USD remains on soft footing ahead of FOMC meeting

USD/TWD: USD weakens sharply against Asian currencies

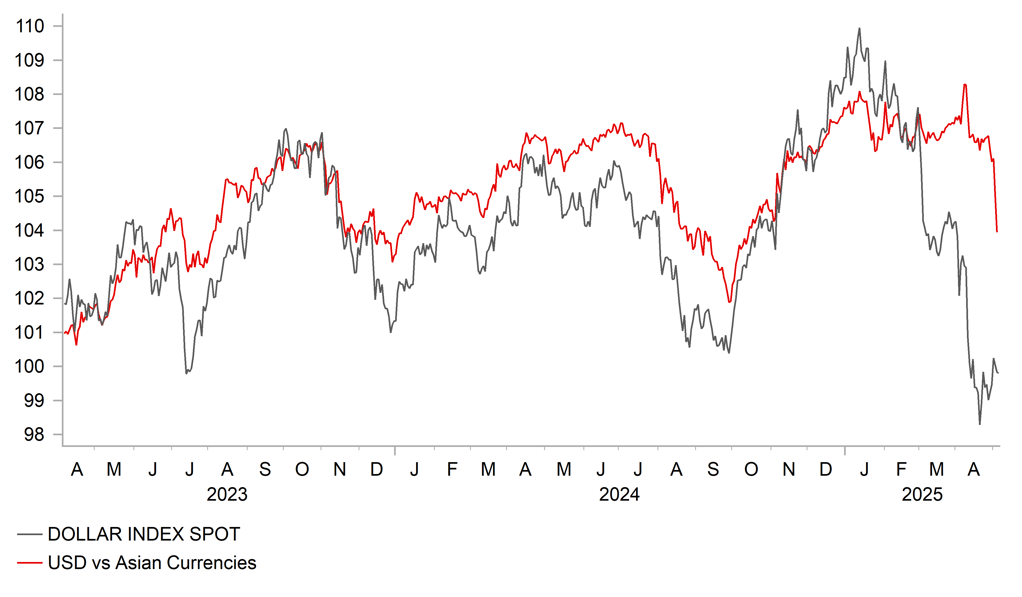

The US dollar has stabilized overnight following heavy losses against Asian currencies over the last couple of trading days. After falling sharply by -8.3% since late last week and hitting a low of 29.458 yesterday, USD/TWD has staged a modest rebound overnight rising back up above the 30.000-level. Strong gains for the Taiwan dollar against the US dollar have also spilled over into broad-based strength for other Asian currencies. From the 1st May the Taiwan dollar has been the best performing currency strengthening by 6.1% against the US dollar followed by the Malaysian ringgit (+2.0%), Thai baht (+1.9%), South Korean won (+1.7%) and Singapore dollar (+1.5%). In contrast, recent moves in G10 currencies have remained more modest. The Australian dollar (+1.3%), New Zealand dollar (+1.2%) and Japanese yen have been the main beneficiaries while the euro and the pound have been more stable resulting in the dollar index continuing to trade around the 100.00-level.

In Taiwan, the central bank held an emergency briefing yesterday at which the governor stated that market commentary had triggered “excessive” buying of the Taiwan dollar by exporters and foreign investors. Governor Yang Chin-long “solemnly urged market commentators not to speculate irresponsibly about the foreign exchange market, as such comments can destabilize the market and potentially impact the broader economy”. Recent market speculation over the potential for further broad-based US dollar weakness fuelled by optimism over trade deals/agreements to reverse tariffs hikes especially with China have helped to lift Asian currencies. Bloomberg notes that that there has been building speculation that Taiwan will let its currency strengthen by scaling back intervention in order to help smooth trade talks with the US. The first round of trade talks between the US and Taiwan finished last week.

Taiwan has been recording outsized current account surpluses of over USD100 billion over the last four years accounting for between 13-15% of GDP indicating that the Taiwan dollar is significantly undervalued. According to reports, Taiwan has caught market participants by surprise since late last week by appearing to scale back its customary interventions in the currency market to slow the rally in the Taiwan dollar. The monetary authority in Taipei has for years operated a “managed floating” currency policy intended to moderate market volatility rather than weaken the Taiwan dollar. Governor Yang Chin-long stated though that they had intervened to smooth volatility in the Taiwan dollar but had been overwhelmed by “excessively strong” and “abnormal” market expectations for appreciation.

At the same time, the Financial Supervisory Commission held a meeting with Taiwan’s life insurance companies who are amongst the biggest Asian holders of US debt. According to reports, they have asked some life insurance firms to discuss how the rapidly strengthening Taiwan dollar has impacted their operations. Bloomberg has reported that the sharp strengthening of the Taiwan dollar could have been reinforced by life insurers seeking to hedge their holdings of US debt which make up the bulk of more than USD767 billion of foreign assets, of which only around 65% were hedged at the end of last year. An increase in hedging flows to better cover long US exposure would continue to put upward pressure on the Taiwan dollar against the US dollar.

CATCH-UP STRENGTH FOR ASIAN CURRENCIES VS. USD

Source: Bloomberg, Macrobond & MUFG GMR

USD: Stronger US data lifts US yields but not the US dollar

The US dollar has continued to weaken since late last week even as the recent US economic data flow has dampened expectations for Fed rate cuts ahead of this week’s FOMC meeting. It has helped to lift US yields with the 2-year US Treasury yield rising by around 30bps. The US rate market is no longer as confident that the Fed will cut rates at the following FOMC meeting in June. There are now only 7bps of cuts priced in for the June FOMC meeting compared to around 16bps prior to the release of the nonfarm payrolls report for April. The release of the nonfarm payrolls report for April revealed that employment growth had not been hit hard yet by trade disruption and heightened policy uncertainty easing pressure on the Fed to resume rate cuts. With inflation expected to move further above the Fed’s target lifted by tariff hikes, the labour market will need to loosen to provide a green light for the Fed to cut rates as much as the market is expecting. Employment growth has even picked up modestly in recent months averaging 181k jobs/month in March and April compared to 107k in January and February.

At the same time, the unemployment rate continues to consolidate between 4.0 and 4.2%where it has been since last summer. The better than expected data flow was added to yesterday by the release of the ISM services survey for April. The survey revealed that business confidence in the service sector held up better than expected at 51.6 and new orders rose to 52.3 helping to ease fears over a sharper slowdown/recession for the US economy. The prices paid sub-component jumped sharply to the highest level since January 2023 reflecting upward pressure on prices from tariff hikes. Overall, it suggests that the Fed will emphasize that policy will remain highly data dependent at this week’s FOMC meeting without committing strongly to the timing of policy easing while uncertainty remains elevated.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:35 |

SNB Vice Chairman Schlegel Speaks |

-- |

-- |

-- |

! |

|

IT |

08:45 |

Italian Services PMI |

Apr |

51.3 |

52.0 |

!! |

|

FR |

08:50 |

French Services PMI |

Apr |

46.8 |

47.9 |

!! |

|

GE |

08:55 |

German Services PMI |

Apr |

48.8 |

50.9 |

!! |

|

EC |

09:00 |

Services PMI |

Apr |

49.7 |

51.0 |

!! |

|

UK |

09:30 |

Services PMI |

Apr |

48.9 |

52.5 |

!!! |

|

EC |

10:00 |

PPI (YoY) |

Mar |

2.0% |

3.0% |

! |

|

US |

13:30 |

Trade Balance |

Mar |

-136.80B |

-122.70B |

!! |

|

CA |

13:30 |

Trade Balance |

Mar |

-1.70B |

-1.52B |

!! |

|

EC |

22:00 |

ECB Financial Stability Review |

-- |

-- |

-- |

!! |

|

NZ |

23:45 |

Employment Change (QoQ) |

Q1 |

0.1% |

-0.1% |

! |

Source: Bloomberg