Jobs in focus as the US dollar shows resilience

USD: Resilience of dollar could quickly give way

The US dollar has certainly shown some better resilience this week although the gains recorded yesterday have reversed so far today – a possible delayed reaction to the steady stream of weak labour market data ahead of today’s nonfarm payrolls report. The DXY is still a touch stronger this week (0.3%) despite the fact that US yields have declined – very modestly admittedly (above 3bps on the 2-year). The obvious conclusion here is that the US rates curve has a lot priced – 120bps of cuts over the next eight FOMC meetings and hence the appetite to react to the weak jobs-related data so far this week has been muted. But there remains only 7bps of easing priced for three rate cuts this year and we certainly see scope for that emerging if the jobs data continues to deteriorate. An NFP print today close to zero (very plausible given the consensus is just 75k) or negative would see a third FOMC cut this year priced very quickly, which in turn would likely see the dollar renew its decline.

There is a chance though that the dollar could see muted declines even in that scenario. The 10% drop of the dollar in the first half of the year was from very over-valued levels and while still over-valued the dollar is now at levels where external factors could play a more influential role in performance. The French confidence vote on Monday is likely to result in the collapse of the government that creates doubts over the appetite to buy the euro post-payrolls. The LDP lawmaker vote on whether to bring forward the leadership election (and effectively likely trigger PM Ishiba’s resignation) is on Monday (see below). This is another factor set to curtail appetite to buy the yen on a weak jobs report this afternoon. Finally, commodity prices showed some weakness yesterday reflecting concerns over global growth with some renewed volatility in risk assets in China. Concerns over OPEC+ increase crude oil supply weighed on crude prices undermining performance for AUD & CAD. The global backdrop matters more for the dollar at these levels than earlier in the year.

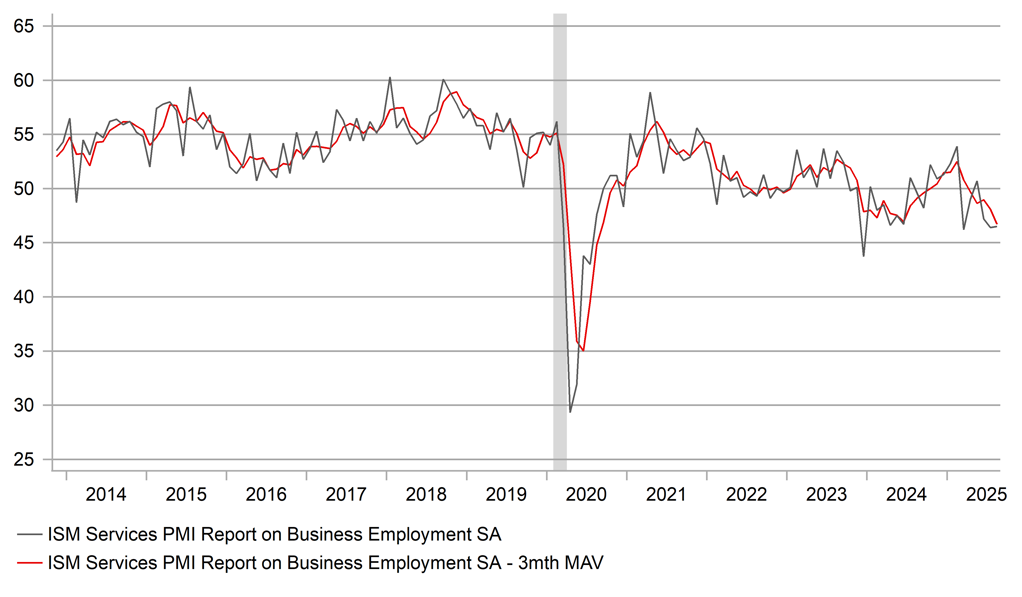

The US dollar was helped yesterday by the fact that the overall ISM Services index jumped more than expected. In particular, the New Orders index jumped sharply, to above the 56-level for the first time since last year. But once again, like with the ISM Manufacturing report, while many measures showed some recovery, the Employment indices of both were weaker than expected. The ADP employment report was weaker too as was the JOLTS report – so risks look to be skewed in favour of data pointing to greater weakness than expected.

Based on the resilience of the dollar this week given global factors are helping curtail non-dollar buying, an NFP print closer to zero or negative will likely be needed in order to trigger a notable drop for the dollar. That could explain the reversal of yesterday’s modest dollar strength as investors position for the risk of a weak print today. An upside surprise could therefore see a larger initial response than a weak report.

LOWEST 3MTH AVERAGE FOR ISM EMPLOYMENT SINCE COVID

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Wage gains highlights BoJ rate hike prospect

The yen is modestly stronger against the dollar this morning although this is more a reflection of US dollar weakness and the drop in USD/JPY is no larger than dollar declines against other G10 currencies. There has been limited market reaction to the finalising of the US-Japan trade deal that saw President Trump sign an executive order detailing a 15% trade tariff on most imports, including autos. That takes Japan’s auto tariff down from 27.5% and is good news for the auto sector.

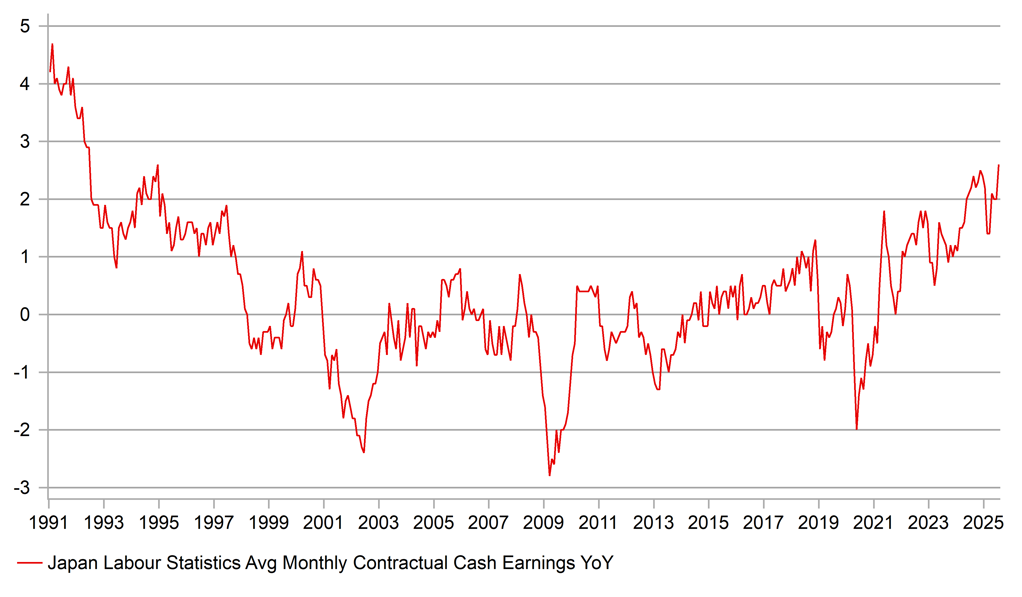

There has also been limited market reaction to the stronger wage data released today. Total labour cash earnings jumped from 2.5% YoY in June to 4.1% in July. Gains over 4.0% are becoming more regular and the July print was the third time since June last year and confirms the strongest period of wage gains since the early 1990s. A 7.9% YoY in special cash earnings (summer bonuses) helped fuel the stronger overall increase but base wages also gained, from 2.6% to 2.8%.

The details are certainly consistent with the BoJ hiking rates again. Ongoing caution and the uncertainty created by the threat to PM Ishiba’s position have been factors resulting in market pricing for an October rate hike coming down to just 8bps. Furthermore, while the signing of the US-Japan trade deal helps reduce uncertainty, trade uncertainties in general will undoubtedly persist. But for the BoJ the biggest issue related to an October rate hike is domestic politics. We will know more next week when the LDP makes its decision on Monday, based on an internal vote, whether to bring forward an LDP leadership election. Today we had the first cabinet member publicly calling for an early LDP leadership election, Justice Minister Keisuke Suzuki.

An early LDP leadership election would be run in late September / early October which would mean a new PM would only just be in office and speculation on a general election would be high (November could feasible be the month for a general election, if there was one). Not the backdrop for a rate hike. It remains a close call and his rising approval rating is helping but momentum appears to indicate a continued gradual loss of support. The wage data today is telling us that the fundamentals are in place for a hike and there is scope for a repricing in the rates market if PM Ishiba manages to hang on and harden speculation on an October hike. The yen would then be set for a period of outperformance from current weak levels.

JAPAN’S WAGE DATA TODAY HIGHLIGHTED RENEWED STRENGTH – CONTRACTUAL WAGE GROWTH WAS THE HIGHEST SINCE 1994

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Retail Sales (MoM) |

Jul |

0.2% |

0.6% |

! |

|

IT |

09:00 |

Italian Retail Sales (YoY) |

Jul |

-- |

1.0% |

! |

|

EC |

10:00 |

Employment Change (YoY) |

Q2 |

0.7% |

0.7% |

! |

|

EC |

10:00 |

Employment Change (QoQ) |

Q2 |

0.1% |

0.2% |

! |

|

EC |

10:00 |

GDP (QoQ) |

Q2 |

0.1% |

0.6% |

!! |

|

US |

13:30 |

Nonfarm Payrolls |

Aug |

75K |

73K |

!!!!! |

|

US |

13:30 |

Private Nonfarm Payrolls |

Aug |

75K |

83K |

!!!! |

|

US |

13:30 |

Unemployment Rate |

Aug |

4.3% |

4.2% |

!!!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Aug |

0.3% |

0.3% |

!!! |

|

US |

13:30 |

Average Hourly Earnings (YoY) (YoY) |

Aug |

3.7% |

3.9% |

!! |

|

US |

13:30 |

Average Weekly Hours |

Aug |

34.3 |

34.3 |

! |

|

CA |

13:30 |

Employment Change |

Aug |

9.3K |

-40.8K |

!!! |

|

CA |

13:30 |

Unemployment Rate |

Aug |

7.0% |

6.9% |

!!! |

|

CA |

15:00 |

Ivey PMI |

Aug |

53.1 |

55.8 |

!! |

Source: Bloomberg & Investing.com