UK election outcome as expected ahead of key jobs data

USD: Risks of a weaker jobs report are increasing

The first Friday of the month is upon us and with that we have the release of the key non-farm payrolls report which feels each month to be increasing in importance given not only the Fed’ usual focus on jobs but also given the data increasingly looks at odds with the vast bulk of other labour market data followed by financial market participants. The latest set of weak data on Wednesday saw yields decline more modestly than we would have expected and anticipation of today’s jobs report may have curtailed the drop in yield. Given the recent history of the non-farm payrolls failing to show the weakness implied in other data investors may well have curtailed their response.

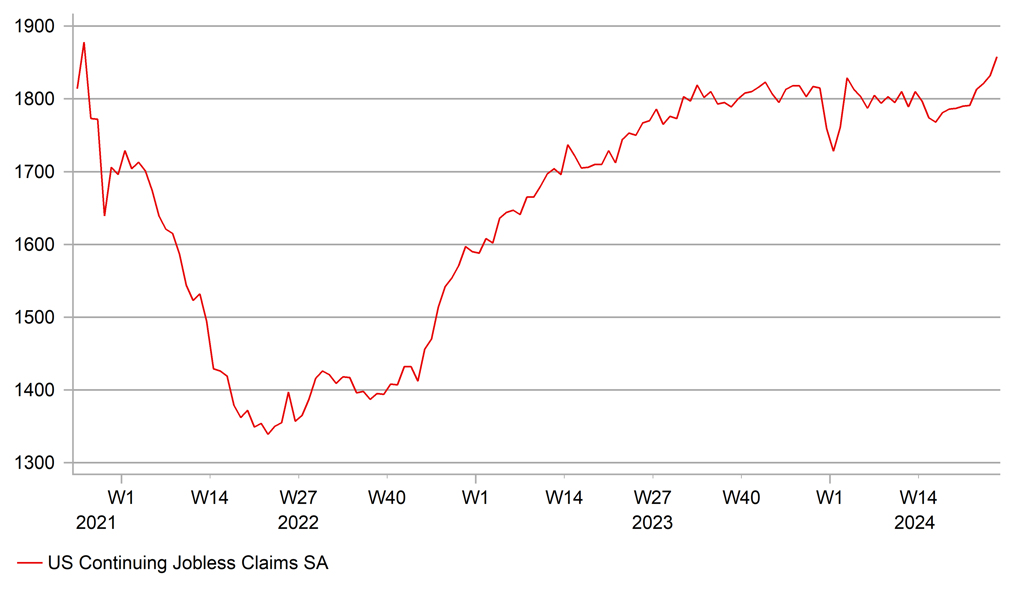

The weakness in the data is building though and that does suggest a bigger risk of a downside surprise in today’s data. ADP employment has now slowed for three consecutive months and was weaker than expected, while initial and continued claims increased further. Continued claims increased to 1,858k in the week of 22nd June and when the covid-related surge is excluded this is the highest level for continued claims since April 2018. The plunge in the ISM services index on Wednesday included another sub-50 reading for employment and points to a clear weakening in services activity. This is already evident in the retail sales data. In nominal terms, retail sales excluding autos and gasoline is running at -0.2% on a year-to-date basis suggesting US consumers are beginning to retrench which is indicative of a more notable slowdown in GDP growth. Declining confidence in labour market conditions could be one factor causing this slowdown in retail sales.

In this context we would certainly argue that there are greater downside risks to the non-farm payrolls consensus of +190k. A downside surprise certainly less than 150k would likely see a more significant rates move lower and with it greater conviction for a rate cut in September. 18bps of cuts are now priced for September and that could quickly be close to fully priced on a weaker report. The FOMC communications remain mixed but certainly we would argue not entirely consistent with the current median dot of just one rate cut this year and there appears to be a growing expectation that weaker labour demand will now see a clearer pick-up in the unemployment rate.

That makes us believe that a clear pivot from the Fed on weaker jobs data is very plausible. Fed Chair Powell himself on Tuesday stated that he sees a “substantial” move toward a better labour market balance while New York Fed President this week indicated that assessments on R* suggest no notable shift higher implying two things – a reversal back to a low yield regime is plausible and secondly that the current monetary stance is very restrictive.

So based on the scale of weak or weakening labour market data currently, we see downside risks to the 190k NFP consensus. Given the drop in yield this week looks a little constrained ahead of the NFP, we would also see a bigger downside move in front-end yields and the dollar. DXY has just broken below the 50-day moving average with the 100-day moving average (104.764) easily achievable today which then brings in the trendline support (104.53) from the intra-day lows last December and in June.

US CONTINUED CLAIMS INCREASE ACCELERATING AGAIN

Source: Macrobond & Bloomberg

GBP: Landslide for Labour should help support GBP

The Labour Party is heading for an unprecedented victory in the UK general election and is looking like it will exceed the exit poll prediction of gaining an overall majority of 170, winning more than the 410 seats predicted last night. Labour is now predicted to end with 415 seats. The Conservative Party has lost a staggering 247 seats at the time of writing with Labour winning 210 seats and is projected to end with 120 seats. The Liberal Democrats won 70 seats for a gain of 62. Last night’s exit poll predicted Reform UK winning 13 seats but that was an over-estimate with Reform UK on 4 seats. Still in terms of the share of the vote, Reform UK has done huge damage to the Tories by gaining 14.3% of the vote share. The latest projected parliamentary majority is now looking closer to 180 seats.

The result is set to be the worst ever result for the Conservatives with a host of figures from the cabinet or just very well-known losing their seats. Most well-known to lose was Liz Truss, along with Jacob Rees-Mogg, Gillian Keegan, and Penny Mordaunt. Jeremy Hunt held on to his seats.

A key question now will be how the different factions in both Labour and the Tories evolve in the wake of this result. Incredibly, despite the landslide and huge majority, Labour won a far smaller share of the vote than Jeremy Corbyn in 2017 – 34% versus 40%. That will embolden those on the left in the Labour Party, no doubt led by Jeremy Corbyn himself, who won as an independent. The turnout was the second lowest since 1885 at just 60%, the least since 2001 (59%) and reason for caution from Labour. For the Tories many will argue, despite some well-known losses for those on the right, that the success of Reform UK means the Tories need to move more to the right.

But all in all and as we have argued in recent weeks, the huge majority for the Labour Party we believe is set to bring a positive political stability growth premium for the UK economy at the very moment when growth is beginning to accelerate as the energy price shock fades and positive real income growth returns. The spending commitments of the Labour party were very small – GBP 7.3bn – so there will be no dramatic increase in fiscal spending over the short-term. But businesses will very likely have increased confidence that will help improve business investment spending while relations with the EU should gradually improve over time. In our July Foreign Exchange monthly (here) we raised our GBP forecasts on the improving economic conditions and on the prospects of a period of political stability ahead – a first for the country going back nearly ten years.

LABOUR ON COURSE POSSIBLY FOR LARGEST MAJORITY SINCE 1924 (1997 MAJORITY WAS 179)

Source: BBC, Results as of 0740 BST with 11 seats still to declare

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Retail Sales (YoY) |

May |

0.1% |

0.0% |

! |

|

EC |

10:00 |

Retail Sales (MoM) |

May |

0.2% |

-0.5% |

! |

|

US |

10:40 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

EC |

13:15 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Jun |

0.3% |

0.4% |

!!!! |

|

US |

13:30 |

Average Hourly Earnings (YoY) |

Jun |

3.9% |

4.1% |

!!! |

|

US |

13:30 |

Average Weekly Hours |

Jun |

34.3 |

34.3 |

! |

|

US |

13:30 |

Nonfarm Payrolls |

Jun |

191K |

272K |

!!!!! |

|

US |

13:30 |

Unemployment Rate |

Jun |

4.0% |

4.0% |

!!!! |

|

CA |

13:30 |

Avg hourly wages Perm employee |

Jun |

-- |

5.2% |

! |

|

CA |

13:30 |

Employment Change |

Jun |

27.3K |

26.7K |

!! |

|

CA |

13:30 |

Unemployment Rate |

Jun |

6.3% |

6.2% |

!! |

|

US |

15:00 |

Total Vehicle Sales |

-- |

15.80M |

15.90M |

! |

|

CA |

15:00 |

Ivey PMI |

Jun |

53.0 |

52.0 |

!! |

|

US |

16:00 |

Fed Monetary Policy Report |

-- |

-- |

-- |

!!! |

|

EC |

18:15 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg