ECB is expected to slow pace of rate cuts providing support for EUR

USD/JPY: Weak US data & JGB auction in focus

The US dollar has been consolidating at weaker levels overnight following yesterday’s sell-off triggered by weak US economic data releases. It has resulted in the dollar index falling back towards recent lows at just below the 99.000-level. The US dollar came under renewed selling pressure yesterday following the releases of the latest ADP and ISM services surveys for May. The ADP survey estimated that private employment growth slowed more sharply than expected to 37k in May which was well below the consensus forecast of 114k. It has heightened expectations that the release of the NFP on Friday could similarly reveal a bigger slowdown in the US labour market which has encouraged market participants to price back in more Fed easing. The 2-year US Treasury bond yield fell sharply yesterday by 8bps taking it back to its lowest level in a month. Looking back at the recent accuracy of the ADP survey as a predictor for NFP private employment growth, one can see that it has underestimated NFP private employment growth for the last three months to April by an average of -74k/month based on the initial data releases. It suggests that yesterday’s weak ADP survey could underestimate the strength of the US labour market although that remains to be seen on Friday, but is still likely consistent with slowing employment growth.

At the same time, the release of the ISM services survey revealed that business confidence continued to deteriorate in May falling to its lowest level since June of last year at 49.9. Weakness was most evident in the new orders sub-component which fell by 5.9 points to 46.4 and to the lowest level since December 2022. The impact of tariff hikes and heightened policy uncertainty is weighing on business confidence and lifting input costs. The prices paid sub-component rose sharply for the second consecutive month to 68.7 in May highlighting that inflation pressures are set to pick-up in the coming months while underlying growth momentum appears to be slowing. The decline in US yields indicates that market participants are putting more weight on loosening labour market conditions than higher inflation from tariff hikes when determining the outlook for Fed policy.

The drop in US yields contributed to USD/JPY hitting a low overnight at 142.53 although it has since risen back above the 143.00-level. The main focus overnight in Japan has been the latest 30-year JGB auction after the recent sharp sell-off at the long-end of the curve. JGBs have reacted positively overnight with the 30-year yield dropping by 6bps to 2.89% as it moves further below last month’s high of 3.20%. According to Bloomberg, the outcome from the 30-year auction was largely seen as being within the expected range providing some initial relief. Nevertheless, the bid-to-cover at 2.92 was lower than both the previous auction (3.07) and the average over the past year (3.39) indicating some softening in demand. It follows stronger demand at the 10-year JGB auction earlier this week. Market participants are now waiting eagerly to see if the MoF will adjust issuance plans to help to ease upward pressure on yields at the long-end of the curve. The BoJ is also set to announce updated JGB tapering plans at their 17th June policy meeting. Recent comments from Governor Ueda have signalled that they are unlikely to slow the pace of tapering.

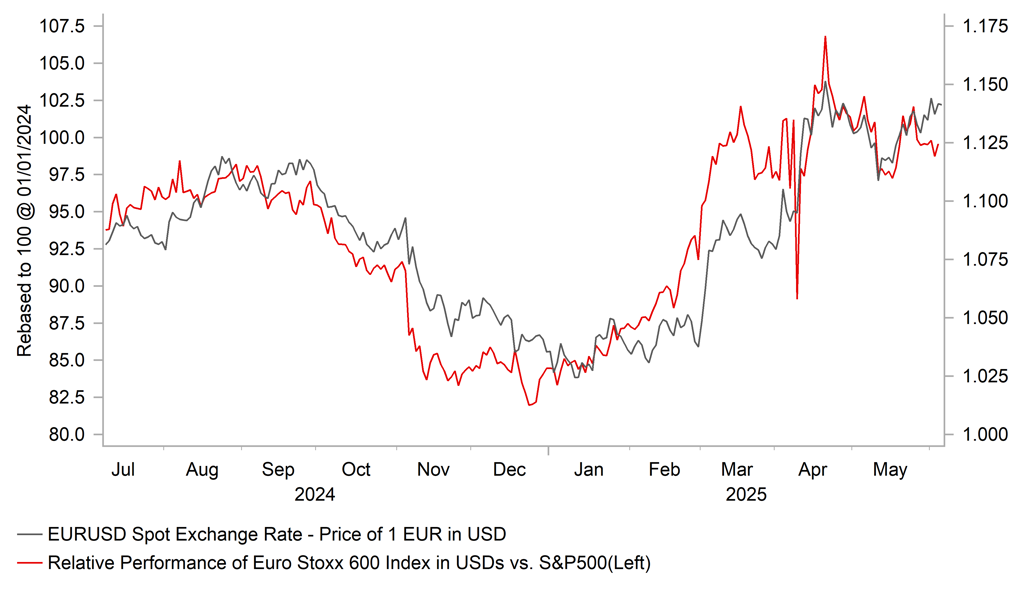

GERMAN FISCAL POLICY SHIFT HELPED TO LIFT EUR EARLIER THIS YEAR

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Weighing up ECB policy options ahead of today’s meeting

Market attention will now shift to the ECB’s latest policy update today ahead of tomorrow’s NFP report. The ECB is expected to deliver another 25bps cut today lowering the policy rate to 2.00%. It would be the eighth rate cut in the current easing cycle. However, we do expect (click here) the ECB to slow the pace of easing going forward now that the policy rate is more in line with policymakers estimates of the neutral rate. After delivering a 25bps rate cut today we expect the ECB to skip next month’s policy meeting. However it is unlikely to be the end of the easing cycle and we expect one or two more cuts before year end depending on the outcome of the trade talks between the EU and US. Our current forecast for the policy rate to fall to a low 1.50% rests on the assumption that the US will impose a higher reciprocal tariff rate on the EU adding to downside risks for the euro-zone economy. It has also been supported by further reassuring evidence showing that core and services inflation in the euro-zone continues to slow alongside wage growth which should give the ECB more confidence that inflation can be sustained close target. The stronger euro and lower energy prices are disinflationary as well.

On the other hand, the new German government’s plans for looser fiscal policy will create some unease over lowering rates further. Germany’s cabinet approved a package of tax breaks for companies yesterday worth an estimated EUR46 billion including write-offs of as much as 30% for companies purchasing movable assets between the end of June and January 2028, and additional depreciation benefits for firms acquiring electric vehicles with a gross list price of as much as EUR100k. Finance Minister Lars Klingbeil also plans to progressively reduce the corporate tax rate over a five-year period beginning in 2028 from around 30% to about 25%. The package now needs approval in parliament. The new measures quickly follow on from legislation passed earlier this year to adjust the debt break to allow a significant step up in defence spending and set up a public infrastructure and climate special investment fund totalling EUR500 billion. The big shift in the outlook for German fiscal policy has been an important driver behind the stronger euro at the start of this year. The euro could strengthen further against the US dollar if the ECB expresses more caution over cutting rates further at today’s policy meeting. It could help lift EUR/USD up closer to the 1.1500-level. However, we doubt that the ECB would rule out further easing given recent favourable inflation developments. More important for EUR/USD direction in the near-term will be the release of the latest NFP report on Friday.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

IHS S&P Global Construction PMI (MoM) |

May |

-- |

46.0 |

! |

|

IT |

09:00 |

Italian Retail Sales (MoM) |

Apr |

0.4% |

-0.5% |

! |

|

UK |

09:30 |

BoE Breeden Speaks |

-- |

-- |

-- |

! |

|

UK |

09:30 |

Construction PMI |

May |

47.4 |

46.6 |

!!! |

|

EC |

10:00 |

PPI (YoY) |

Apr |

1.2% |

1.9% |

! |

|

US |

12:30 |

Challenger Job Cuts (YoY) |

-- |

-- |

62.7% |

! |

|

EC |

13:15 |

Deposit Facility Rate |

Jun |

2.00% |

2.25% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

236K |

240K |

!!! |

|

US |

13:30 |

Nonfarm Productivity (QoQ) |

Q1 |

-0.8% |

-1.7% |

!! |

|

US |

13:30 |

Trade Balance |

Apr |

-67.60B |

-140.50B |

!! |

|

US |

13:30 |

Unit Labor Costs (QoQ) |

Q1 |

5.7% |

2.0% |

!! |

|

CA |

13:30 |

Trade Balance |

Apr |

-1.40B |

-0.51B |

!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!! |

|

EC |

15:15 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

17:00 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

! |

|

CA |

17:20 |

BoC Deputy Gov Kozicki Speaks |

-- |

-- |

-- |

!! |

|

US |

18:00 |

Atlanta Fed GDPNow |

Q2 |

4.6% |

4.6% |

!! |

|

US |

18:30 |

Fed Schmid Speaks |

-- |

-- |

-- |

! |

|

US |

18:30 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,673B |

!! |

Source: Bloomberg & Investing.com