Calm restored in FX market ahead of NFP report

USD/JPY: Japanese political uncertainty and softer US labour market in focus

The major foreign exchange rates have remained relatively stable overnight after the pick-up in volatility in recent days triggered in part by the sell-off at the long-end of global bond markets. Global bonds recovered some lost ground yesterday providing some temporary relief and helping to stabilize the foreign exchange market. The 30-year JGB yield dropped back towards 3.25% overnight after hitting a year to date high yesterday of 3.31%. The rebound for long-term JGBs was supported by favourable results from the latest 30-year JGB auction held overnight. The bid-to-cover ratio (3.31) came in broadly in line with the average over the past year of 3.38. The yen and JGBs have come under renewed selling pressure in recent days that helped to temporarily lift USD/JPY up to a high yesterday of 149.14 in response to fresh political uncertainty in Japan. There has been heightened speculation over the future of Prime Minister Ishiba. According to Bloomberg, the LDP is expected to vote on Monday on whether to bring forward a leadership election that is currently scheduled to take place in 2027. The party will be compelled to hold an early election if over half of the 342 party lawmakers and regional representatives seek one on Monday.

However, the LDP have stated that the vote will not be anonymous which could work in Prime Minister Ishiba’s favour. Recent surveys from Yomiuri newspaper and broadcaster NHK have revealed that about 100 people are in favour of an early election compared to 50 who are against it whereas the remaining half of eligible electors are undecided. If an early leadership election is called, the yen could weaken further at least initially as market participants are wary that Sanae Takaichi, who came second in the last leadership contest, remains one of the favourites to be the next prime minister. She is a strong supporter of the Abenomics policies of loose fiscal and monetary policies. However, those policies are unlikely to prove as popular with the public. Higher inflation was one of the reasons why the LDP performed poorly in the Upper House election. As a result, the LDP should be less inclined to pick Sanae Takaichi to be their leader.

The rise in USD/JPY in recent days has also been driven by board-based US dollar strength which helped to lift the dollar index by just over 1%. The US dollar initially benefitted from more risk-off trading conditions triggered by the sell-off at the long-end of global bond markets. However, it has given back some of those gains ahead of the release of the important nonfarm payrolls report on Friday. The US dollar’s upward momentum was undermined yesterday by the release of further evidence of softening US labour market conditions. The latest JOLTS report revealed a notable drop in job openings and upward revisions to layoffs in prior months. The job openings-to-unemployed ratio fell below 1.0 for the first time since April 2021. It fits with recent comments from Fed Chair Powell at Jackson Hole that the labour market has softened more than previously anticipated. At the same time, the release of the Fed’s latest Beige book for August pointed to weak consumer spending and slower growth. Firms indicated that they were reluctant to hire new workers given weak demand and elevated uncertainty. It continues to suggest that there is a higher hurdle for the Fed not to resume rate cuts this month. Tomorrow’s NFP report would have to be significantly stronger than expected to push back Fed rate cut expectations and lift the US dollar.

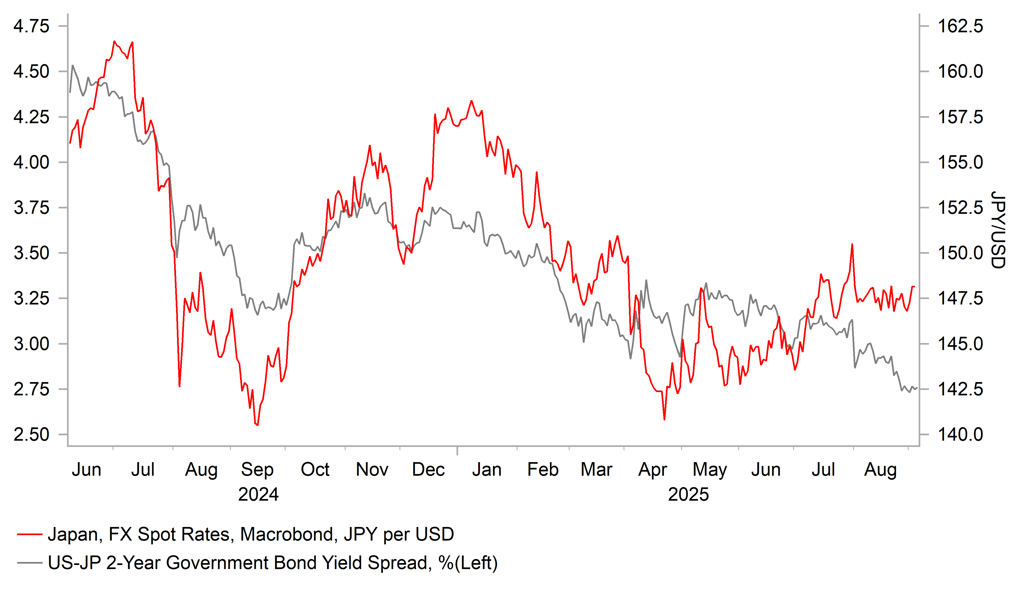

USD/JPY IS FAILING TO TRACK NARROWING YIELD DIFFERENTIALS

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Governor Bailey indicated pace of QT remains under consideration

The pound has been on been one of worst performing G10 currencies so far this week alongside the yen. The pound has been negatively impacted by the sharp sell-off in log-term Gilt yields with the 30-year yield breaking above resistance at 5.60% and rising to a fresh year to date high of 5.75%. It is the highest level since the 1H 1998 which adds to building concerns over the UK government’s finances. Those fiscal concerns have become more important again recently in driving pound performance. It has been notable that the pound has fully reversed gains recorded in August after the BoE provided a hawkish policy update which cast more doubt on whether they would deliver another quarterly rate cut in November. EUR/GBP fell to a low of 0.8597 on 14th august but has risen back up to the 0.8700-level in recent days. At the same time, the UK rate market continues to price in less BoE rate cuts going forward. The yield on the 2-year gilt yield is still around 14bps higher than prior to the BoE’s August MPC meeting.

BoE Governor Bailey’s comments in front of Parliament’s Treasury committee shed more light on recent developments. He effectively endorsed the recent hawkish repricing of the UK rate market by stating that his “message has landed”, and that there is “now considerably more doubt about exactly when and how quickly we can make those further steps”. The BoE has become more concerned again over the risk of higher inflation proving persist. He added “the risk on inflation has gone up” but he remains more concerned than colleagues over the state of the labour market. At the same time he attempted to downplay the importance of the move higher in long-term gilt yields. He told the Treasury Committee that he wouldn’t “exagerrate” the significance of recent moves and there's “a danger of being slightly overly focused”.

However, he did indicate that the BoE will take into account the move in gilt yields when making their upcoming decision over adjusting the pace of QT at the September MPC meeting. He noted that the pace of QT remains an “open decision”. The comments will encourage speculation that the BoE could announce a bigger slowdown in the pace of QT this month. The BoE’s Market Participants Survey from August revealed that the median forecast is for QT to slow to around GBP75/year down from the current pace of GBP100 billion. Plans for a faster slowdown in QT could offer some support for the gilt market and help ease downside risks for the pound in the near-term. Governor Bailey also added that the Debt Management Office (DMO) is already cutting back issuance at the long-end to a record low proportion of sales to reflect less structural demand for long-dated, long-maturity bonds. The overall average maturity of outstanding debt issued by the UK government is around 14 years according to the DMO which is much longer than in most advanced economies. It compares to between 6-8 years for other advanced countries.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

IHS S&P Global Construction PMI (MoM) |

Aug |

-- |

44.7 |

! |

|

UK |

09:30 |

Construction PMI |

Aug |

45.2 |

44.3 |

!!! |

|

EC |

10:00 |

Retail Sales (MoM) |

Jul |

-0.3% |

0.3% |

! |

|

CA |

11:00 |

Leading Index (MoM) |

Aug |

-- |

0.15% |

! |

|

US |

12:30 |

Challenger Job Cuts |

Aug |

-- |

62.075K |

! |

|

US |

13:00 |

Total Vehicle Sales |

Aug |

16.10M |

16.40M |

! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Aug |

73K |

104K |

!!! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,960K |

1,954K |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

230K |

229K |

!!! |

|

US |

13:30 |

Nonfarm Productivity (QoQ) |

Q2 |

2.8% |

2.4% |

!! |

|

US |

13:30 |

Trade Balance |

Jul |

-77.70B |

-60.20B |

!! |

|

US |

13:30 |

Unit Labor Costs (QoQ) |

Q2 |

1.2% |

1.6% |

!! |

|

CA |

13:30 |

Trade Balance |

Jul |

-5.20B |

-5.86B |

!! |

|

CA |

14:30 |

Services PMI (MoM) |

Aug |

-- |

49.30% |

! |

|

US |

14:45 |

Services PMI |

Aug |

55.4 |

55.7 |

!!! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Aug |

-- |

52.6 |

! |

|

US |

17:05 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com