Weak US employment growth & political uncertainty in focus

USD: Another weak NFP report supports more active Fed easing

The US dollar has continued to trade at weaker levels following the release of another weak nonfarm payrolls report on Friday. It has resulted in the dollar index falling back below support at the 98.000-level although the negative impact on the US dollar is more modest than implied by the drop in short-term US yields. The 2-year US Treasury yield has dropped sharply by around 7bps since the release of the nonfarm payrolls report on Friday moving back closer to the year to date low from April of 3.43%. The weak nonfarm payrolls report for August has reinforced expectations that the Fed will resume cutting rates this month, and has even encouraged expectations that they could begin with a larger 50bps rate cut similar to last September. The US rate market is currently pricing in around 28bps of rate cuts for this month’s FOMC meeting and 69bps of cuts by December indicating that market participants are now more confident that the Fed will cut rates at every remaining policy meeting this year. The Fed had already signalled it was becoming more concerned by downside risks to the US labour. Those concerns will have been heightened by the August employment report revealing that the US economy added only 22k jobs in August. More worrying for the Fed, the US economy lost -13k jobs in June after further downward revisions to prior months.

There is clear evidence that the US labour market deteriorated sharply after President Trump’s Liberation Day tariffs announcement in April. In the four months after the announcement, employment growth has slowed to an average of around 27k/month which compares to an average of around 123k/month in the first four months of this year. While the worst point of the negative shock may now have passed in May/June, it is still not clear that the US labour market is recovering after only 22k jobs were added in August. It is increasing pressure on the Fed to bring the policy rate back closer to their estimate of the neutral rate at closer to 3.00% despite upside risks to inflation in the near-term from the tariffs. More active Fed easing at a time when other major central banks such as the ECB and BoE have recently become more cautious/reluctant to cut rates further should result in yield spreads narrowing with the US, and encouraging the US dollar to weaken further. We expect the ECB to leave rates on hold this week for the second consecutive meeting. The ECB staff forecasts for GDP and inflation are expected to reveal modest upward revisions. The ECB have recently signalled that there is a higher hurdle for further rate cuts although we don’t expect the ECB to signal as soon as this week that their rate cut cycle has now ended. Policy divergence between the ECB and Fed heading into year-end supports our forecast for EUR/USD to rise back above the 1.2000-level. We are not expecting the pick-up in political uncertainty in France to derail the euro’s current upward trend and/or encourage the ECB to cut rates further at the current juncture. The French government appears likely to lose the vote of confidence today.

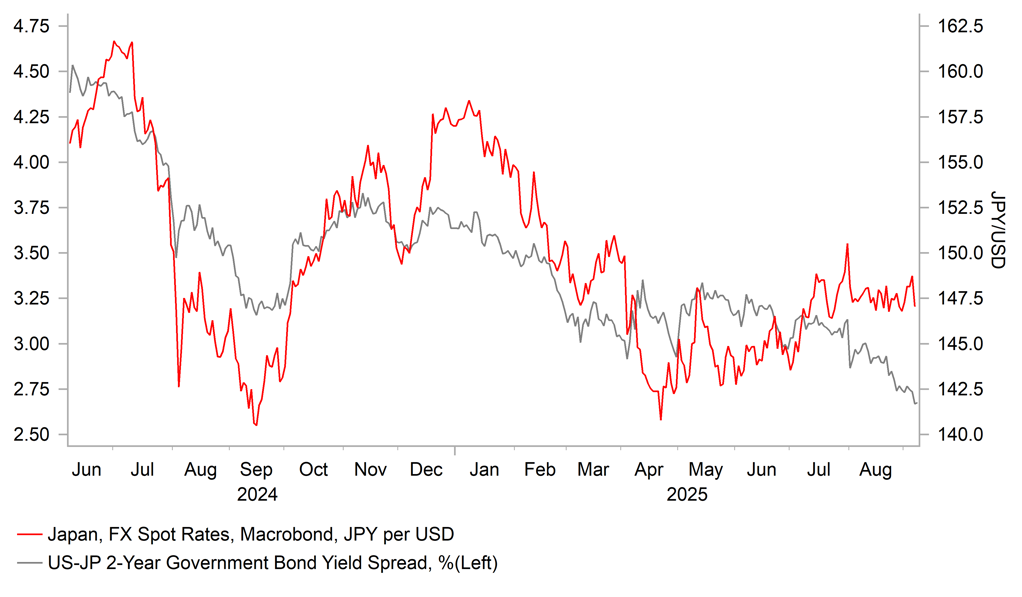

USD/JPY HAS NOT BEEN TRACKING US YIELDS LOWER

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Heightened political uncertainty in Japan weighs on JPY

The yen has quickly given back all of its initial NFP gains against the US dollar at the start of this week following Prime Minister Ishiba’s resignation over the weekend which has heightened political uncertainty in Japan. USD/JPY tracked short-term US yields lower and hit a low of 146.82 on Friday afternoon but has since risen back above the 148.00-level. The LDP was set to hold a vote today on whether to hold an early leadership contest, but Prime Minister Ishiba decided to resign in advance after holding talks with agriculture minister Shinjiro Koizumi and former prime minister Yoshihide Suga. Prime Minister Ishiba stated that “having seen the US trade negotiations through, I felt that now is the right time to stand down and give way to my successor”. He plans to stay on as prime minister until his successor takes over.

The LDP will now discuss how to choose a new leader. Bloomberg is reporting that the LDP will hold a meeting tomorrow to discuss whether to hold a simplified election that could be held within 2-3 weeks or a full-scale election including party members outside of the Diet that would take about a month to organise. With political uncertainty in Japan set to persist at least into early October, it will dampen market expectations for the BoJ to resume rate hikes a soon as at the October policy meeting. There are now only 5bps of rate hikes priced in for the October policy meeting compared to 13bps over a week ago which is putting a dampener on yen performance in the near-term.

Market attention will now switch to who are the likely candidates to replace Prime Minister Ishiba. The media has reported several names as potential successors including Agriculture Minister Shinjiro Koizumi, former Minister for Economic Security Sanae Takaichi, Chief Cabinet Secretary Yoshimasa Hayashi, former Minister for Economic Security Takayuki Kobayashi, and former LDP Secretary General Toshimitsu Motegi. Each potential candidate will need support from at least 20 other members of parliament to enter the leadership contest. Our analysts in Tokyo has noted that Sanae Takaichi may face a harder task to reach 20 endorsements given 9 out of her 20 endorsers from the last election have since lost their seats in parliament

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:30 |

Sentix Investor Confidence |

Sep |

-2.2 |

-3.7 |

! |

|

US |

15:00 |

CB Employment Trends Index |

Aug |

-- |

107.55 |

! |

|

US |

20:00 |

Consumer Credit |

Jul |

10.40B |

7.37B |

! |

|

NZ |

23:45 |

Manufacturing Sales Volume (QoQ) |

Q2 |

-- |

2.4% |

! |

Source: Bloomberg & Investing.com