Market lull ahead of US CPI data

USD: Reduced volatility means yields matter

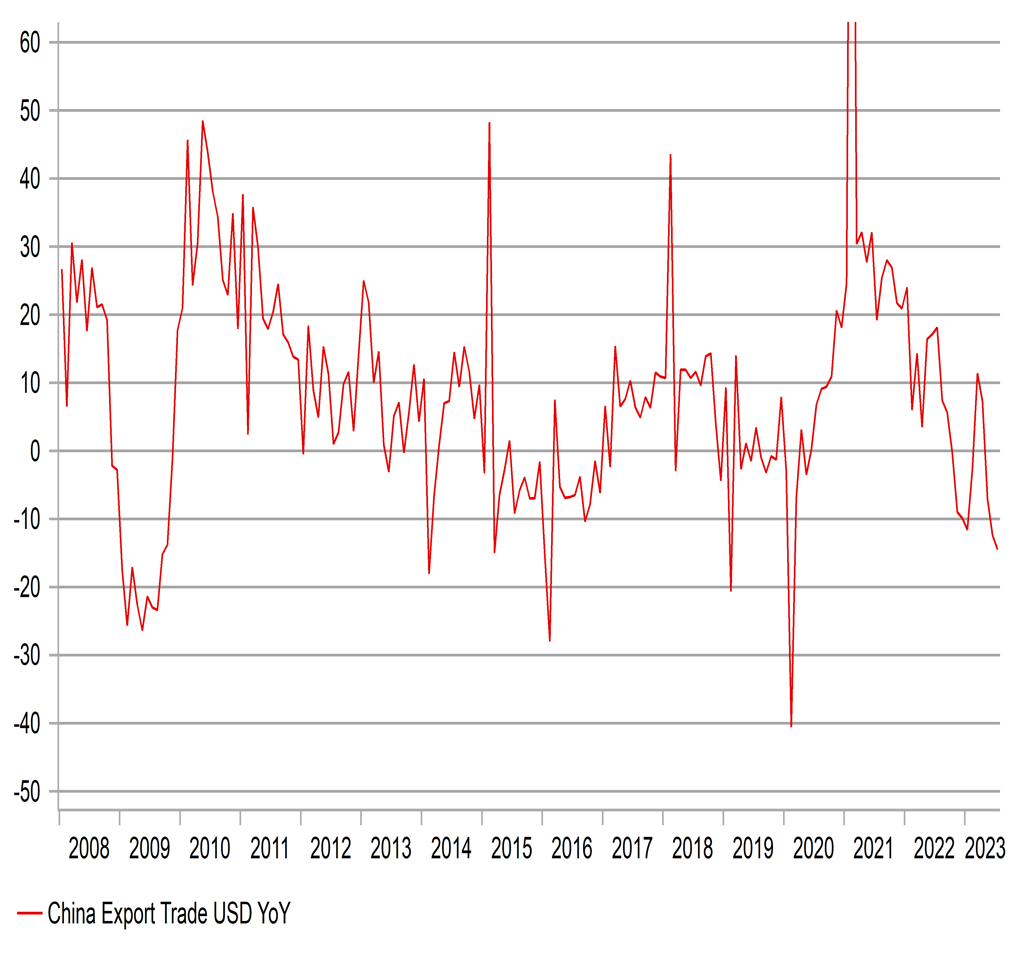

The aftermath of the US jobs data was relatively modest yesterday and an initial bounce in yields as investors assessed the NFP data further and reacted to comments from Fed Governor Bowman reversed with the 2-year UST bond yield dropping close to 10bps from the London trading intra-day high (4.85%) and that helped take away some of the early demand for the US dollar as well. We believe what is clear for FX markets from here is that in circumstances of relatively low volatility and continued optimism over the prospect of a soft landing in the US is that yields will matter a lot as the market drifts from one data release to the next. That means for this week that the dollar is likely to take a lead from the rates market into the key data release of the week – the July CPI report on Thursday. Fed Governor Bowman got much of the attention yesterday with remarks from Saturday fuelling Asian trading into early London trading. Bowman repeated those remarks at a ‘Fed Listens’ event in Atlanta – which was Bowman indicating that further rate rises would be required to bring inflation back to target. The fading impact of these remarks were partly due to comments from New York Fed President Williams who stated that monetary policy was “in a good place” and that we rates “where they need to be”. There is no saying which view will prove correct but Williams’ comments served as a reminder that there are a number now of the view that no further rate hikes will be necessary. Based on Fed Chair Powell’s press conference at the July FOMC we would conclude that there are more Fed officials in Williams’ camp than in Bowman’s and it would take a string of stronger activity data and higher inflation to alter that balance within the FOMC. Weak China trade data today will only add to concerns over the outlook for global growth – exports from China fell 14.5% in July, the worst reading since February 2020.

If yields matter and we remain in this relative calm, there may be some scope for the dollar to advance further from here. Looking across our rates/FX charts and covering between one to three years of data, the moves in 2yr swap spreads are supportive for the US dollar – all else equal. EUR and GBP are a little over-extended to the upside while USD/JPY has scope to drift higher. Of course, the USD/JPY scope may not materialise and that rates/FX divergence likely reflects a degree of uncertainty that has emerged following the change in the YCC framework. The YCC change on 28th July was the second in seven months and in our view is a key step by the BoJ toward fully abandoning the framework. While the BoJ may never formally announce an abandonment, increasing the flexibility of YCC is in of itself a move away from YCC. Admittedly, the weaker wage data from Japan today certainly argues against the BoJ pushing to end YCC for fundamental reasons. Full-time scheduled workers’ wages slowed from 2.0% to 1.6% - a level inconsistent with price stability.

Of course, rate spreads will matter as long as these low vol conditions last. We have entered the Aug-Sept period which historically can be the most volatile times of the year. There doesn’t appear to be anything on the immediate horizon to alter the current conditions and while from a rates spread perspective that might allow for some further US dollar strength, we equally don’t see these conditions as conducive to any meaningful FX moves either. Given we have another CPI print before the Sept FOMC it also means the importance of this week’s CPI is diminished.

CHINA YOY EXPORT GROWTH HITS WEAKEST SINCE FEB 2020

Source: Bloomberg, Macrobond & MUFG GMR

GBP: BoE signs of caution justified by incoming the data

The US dollar is strengthening this morning more versus AUD and NZD on the back of the weak China trade data. The performance of the pound is also beginning to sag after a strong performance in the first half of the year and in our view incoming data is certainly strengthening the case for the BoE to possibly pause its tightening cycle. We have pencilled in one further 25bp rate hike by the BoE in September but this was a very close call and one further hike was merely a reflection of the higher inflation in the UK than elsewhere and the limited evidence of worsening economic conditions.

Demand certainly seems to have softened in July however with the BRC Retail Sales data, released earlier, indicating a slowdown in consumer spending. Total sales increased 1.5% in the four weeks to 29th July YoY, below the 3-month average YoY growth rate of 3.5%. A nominal reading, the data continues to show a fall in retail sales in volume terms. Wet weather played a role here with seasonal clothing sales weak.

House prices are now falling more widespread across the country and of the 1.7mn tracker mortgage rolling off in 2023, September is one of the largest single months for resetting underlining the ongoing gradual feed-through of BoE monetary tightening.

Labour market survey data released this week will also help the case for the BoE pausing. The REC labour market survey, released yesterday, certainly provided compelling evidence that the labour market is softening. The Staff Availability index jumped to 61.4 in July from 57.6 in June, the highest since the GFC period in 2009. Demand is weakening also. The Permanent Staff Placement index fell to 42.4 and the wage index is now softening also.

GBP is set to continue to underperform. We see rate expectations in the UK as excessive given around 50bps of tightening remains priced and a further downward adjustment is likely with at most only one further 25bp hike likely.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

11:00 |

NFIB Small Business Optimism |

Jul |

90.6 |

91.0 |

!! |

|

US |

13:15 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

Trade Balance |

Jun |

-65.00B |

-69.00B |

!! |

|

CA |

13:30 |

Trade Balance |

Jun |

-2.90B |

-3.44B |

!! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

0.1% |

! |

|

US |

15:00 |

IBD/TIPP Economic Optimism |

-- |

43.0 |

41.3 |

! |

|

US |

15:00 |

Wholesale Inventories (MoM) |

Jun |

-0.3% |

-0.3% |

! |

|

US |

15:00 |

Wholesale Trade Sales (MoM) |

Jun |

0.3% |

-0.2% |

! |

|

US |

17:00 |

EIA Short-Term Energy Outlook |

-- |

-- |

-- |

!! |

|

US |

18:00 |

3-Year Note Auction |

-- |

-- |

4.534% |

!! |

Source: Bloomberg