FX market weighs up shorter US tariff deadline extension

JPY: Extending US trade policy uncertainty weighs more on yen

The yen has weakened sharply at the start of this week resulting in USD/JPY rising back above the 146.00-level yesterday following President Trump’s decision to send a letter to Prime Minister Ishiba informing him that he plans to impose a 25% tariff on goods imported from Japan from 1st August. The new tariff rate was similar to the rate announced back on Liberation Day in early April which had been suspended for 90-days until 9th July. Yesterday’s announcement effectively represents another shorter delay as President Trump attempts to increase pressure on trading partners to make concessions in order to reach trade deals before the new deadline of 1st August. Letters informing trading partners of the new tariff rates were also sent out to other trading partners including South Korea (25%), South Africa (30%), Malaysia (25%), Indonesia (32%) and Thailand (36%). The new tariff rates were again similar to the Liberation Day announcement. At the end of each letter President Trump stated that “these tariffs may be modified, upward or downward, depending on our relationship with your Country. You will never disappointed with the United States of America”. It leaves the door open for countries to negotiate better deals before the tariffs are due to be implemented on 1st August.

When asked by reporters about whether the new 1st August deadline was firm President Trump replied that “I would say firm but not 100% firm. If they call up and they say we’d like to do something a different way, we’re going to be open to that. But essentially that’s he way it is right now”. The comments will also provide encouragement that the tariff deadline could be extended for a third time. It helps to explain why the initial market reaction to the tariff letters has been relatively muted. Some Asian currencies are even trading at stronger levels against the US dollar, Market participants are just viewing the letters as another shorter extension of the “reciprocal” tariff delay until 1st August or beyond to allow more time to reach deals with other trading partners. The yen had already been weakening ahead of the tariff letters after weak wage data from Japan encouraged market participants to further push back expectations for BoJ rate hikes. An extension to tariff uncertainty for Japan will continue to contribute to BoJ caution weighing on the yen in the near-term.

At the same time, there have encouraging signs that India and the EU are close to reaching trade deals with the US to avoid higher tariffs. President Trump stated yesterday that “we’re close to making a deal with India”. Bloomberg has reported that the EU is seeking to conclude a preliminary trade deal this week that would allow it to lock in the lower 10% tariff beyond the new 1st August deadline as they continue to negotiate a permanent agreement. The EU is also seeking an exemption from the 10% tariff rate for certain key products including aircrafts, aircraft parts as well as wine and spirits. Furthermore the EU is reportedly pushing the US for quotas and exemptions to effectively lower the 25% tariff that currently applies to autos and parts as well as the 50% tariff for steel and aluminium. A potential deal that sounds similar to the one agreed recently by the UK.

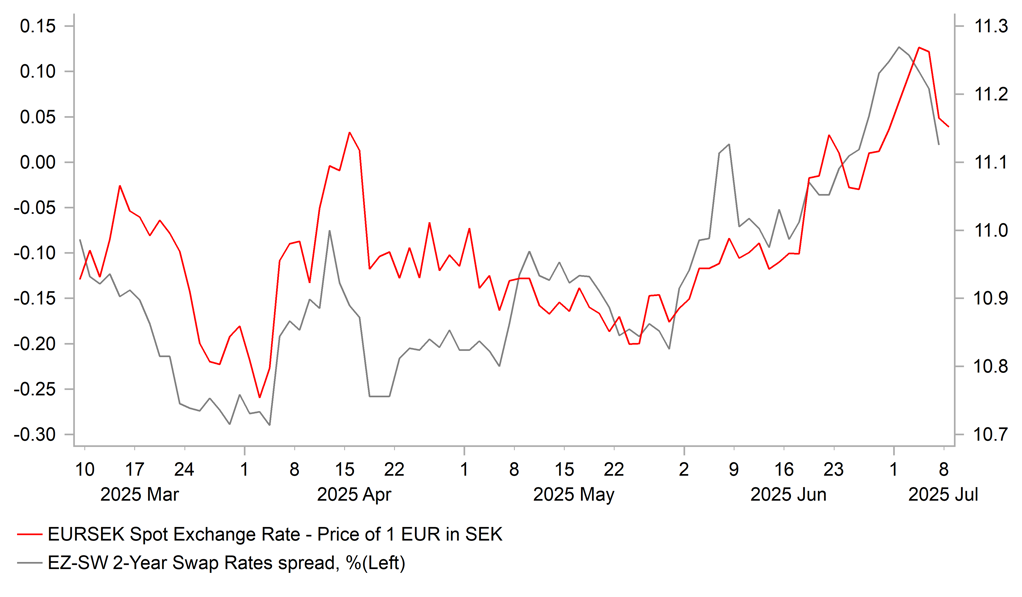

SEK OUTPERFORMS AFTER STRONGER SWEDISH CPI REPORT

Source: Bloomberg, Macrobond & MUFG GMR

AUD & SEK: Hawkish repricing of RBA & Riksbank expectations provides boost

The top performing G10 currency overnight has been the Australian dollar highlighting that the latest US trade policy developments have not significantly undermined global investor risk sentiment. Market participants remain optimistic that trade deals will eventually be reached to help dampen the impact of higher tariffs. Domestic developments have also been favourable for the Australian dollar overnight after the RBA unexpectedly decided to leave rates on hold at 3.85%. The Australian rate market had been almost fully pricing in another 25bp rate cut as of yesterday so it was a big surprise to leave rates on hold. The yield on the 2-year Australian government bond initially jumped by almost 10bps after the policy decision which helped to lift AUD/USD up to a high of 0.6558 from around 0.6510 prior to the announcement. The decision to leave rates on hold was not unanimous. There were 3 dissenters who voted for the rate cut today while 6 members voted to leaves rates on hold.

In the accompanying press conference, Governor Bullock emphasized that today’s decision was more about “timing” rather then direction indicating that they will continue to lower rates in a “sensible, cautious way”. The RBA wants to be more confident that it has “nailed” inflation and is waiting to confirm that inflation is sustainably on track to their 2.5% target. As a result, the RBA judged that they could wait for more information to confirm inflation. The next RBA policy meeting is on 12th August and by that time the Australian CPI report for Q2 will have been released which without any major upside surprises should allow the RBA to resume rate cuts next month.

Elsewhere, there was a big upside inflation surprise yesterday in Sweden which has killed expectations for another rut cut from the Riksbank as soon as next month. The release of the latest CPI report from Sweden revealed that core inflation (CPIF excluding energy) jumped to 3.3% in June up from 2.5% in May. The Riksbank will now have to wait for confirmation as to whether the pick-up will prove temporary before considering cutting rates again to support the weak economic recovery in Sweden. The hawkish repricing of Riksbank expectations has helped to prevent EUR/SEK from breaking above resistance from the 200-day moving average at just above the 11.200-level. Please see our latest FX Weekly (click here) for more details on Scandi FX.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

11:00 |

NFIB Small Business Optimism |

Jun |

98.9 |

98.8 |

! |

|

GE |

15:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

16:00 |

NY Fed 1-Year Consumer Inflation Expectations |

Jun |

-- |

3.2% |

!! |

|

US |

17:00 |

EIA Short-Term Energy Outlook |

-- |

-- |

-- |

!! |

|

US |

20:00 |

Consumer Credit |

May |

10.60B |

17.87B |

!! |

Source: Bloomberg & Investing.com