Euro holds steady in the face of more political surprises in France

EUR: French political uncertainty remains elevated but market impact muted

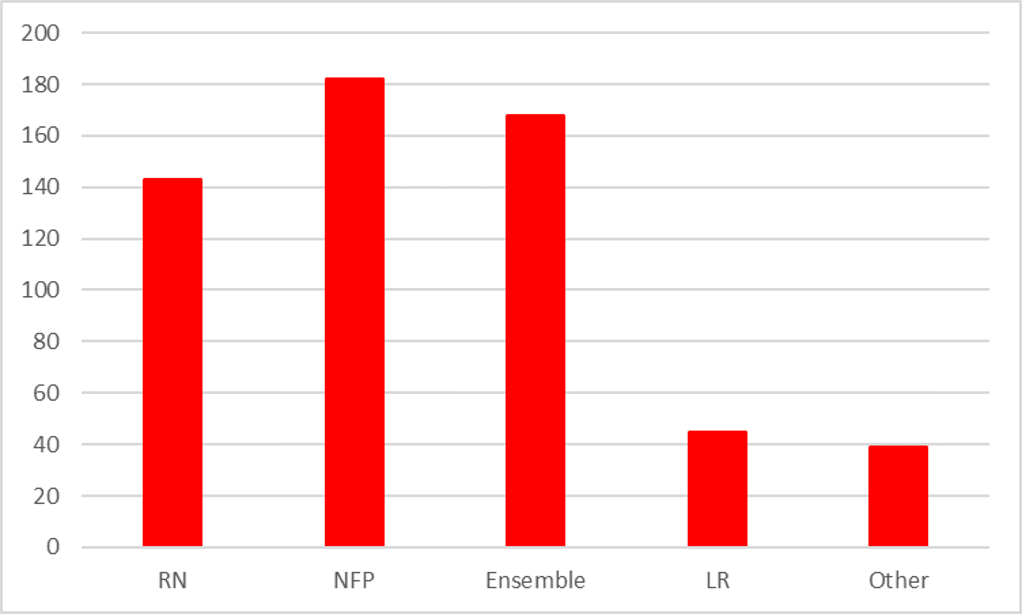

The euro has remained relatively stable during the Asian trading session following the release of results from the second round of the French elections held over the weekend. EUR/USD has traded within a narrow range between 1.0802 and 1.0836. The results revealed that the Republican Front has blocked the rise of the far right in France. According to Interior Ministry, Marine Le Pen’s RN party won only 143 seats in parliament and will be only the third largest party in contrast to results from the first round of the elections and opinion polls which indicated they were likely to become the largest party in parliament. Instead, the left-alliance of the New Popular Front won the most seats (182) followed in second place by President Macron’s centrist alliance who won 168 seats. Its means that all three parties fell well short of the 289 seats required for an absolute majority in parliament. While a hung parliament was the expected outcome from the second round of the elections, the main surprise is that parliament is now leaning more to the left than the right. French Prime Minister Gabriel Attal has already announced that he will present his resignation to President Macron today which will start the process of forming a new government.

The lack of a clear majority creates significant uncertainty over the form of the next government. Under Article 8 of the Constitution, the President appoints the Prime Minister and there are no conditions attached to that choice. The two main options according to Bloomberg, would be either for President Macron to: i) try to put together a “centre-left” coalition government perhaps involving the centrist parties and the left parties excluding the far-left France Unbowed party or ii) to name a technocratic administration. Socialist leader Olivier Faure has stated since the elections that it’s the party’s job to “find a path” to respond to the needs and demands of the French people. In contrast, Jean-Luc Melenchon, the leader of France Unbowed has told supporters that the New Popular Front would implement its program in its entirety and that he would refuse to enter into a deal with President Macron. Political uncertainty in France is set to remain elevated in the coming weeks until there is greater clarity over what form the next government will take. With all three major parties falling well short of an absolute majority in parliament, it remains likely that the next government will struggle to implement their policy agenda. An outcome which is modestly negative for France’s economy and the euro, but better than the alternative of majority wins for the far-right or left leaning parties whose policies could have proven more disruptive. Overall, the developments support our outlook for the euro to continue to stabilize in the near-term between the 1.0500 and 1.1000 levels against the US dollar.

REPUBLICAN FRONT DEFEATS FAR-RIGHT

Source: Ministry of the Interior

USD: Softer NFP report reinforces expectations for multiple Fed rate cuts

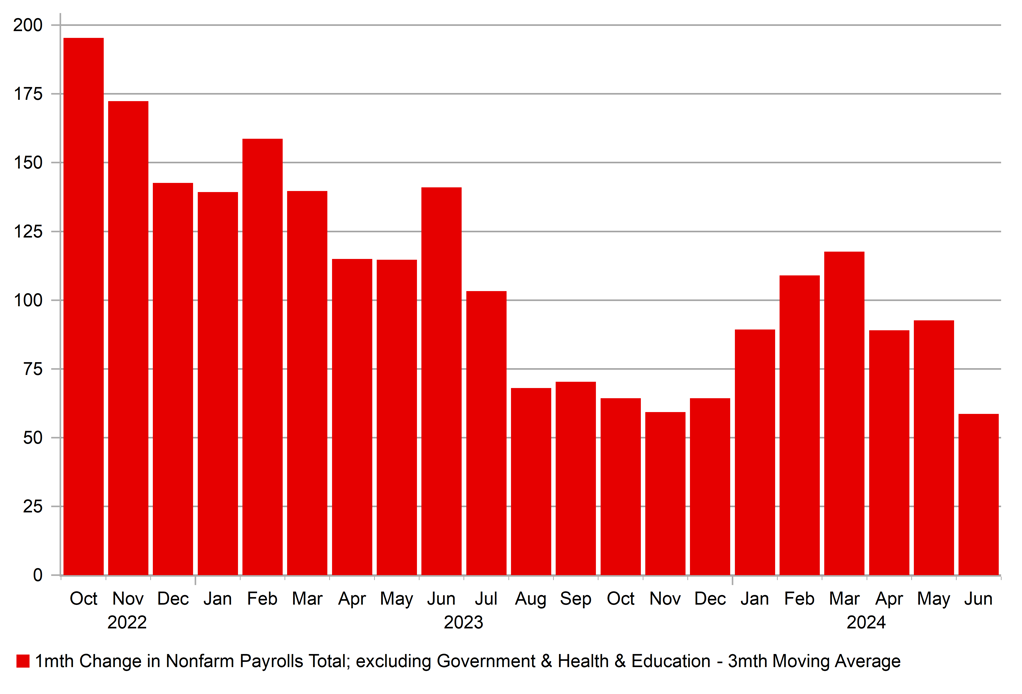

The US dollar has continued to trade at modestly weaker levels at the start of this week following the release of the softer than expected nonfarm payrolls report on Friday. As a result, the dollar index fell back below the 105.00-level at the end of last week. The softer nonfarm payrolls report has reinforced market expectations for multiple rate cuts from the Fed by the end of this year. The US rate market is now fully pricing back in 50bps of cuts by year end and 20bps by the September. The 2-year US Treasury bond yield has fallen back to its lowest level since March at 4.60% as it continues to move further below the peak from the end of April at 5.04%. The ongoing pullback for US yields is creating a headwind for US dollar performance in the near-term.

The nonfarm payrolls report revealed that employment growth slowed to 206k in July alongside downward revisions totalling 111k to the prior months. Headline employment growth was boosted as well by strong public sector job gains while private sector job growth was much weaker adding only 136k jobs in June. It compares to average private sector job growth of 174k in the first half of this year and 192k/month in 2023. At the same time, the household survey revealed that the unemployment rate continued to tick higher by a further 0.1 point to 4.1%. The Sahm rule is expected to be triggered in the coming months with the three-month moving average of the unemployment rate haven already risen by 0.4 points from the low over the last twelve months. Overall, the report should provide further reassurance to the Fed that the US labour market is continuing to become more balanced helping to dampen upside inflation risks.

The main focus points in the week ahead will be Fed Chair Powell’s semi-annual testimony on monetary policy and the release of the latest US CPI report for June. We are expecting Chair Powell to signal that rate cuts could come as soon as in September if inflation continues to ease in the coming months. Another softer core CPI print of 0.2%M/M or 0.3%M/M in June would keep the Fed on track to begin cutting rates by providing further confirmation that the stronger prints averaging +0.4%M/M in Q1 were one-offs. In these circumstances, we expect the US dollar to continue trending weaker in the week ahead unless there is a significant upside US inflation surprise on Thursday.

“CYCLICAL” EMPLOYMENT GROWTH WAS MUCH WEAKER

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:30 |

Sentix Investor Confidence |

Jul |

-0.6 |

0.3 |

! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

UK |

12:00 |

MPC Member Haskel Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

CB Employment Trends Index |

Jun |

-- |

111.44 |

! |

|

UK |

17:15 |

MPC Member Haskel Speaks |

-- |

-- |

-- |

!! |

|

US |

20:00 |

Consumer Credit |

May |

10.70B |

6.40B |

! |

Source: Bloomberg