US jobs was a positive for the dollar but the focus now shifts to trade

USD: Jobs data kills July rate cut prospects

Once again the monthly non-farm payrolls report has defied expectations of showing clearer signs of weakness consistent with other labour market data which saw the US dollar strengthen in line with higher yields – albeit the gain for the dollar has since reversed. As you would expect, yields at the front-end of the Treasury yield curve have gained the most given there had been some recent speculation of a July rate cut – about 6-7bps was priced prior to the NFP release. The chances of the FOMC cutting now in July are effectively close to non-existent. The OIS curve has one basis point priced. However, the DXY only gained about 0.4% since the release of the report has retraced the move while yields are unchanged with the US Treasury market closed for the 4th July US holiday.

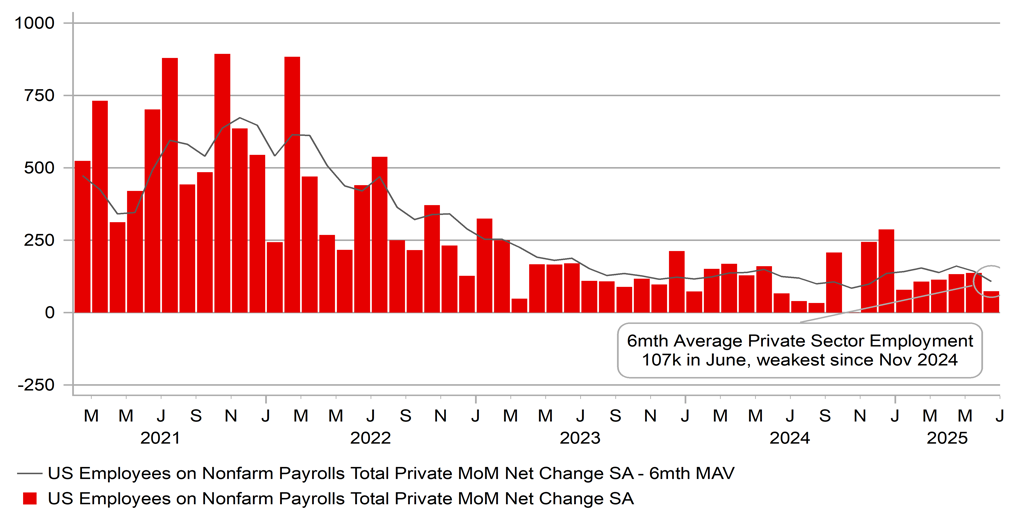

As always, there were reasons for the caution – both related to the data and other events that are on the horizon. The 147k increase in NFP in June was much stronger than implied by the ADP the previous day that revealed a 33k drop in private sector employment. However, the curtailed market response was in part due to private sector employment slowing sharply, to 74k. That was the weakest print since October last year. Of that 74k increase, 51k was in the private education and health. The balance of 23k is a good benchmark of the health of cyclical employment. With education and health accounting for nearly 70% of the private sector employment there were certainly some signs of the weakness that has been evident in other data. The unemployment rate fell 0.2ppt but that should be interpreted with caution given over 750k have left the labour market over the last two months. The labour force participation rate fell – hardly a sign of labour market strength.

So a better than expected report but reason for market participants not to over-react. With a July cut now off the agenda, the pricing for Fed cuts through the remaining three FOMC meetings will be important for the dollar. The One Big Beautiful Bill Act will be signed into law today by President Trump – we didn’t expect the “hold-outs” amongst House Republicans to fold so quickly. While this has been turned around more quickly than we expected, market participants fully expected this to happen relatively soon and hence it is unlikely to shape Fed expectations much with the markets largely priced for this.

The greatest unknown therefore is the outcome of the reciprocal tariff plans that should become clear over the weekend and first few days of next week before 9th July. The reversal of the dollar has been triggered by the comment from President Trump that “10 to 12” letters would be sent out Friday and others in the coming days with the range of tariffs set at 10-20% to 60-70%. Given the UK tariff rate is 10% and Vietnam, with one of the fastest growing trade imbalances with the US, at 20%, the markets were expecting much lower ranges. Certainly the 2nd April rates were not expected to be repeated or as implied by Trump yesterday, even higher. If Trump’s comments prove accurate then investors will again begin to downgrade growth expectations and upgrade inflation expectations which will only encourage further dollar selling. Market participants are not expecting higher tariff rates. Of course the 60-70% rates may well prove isolated to a small number of smaller countries which would help limit dollar selling and improve the prospect of consolidation at these weaker levels.

US PRIVATE SECTOR EMPLOYMENT REMAINS SUBDUED

Source: Bloomberg, Macrobond & MUFG GMR

JPY: BoJ rate hike expectations could build

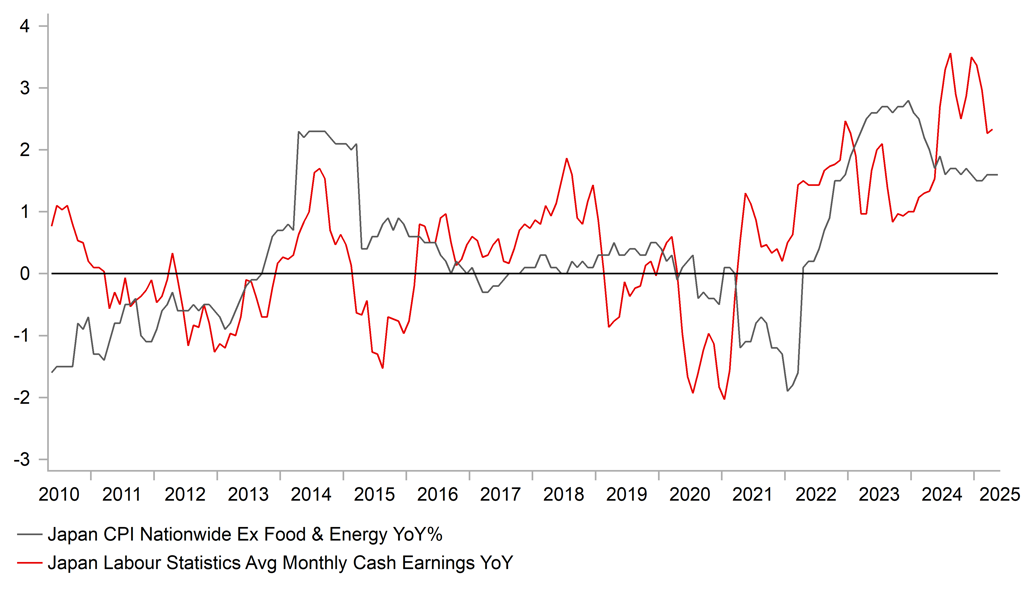

The outcome of Trump’s trade deal announcements ahead of 9th July will be important for many countries, including Japan. If a deal has been reached that is not too disruptive to trade, then other factors certainly are pointing to increased prospects that the BoJ will resume its monetary tightening cycle. Yesterday, we got confirmation of the final outcome of the ‘shunto’ wage negotiations with Rengo confirming a final wage increase of 5.25%. This was higher still than last year’s 5.1%. Achieving real income growth is an important aspect of policy in Japan as it helps sustain the wage/price spiral in order for the BoJ to achieve its inflation goal. Data released today confirmed a surge in household spending, which in real terms jumped 4.7% YoY. This in part was helped by a favourable base-effect due to weak auto sales a year ago but even outside of this sales related to tourism picked up as did restaurant sales.

It will help encourage the BoJ in holding on to its view that additional rate hikes will be required if the economy is to unfold as expected. Today, BoJ policy board member Hajime Takata stated that the BoJ is currently only pausing its tightening cycle and should resume after a period of “wait-and-see”. Takata is one of the more hawkish members of the BoJ’s policy board but no doubt still high inflation and now some evidence of a pick-up in growth, the wider policy board will likely lean in that direction if external developments allow.

The yen is rebounding today and has nearly fully retraced the jump after the US jobs data and jump in yields yesterday. While a lot will depend on the scale of tariffs in any deal with Japan to be confirmed in the coming days, the domestic factors look more compelling for another hike this year. September is only priced for 2bps of policy tightening which is too low and we see scope for this to adjust which will reinforce the potential for the yen to strengthen over the coming months.

POSITIVE CASH EARNINGS GROWTH IN REAL TERMS CAN BE SUSTAINED

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

08:30 |

HCOB Italy Construction PMI |

Jun |

-- |

50.5 |

! |

|

GE |

08:30 |

HCOB Germany Construction PMI |

Jun |

-- |

44.4 |

! |

|

FR |

08:30 |

HCOB France Construction PMI |

Jun |

-- |

43.1 |

! |

|

EC |

08:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

EC |

08:30 |

HCOB Eurozone Construction PMI |

Jun |

-- |

45.6 |

! |

|

UK |

09:00 |

Car Registration (YoY) |

Jun |

-- |

1.6% |

! |

|

IT |

09:00 |

Italian Retail Sales (YoY) |

May |

-- |

3.7% |

! |

|

IT |

09:00 |

Italian Retail Sales (MoM) |

May |

0.5% |

0.7% |

! |

|

EC |

09:00 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

UK |

09:30 |

S&P Global Construction PMI |

Jun |

48.6 |

47.9 |

!! |

|

EC |

10:00 |

PPI (MoM) |

May |

-0.6% |

-2.2% |

! |

|

EC |

10:00 |

PPI (YoY) |

May |

0.3% |

0.7% |

! |

|

CA |

11:00 |

Leading Index (MoM) |

Jun |

-- |

0.10% |

! |

|

EC |

13:15 |

ECB's Villeroy speaks |

!! |

|||

|

IT |

17:00 |

Italian Car Registration (YoY) |

Jun |

-- |

-0.1% |

! |

|

UK |

18:30 |

BoE's Taylor speaks |

!! |

Source: Bloomberg & Investing.com