US growth fears continue to build ahead of NFP report

USD: US slowdown/recession fears continue to build

The US dollar has continued to trade close to recent lows overnight ahead of the release tomorrow of the latest non-farm payrolls report for March. So far this week the US dollar has fallen to fresh year to date lows against the pound and Swiss franc. It has resulted in cable rising to just above the 1.2500-level and USD/CHF has fallen to within touching distance of the 0.9000-level. The other top performing G10 currency this week has been the yen. The price action continues to highlight that the US dollar is being undermined by the dovish repricing Fed policy expectations in response to building fears over sharper slowdown/recession for the US economy. Those fears were reinforced yesterday by the release of softer economic data from the US that triggered a further adjustment lower for US yields. The 10-year US Treasury bond yield hit a fresh year to date low of 3.26% yesterday and as it continues to move further below the intra-day high from the start of March at 4.09%. At the short end of the US yield curve, market participants have become even more confident that the Fed will not raise rates further which is then expected to be followed by 75bps of rate cuts by the end of this year.

The main trigger for the further dovish repricing of the Fed policy outlook was the release of the much weaker than expected ISM services and ADP surveys for March that have heightened concerns over a sharper slowdown for the US economy in the coming quarters. It follows quickly on the heels of the release of the weaker than expected ISM manufacturing survey on Monday. The ISM services survey revealed that business confidence dropped by 3.9 point to 51.2 in March, and the new orders sub-component dropped even more sharply by 10.4 point to 52.2. It appears that negative shock from the recent loss of confidence in US regional banks is having a more immediate chilling effect on business confidence. While the survey is not yet at levels that is consistent with recession, it does signal an increased risk of a sharper slowdown in growth in the coming months. Furthermore, the survey provided further evidence that inflation pressures should continue to ease going forward. The forward-leading prices paid sub-component dropped by 6.1 point to 59.5 in March as it moved further below the peak from the end of 2021 at 84.5. It has returned back to pre-COVID levels that were in place at the end of 2019. The normalization of the prices index was also evident in the manufacturing survey. The surveys should provide further reassurance to the Fed that upside risks to the inflation outlook are easing.

The market’s focus will now shift to the release tomorrow of the latest non-farm payrolls report to see if evidence begins to emerge of a sharper slowdown in the labour market as well although it is more of lagging indicator. The softer ADP and JOLTS surveys this week both signalled a higher risk of slower employment growth ahead. Overall, the developments support our outlook for a weaker US dollar (click here). The main risk to our view is if US recession risks intensify and trigger a sharper sell off in risk assets, the US dollar could begin to derive more support form safe haven demand especially against high beta currencies that are more closely linked to the global growth outlook

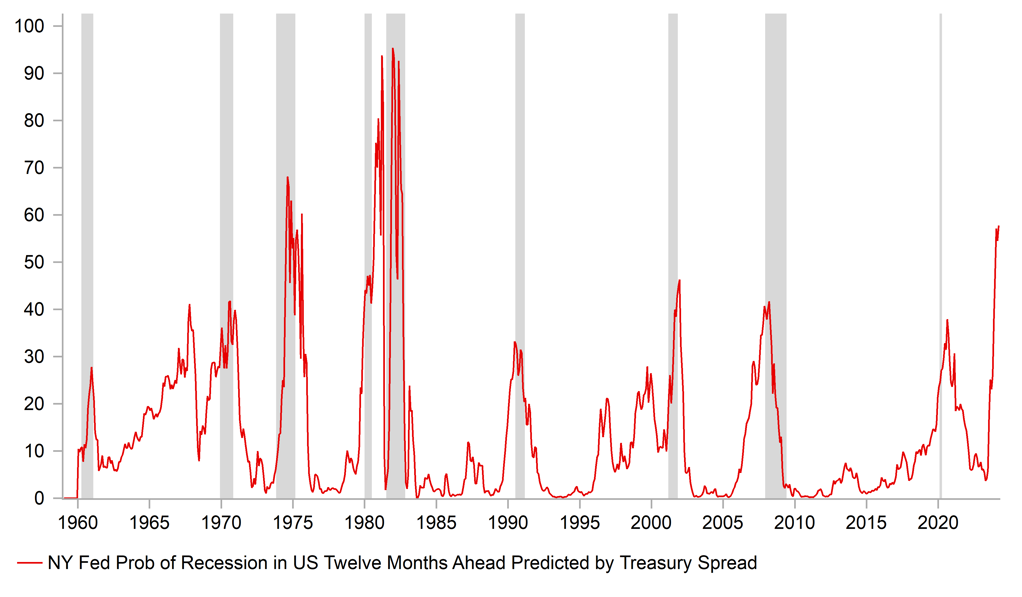

US BOND MARKET SIGNALLING ELEVATED RECESSION RISK

Source: Macrobond & MUFG GMR

CNY: China reopening optimism evident in PMI surveys

One of the main economic data releases overnight during the Asian trading session was the latest Caixan PMI surveys from China. The surveys revealed a bigger than expected improvement in business confidence in the services sector that increased by 2.8 point to 57.8 in March. It was the highest reading since November 2020 and provides another encouraging signal that China’s economy is set to rebound strongly this year. While China reopening trades have lost some upward momentum in recent months, we still believe that the positive growth momentum in China this year will provide support for Asian currencies and commodity-related EM currencies that are more tightly linked to demand from China. In terms of year to date performance, Latam currencies (COP +9.8% vs. USD YTD, BRL +8.5%, & CLP +7.8%) have been the best performing EM currencies so far this year and have benefitted from China reopening optimism. They also remain attractive carry currencies given the higher double digit yields on offer. The main external downside risk would be a sharper global slowdown/recession that overwhelms the expected pick-up in demand from China.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Construction PMI |

Mar |

53.5 |

54.6 |

!!! |

|

US |

12:30 |

Challenger Job Cuts |

Mar |

-- |

77.770K |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

200K |

198K |

!!! |

|

CA |

13:30 |

Employment Change |

Mar |

12.0K |

21.8K |

!!! |

Source: Bloomberg