US trade policy moves back to centre stage driving FX market performance

USD: Time is running out to reach trade deals ahead of 9th July deadline

The high beta G10 commodity currencies of the Australian and New Zealand dollars have underperformed at the start of this week amidst more risk-off trading conditions. Asian equities and currencies have also weakened overnight. The deterioration in risk sentiment at the start of this week reflects fresh investor concern over the potential for US trade policy disruption as we move closer to the end of the 90-day delay for the higher “reciprocal” tariffs on 9th July. So far only trade deals with the UK and Vietnam have been announced to avoid the full implementation of higher tariffs announced in early April on Liberation Day. Even then the UK still faces a minimum 10% tariff on all goods alongside sectoral tariffs, and Vietnam will face a 20% tariff which will rise up to 40% for transshipments. Over the weekend, President Trump told reporters that he “signed some letters and they’ll go out on Monday – probably 12” initially to inform other countries of the higher tariffs they’ll have to pay. Adding only that his directives involve “different amounts of money, different amounts of tariffs and somewhat different statements” At the end of last week, he had indicated that tariff rates could range from 10% or 20% for some countries and as high as 60% or 70%. We are assuming that only relatively small trading partners will face 60% or 70% tariffs to limit the economic disruption.

At the same time, Treasury Secretary Bessent spoke with CNN yesterday and attempted to provide some further guidance over what to expect in the coming days. He said that the letters sent out by President Trump will not be the final word on countries’ immediate tariff rates. The new levies will kick in from 1st August leaving some time in the interim for countries that aren’t close to an agreement to bring offers to the table. The 1st August implementation date was also highlighted by Commerce Secretary Lutnick. Treasury Secretary Bessent stated that he expects trade talks with other countries to really move along in the net couple of days and weeks now that President Trump has threatened to raise tariffs back to levels announced on Liberation Day. He warned other countries that “if you want to speed things up, have at it. If you want to go back to the old rate, that’s your choice”. He added the Trump’s administration’s focus is on 18 major trading partners and he believes that several big agreements are close even though “there’s a lot of foot-dragging on the other side”. Stephen Miran, the chair of the white House Council of Economic Advisers expressed some optimism that that he was hearing “good things” about trade negotiations with Europe and India which may partly explain why the euro has been more stable overnight alongside it’s more normal safe haven properties as one of the most liquid global currencies.

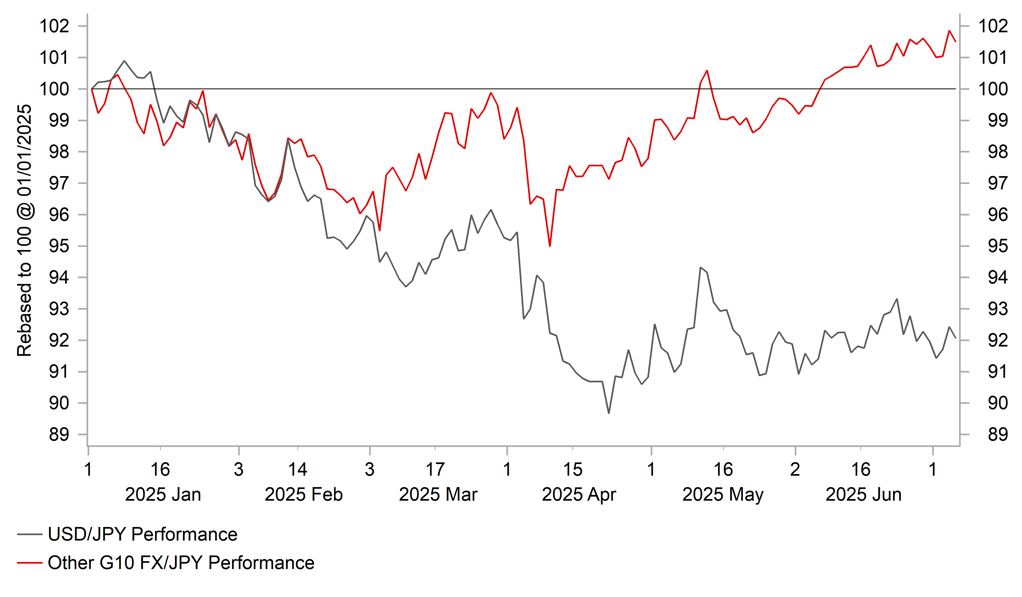

JPY HAS WEAKENED AGAINST OTHER (NON-USD) G10 FX THIS YEAR

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Trade uncertainty & softer wage data dampen BoJ rate hike speculation

The yen has underperformed despite more risk-off trading conditions overnight resulting in USD/JPY rising back above the 145.00-level. Yen weakness reflects in part building concerns over the failure of Japan to reach a trade deal with the US that could see higher tariffs remain in place for longer than expected. Japan has been singled out for criticism by the Trump administration in recent weeks for the lack of progress in trade talks. Japanese Prime Minister Ishiba stated over the weekend that he won’t “easily compromise” in talks with Washington as he seeks to avert President Trump’s threat to impose “reciprocal” tariffs of up to 35% on goods from Japan. President Trump has pressed Japan to accept more imports of US autos and rice. Japanese Prime Minister Ishiba noted that Japan was “preparing to deal with all kinds of situations”. In a rush to secure a last minute trade deal, Japan’s chief trade negotiator Akazawa has held two phone meetings since late last week with US Commerce Secretary Lutnick with both sides agreeing to continue to co-ordinate.

The elevated level of trade policy uncertainty has been one reason why the BoJ has become more cautious over tightening monetary policy further in the near-term. Failure to reach a trade deal to avoid the higher tariffs would add to their caution further pushing back the timing of BoJ rate hike expectations beyond the end of this year. At the same time, BoJ rate hike expectations have been dampened overnight by the release of weaker wage growth from Japan. The release of the latest labour cash earnings report for May revealed that wag growth slowed to 1.0%Y/Y down from a revised increase of 2.0% in April. The slowdown in headline cash earnings appears to reflect swings in special cash earnings and fewer working days. According to Bloomberg, special cash earnings dropped by 18.7% and the number of working days by 0.3 from the same month a year earlier. In contrast, base salaries for full-time workers which smooths out distortions from survey sample changes slowed only modestly to 2.4%Y/Y from 2.5%Y/Y. The BoJ is unlikely to place too much emphasis on the slowdown in headline wage growth in the report. The drop in real wages of -2.9%Y/Y in May is also a headache for the government ahead of the Upper House election taking place in about two weeks. The government has pledged to provide cash handouts of JPY20k per adult along with additional incentives to spur wage growth.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

09:00 |

Total Sight Deposits CHF |

Jul-25 |

-- |

460.7b |

! |

|

EC |

09:00 |

ECB's Nagel Speaks in Tallinn |

!! |

|||

|

EC |

09:30 |

Sentix Investor Confidence |

Jul |

1.0 |

0.2 |

!! |

|

EC |

10:00 |

Retail Sales MoM |

May |

-0.6% |

0.1% |

!! |

Source: Bloomberg & Investing.com