% |

! |

|

US |

15:00 |

Wholesale Trade Sales (MoM) |

May |

-- |

0.1% |

! |

|

US |

16:00 |

Thomson Reuters IPSOS PCSI |

Jul |

-- |

53.36 |

! |

|

CA |

16:00 |

Thomson Reuters IPSOS PCSI (MoM) |

Jul |

-- |

48.82 |

! |

|

US |

18:00 |

10-Year Note Auction |

-- |

-- |

4.421% |

!!! |

|

US |

18:00 |

Atlanta Fed GDPNow |

Q2 |

2.6% |

2.6% |

!! |

|

US |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

-- |

!!!! |

Source: Bloomberg & Investing.com