RBA decision highlights increased caution over need for further hikes

AUD: RBA leaves rates on hold & softens guidance over need for further hikes

The main macro event overnight has been the RBA’s latest policy meeting. The Australian dollar has weakened modestly initially following the RBA’s policy decision by around -0.3% against the US dollar and -0.4% against the New Zealand dollar. It does though follow strong gains yesterday for the Australian dollar that have only been partially reversed so far. The Australian dollar sold off overnight after the RBA decided to leave their policy rate unchanged at 3.60%. The decision brought an end to the run of rate hikes at ten consecutive policy meetings. The RBA’s updated policy statement outlined that the decision to hold rates steady this month was to “provide additional time to assess the impact of the increase in interest rates to date and the economic outlook”. The RBA emphasized that that monetary policy operates with a lag and that the full effect of the “substantial” increase (3.50ppts) in interest rates is yet to be felt. Recent banking system problems contributed to the RBA’s decision. The RBA highlighted that the expected tightening in financial conditions would provide an additional headwind for the global economy, but like other major central banks recently they also attempted to provide reassurance over the health of the Australian banking system.

The RBA’s decision to hold rates overnight was also in response to recent domestic economic developments. The RBA is confident now that inflation has peaked and their central forecast is for inflation to decline this year and next to around 3% by the middle of 2025. Rising rents and the price of utilities were cited as two specific areas of concern where inflation was still rising quickly. The RBA is not yet overly concerned by stronger wage growth provided that productivity growth picks up. Furthermore, the RBA is more confident that the impact higher rates, the rising cost of living and the decline in house prices are leading to a “substantial slowing in household spending.

In these circumstances, the RBA decided to leave rates on hold overnight but still left the door open to further hikes ahead. The forward guidance though showed less conviction. The RBA now expects some further tightening of monetary policy “may” well be needed instead of “will” be needed from the previous policy meeting from 7th March. The softer guidance over the need for further hikes reflects the “considerable” uncertainty over the economic outlook. Overall, the developments will reinforce market expectations that the RBA is close to or has just brought an end to rate hike cycle. It is negative factor for the Australian dollar although it is partially offset by expectations that other G10 central banks are at similar points in their own rate hike cycles. We continue to expect Australian dollar performance to be driven more by the outlook for global growth in particular for China’s economy. Stronger growth in China as its economy continues to fully reopen this year supports our forecast for the Australian dollar to strengthen (click here).

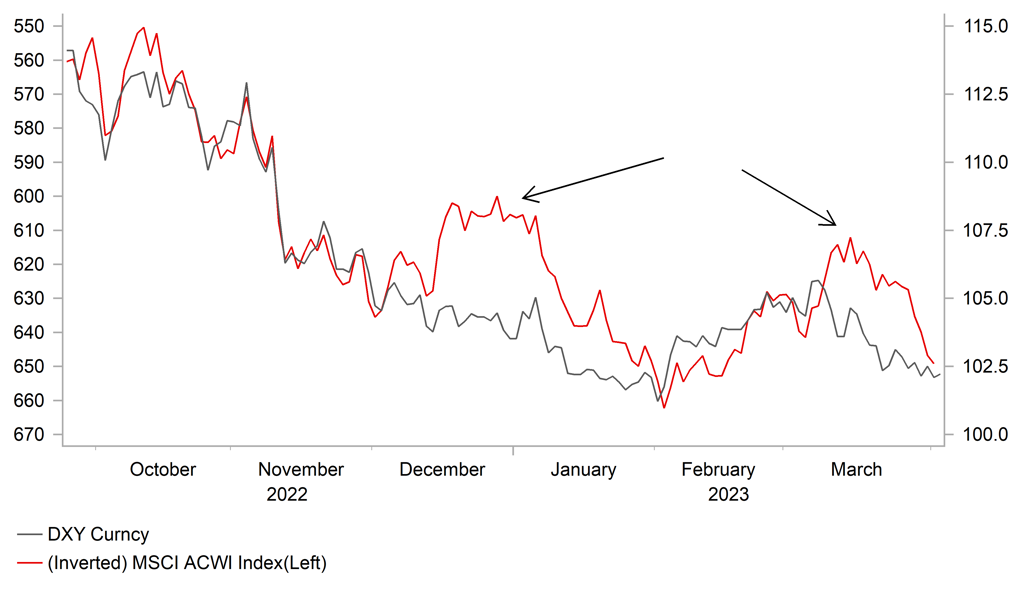

RISK-OFF PERIODS HAVE OFFERED LITTLE SUPPORT FOR USD RECENTLY

Source: Bloomberg, Macrobond & MUFG GMR

USD: Lowering our forecasts for USD & expecting more front-loaded weakness

The US dollar suffered a sharp reversal lower yesterday with the dollar index falling back close to recent lows at 101.92 after hitting an intra-day high earlier in the day at 103.06. The unfavourable price action highlights that risks remain tilted more to the downside for the US dollar in the near-term. The US dollar is currently being undermined by the improvement global investor risk sentiment as fears over a bigger hit to the global economy from a systemic banking crisis have eased, while US yields continue to remain at significantly lower levels. It reflects ongoing confidence amongst market participants that the Fed will bring an earlier end to their rate hike cycle in anticipation that the expected tightening in credit conditions imposed by regional banks will help to slow the US economy and inflation. The improvement in investor risk sentiment is evident by the performance of MSCI’s ACWI global equity index that has now fully reversed last month’s sell off and is trading at its highest level since the middle of February, while the US rate market is still not fully pricing in at least one more rate hike and then almost 50bps of cuts by the end of this year.

The recent dovish repricing of the Fed policy outlook was supported yesterday by the release of the softer ISM manufacturing survey for March that remained consistent with recessionary conditions in the sector. The prices paid sub-component has already normalized after the initial COVID driven surge higher and continues to signal that inflation should fall further. The release of the latest ISM services survey and non-farm payrolls report on Wednesday and Friday are expected to provide bigger tests of the recent dovish repricing. US rate market participants chose to largely ignore comments from St Louis Fed Bullard yesterday who still expects rates to peak much higher at 5.625% this year. He believes market participants are putting too much focus on banking strains. In light of recent regional banking developments, we have revised lower our forecasts for the US dollar in our latest monthly FX Outlook report (click here). The updated forecasts show more front-loaded US dollar weakness than we were previously expecting

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

PPI (YoY) |

Feb |

13.3% |

15.0% |

!! |

|

UK |

10:15 |

MPC Member Tenreyro Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

Trade Balance |

Feb |

1.80B |

1.92B |

!! |

|

US |

15:00 |

Durables Excluding Defense (MoM) |

Feb |

-- |

-0.5% |

! |

|

US |

15:00 |

JOLTs Job Openings |

Feb |

10.400M |

10.824M |

!!! |

|

UK |

15:30 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

US |

18:30 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

!! |

|

US |

18:30 |

FOMC Member Rosengren Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg