US-China talks finally but limited FX impact

USD: Mixed performance and muted equity moves

The positive news from US Treasury Secretary Scott Bessent last night on Fox News that there would be senior level talks to de-escalate trade tensions has helped reinforce the improved risk sentiment. Understandably though, given the S&P 500 had already fully retraced the drop after the announced reciprocal tariffs, the reaction in equity futures in the US and in equities globally has been muted. After the S&P 500 dropped 0.8% yesterday, the equity future is up 0.5% today. Sentiment was further helped by the PBoC’s decision to finally announce monetary easing – a 0.5ppt cut to the RRR and a 0.1%ppt cut to the 7-day reverse reop rate to 1.40%. Still, there have been signals from China that policy easing was coming for some time and hence the reaction there too has been modest. The CSI 300 is 0.4% higher today and USD/CNY is close to unchanged. Risk appetite in part will have been curtailed following India’s decision to attack Pakistan close to the border with Kashmir, which has been described by Pakistan as an “act of war”. Pakistan has also retaliated, leaving the risk of conflict elevated.

But it’s the news of trade talks between the US and China this weekend in Switzerland with Scott Bessent and Jamieson Greer travelling to meet a delegation led by Vice Premier He Lifeng. Bessent stated on Fox News that the focus will be on de-escalation rather than negotiating aspects of a trade deal. The likely outcome could be a notable drop in the current rates – possibly the US rate on China imports dropping to 60% and similarly for China on US imports. That was the level that Trump had originally suggested when election campaigning – a level that then was deemed as unbelievably high and a worst-case scenario. So a reduction to that level would be positive but a level that is hardly reason for global growth optimism. Equity market performance implies this initial prospect of de-escalation was expected and is fully priced.

US yields have moved modestly higher but with the FOMC meeting this evening (see below), the reaction to the US-China news is limited. USD/Asia is higher given the PBoC easing and the India/Pakistan conflict while AUD and NZD failed to advance on the US-China news with yields falling notably – again a reflection perhaps of the “damage already done” conclusion and the view that the probable de-escalated tariff rates will still be economically damaging. Tonight’s FOMC decision will be important of course but the failure of the higher-beta global growth sensitive currencies, AUD, NZD, SEK and NOK indicates that the good news of de-escalation is already priced which could encourage liquidation of long positions in these currencies, especially if the talks over the weekend in Switzerland underwhelm.

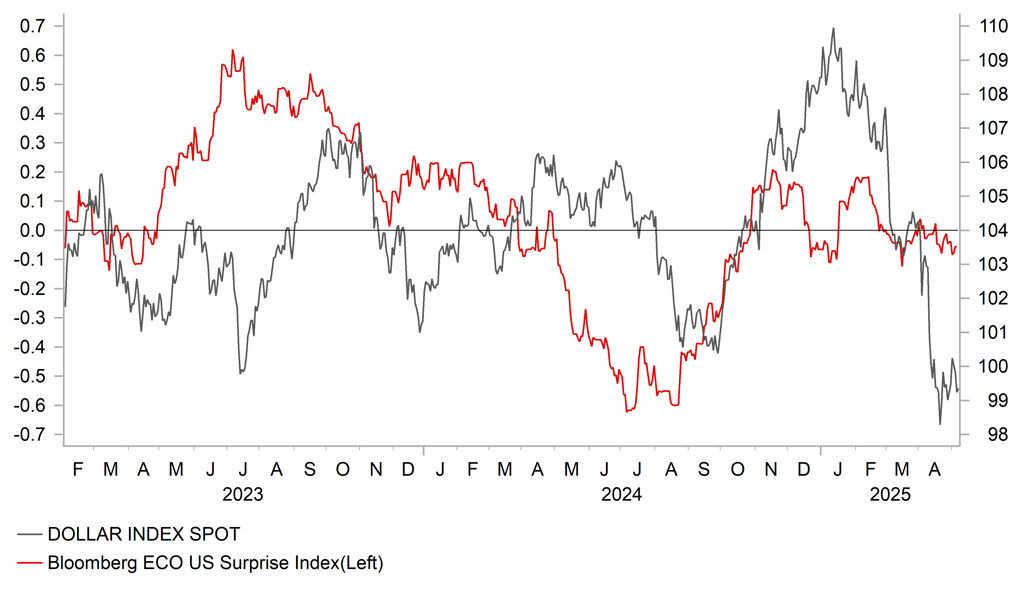

USD IS WEAKER IN PART ON ANTICIPATION OF WEAKER US DATA

Source: Bloomberg, Macrobond & MUFG GMR

USD: FOMC to keep its options open

Tonight the FOMC will announce its monetary policy decision – no surprise with that as the Fed is set to announce and unchanged policy stance – with the focus on the statement and then Fed Chair Powell’s press conference. In the statement in March, the FOMC described economic activity as expanding “at a solid pace”, the labour market was also “solid” and inflation was “somewhat elevated”. The description of the economy could change given real GDP contracted by 0.3% although that was entirely down to a surge in imports. If the FOMC was also to change the description of the labour market as being “solid” that would certainly be a dovish signal. The NFP gain of 177k was stronger than expected and even when considering the 48k downward revision, there wasn’t compelling reason to downgrade the assessment on the jobs market. However, most of the soft sentiment data has certainly indicated some worsening of the labour market ahead.

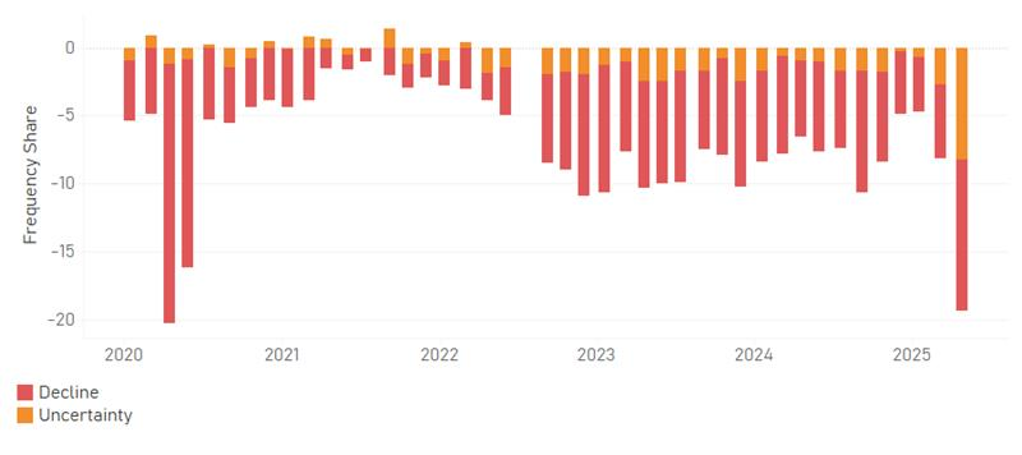

Given the scale of volatility that has taken place since 2nd April when reciprocal tariffs were announced, there is likely to be a shift toward a lack of clear guidance ahead. To provide a clear signal of either a cut or a delay to a cut would create further volatility and could be dangerous given the potential for sudden policy shifts and given the 90-day postponement period for reciprocal tariffs expires on 9th July. If that remains an active date come the next FOMC meeting on 18th June, it may well be difficult for the FOMC to cut rates. The jobs data last week and the full retracement of the S&P 500 back to the level on 2nd April before the tariff announcements has seen pricing for a cut in June drop to just 8bps. A scale of the level of uncertainty was highlighted in the Beige Book published for this meeting. Our own text analysis work revealed the net negative sentiment related to “decline” and “uncertainty” had reached the lowest since the onset of covid in 2020.

But a cut is fully priced by the meeting on 30th July with investors happy to push the timing of a cut back a meeting given the confidence remains that the economy is weakening and that the FOMC will be focused on the demand rather than the inflation shock associated with tariffs. The Beige Book certainly indicated increased inflation risks with “most Districts” reporting that firms expected elevated input costs growth due to trade tariffs. So the Beige Book highlights the need for a balanced interpretation given both growth and inflation risks.

Since the start of April, the 2-year EU-US yield spread has moved 10bps in favour of the US but over the same period EUR/USD has advanced by 4.8%. So it is questionable to argue that a hawkish Powell tonight will lift the dollar. In essence, it is the uncertainty over policy and the strong expectation (in the Beige Book for example) that the economy is going to weaken that will prevail and so risks remain skewed to the dollar staying weak or weakening further.

BEIGE BOOK TEXT SENTIMENT INDICATOR – “DECLINE” & “UNCERTAINTY” COMBINED HITS MOST NEGATIVE SINCE COVID IN 2020

Source: Federal Reserve & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:30 |

German IHS S&P Global Construction PMI |

Apr |

-- |

40.3 |

!! |

|

FR |

08:30 |

French IHS S&P Global Construction PMI |

Apr |

-- |

43.8 |

! |

|

EC |

08:30 |

IHS S&P Global Construction PMI |

Apr |

-- |

44.8 |

! |

|

UK |

09:30 |

Construction PMI |

Apr |

46.0 |

46.4 |

!! |

|

UK |

10:00 |

5-Year Treasury Gilt Auction |

-- |

-- |

4.142% |

! |

|

FR |

10:00 |

French 10-Year OAT Auction |

-- |

-- |

3.37% |

! |

|

EC |

10:00 |

Retail Sales (MoM) |

Mar |

-0.1% |

0.3% |

! |

|

EC |

10:00 |

Retail Sales (YoY) |

Mar |

1.6% |

2.3% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-4.2% |

! |

|

CA |

12:00 |

Leading Index (MoM) |

Apr |

-- |

0.07% |

! |

|

US |

19:00 |

FOMC Statement |

-- |

-- |

-- |

!!!! |

|

US |

19:00 |

Fed Interest Rate Decision |

-- |

4.50% |

4.50% |

!!! |

|

US |

19:30 |

FOMC Press Conference |

-- |

-- |

-- |

!!!!! |

|

US |

20:00 |

Consumer Credit |

Mar |

9.80B |

-0.81B |

! |

Source: Bloomberg