Commodity FX performance in focus after RBA policy update

AUD: RBA leaves rates on hold & maintains the same forward guidance

The Australian dollar has underperformed overnight following the RBA’s decision to leave their policy rate unchanged at 4.10%. It has resulted in the AUD/USD rate falling back towards 0.6650 and the AUD/NZD rate towards 1.0825. As we highlighted in yesterday’s FX Daily Snapshot, the Australian rate market had moved ahead of today’s RBA policy meeting to pare back expectations for back to back rate hikes and a hawkish hold was judged as the most likely outcome. However, Australian economists surveyed by Bloomberg had been more evenly split over the whether the RBA would deliver another hike today or leave rates on hold. In the accompanying policy statement, the RBA explained that the decision to leave rates on hold this month “will provide some time to assess the impact of the increase in interest rates to date and the economic outlook”. The RBA acknowledged that the monthly CPI indicator for May had shown a further decline. Yet they still believe that inflation is “too high” and will “remain so for some time”. The RBA was also encouraged by recent developments in the labour market with firms reporting that labour shortages have “lessened”. The RBA remains wary though that with labour force participation at a record high and the unemployment rate close to a 50-year low that wage growth will pick-up further and pose upside risks to their inflation target. The RBA currently believes wage growth is consistent with their target providing that productivity picks up.

One section that remained unchanged from last month was the forward rate guidance. The RBA repeated that “some further tightening of monetary policy may be required to ensure that inflation returns to target n a reasonable time frame, but that will depend upon how the economy and inflation evolve”. It signals that the RBA are planning to deliver at least one more 25ps rate hike this year. The RBA added that they will pay close attention to the “forecasts” for inflation and the labour market. After today’s policy update the Australian rate market has scaled back expectations for further policy tightening from the RBA. There are currently around 10bps of hikes priced in the for next policy meeting on 1st August and 34bps hikes by the end of this year. The Australian rate market has become less confident over whether the RBA will deliver more than one more hikes in this cycle. It will put a dampener on the performance of the Australian dollar in the near-term alongside the recent loss of growth momentum in China’s economy in Q2. Domestic policymakers in China are expected to roll out further stimulus measures this month that will be important in determining whether confidence continues to deteriorate in China’s economy.

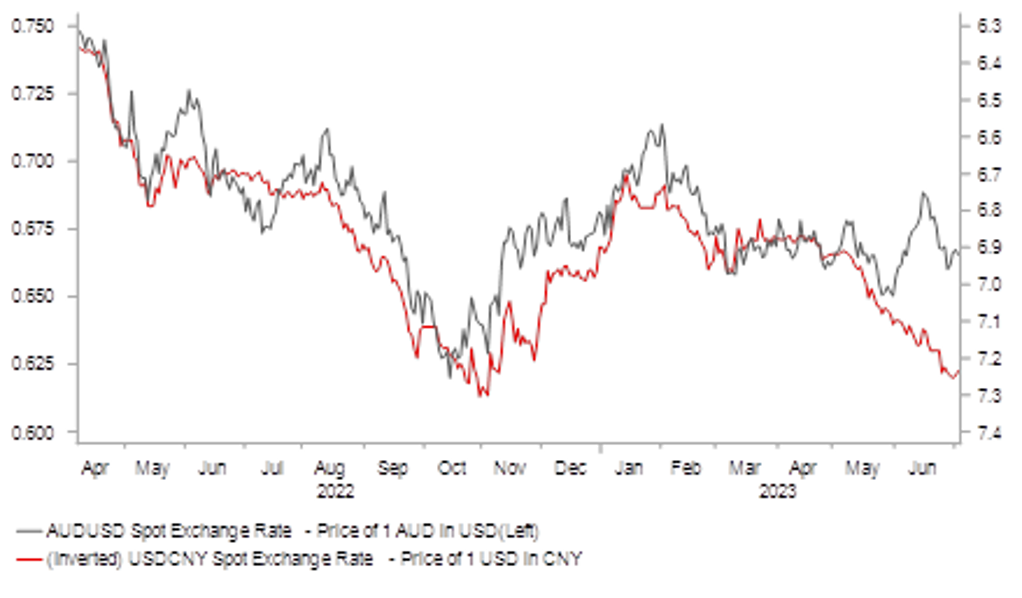

LIMITED NEGATIVE SPILLOVER TO AUD PERFORMANCE SO FAR

Source: Bloomberg, Macrobond & MUFG GMR

Oil FX: Saudi Arabia & Russia attempt to provide more support for price of oil

It was announced yesterday that Saudi Arabia will prolong its unilateral oil production cut by one month. Saudi Arabia will maintain the 1 million barrel-a-day reduction in oil production into August and could extend it further according to a statement published by the state-run Saudi Press Agency. According to Bloomberg it will result in Saudi Arabia pumping about 9 million barrels-a-day as it seeks to supports the price of oil. At the same time, Russian Deputy Prime Minister Novak stated that Russia will reduce oil exports by 500k barrels-a-day in August. The market impact of yesterday’s policy announcements followed a similar pattern to other production cuts announcements this year, the price of oil initially rallied before giving back those gains. The price of Brent jumped initially to USD76.60/barrel but has since fallen back to the USD75.00/barrel where it was trading prior to yesterday’s announcements. The price of oil continues to trade close to year to date lows despite a number of production cuts announcements in recent months. At the best the measures have helped to stabilize the price of oil at lower levels so far. Our commodity analysts still expect tightening supply and demand conditions to support a rebound in the price of oil in 2H of this year (click here).

The performance of oil-related currencies has been mixed over the past month. The Norwegian krone (+3.6% vs. USD) and Canadian dollars (2.5%) have been the best performing G10 currencies since the end of May driven in large part by the hawkish repricing of Norges Bank and BoC rate hike expectations. While the Russian rouble (-9.0% vs. USD) has been one of the worst performing currencies alongside the Turkish lira over the same period. After a brief period of consolidation, the rouble resumed the bearish trend last month that has been in place since late last year. The rouble has declined sharply by around a third against the EUR and USD basket since the end of November of last year as it has fallen back to lows recorded in March of last year when it initially collapsed after the Ukraine conflict started. The bearish trend highlights that fundamental support for the rouble from Russia’s record current surplus has now evaporated. Russia posted a record current account surplus of USD77.2 billion in Q2 of last year, but the surplus has since narrowed sharply back to more normal levels at USD14.8 billion in Q1 of this year. For this year as a whole the surplus is expected to shrink by more than half from last year’s total of just over 10% of GDP. It is making it more difficult for Russia to financing their war efforts, and casts doubt on their willingness to follow through on planned oil production cuts.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Deficit to GDP YTD |

1Q |

-- |

8.0% |

! |

|

CA |

14:30 |

S&P Global Canada Manufacturing PMI |

Jun |

-- |

49.0 |

!! |

|

EC |

17:00 |

ECB's Nagel speaks |

!! |

|||

|

EC |

18:00 |

ECB's Stournaras speaks |

!! |

Source: Bloomberg