Long-end risks reinforced by political uncertainty in Japan

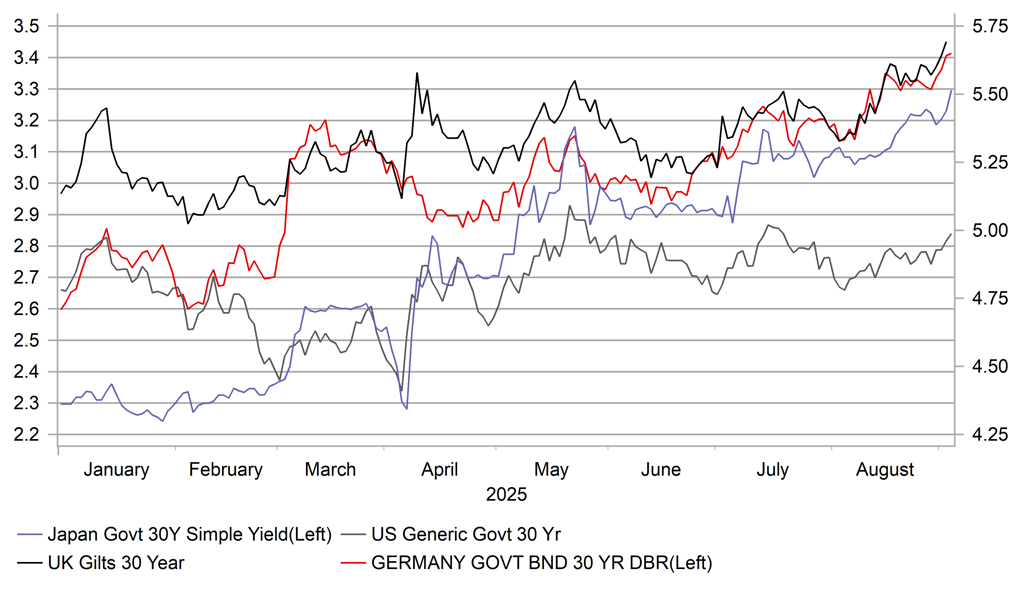

JPY: Speculation persists that Ishiba may be forced to resign

The US dollar gained broadly across G10 yesterday as selling of long-end sovereign debt intensified concerns over debt sustainability. The pound was the worst performing G10 currency (see below) with the yen the next worst performer. From a fiscal sustainability perspective, the concerns have shifted away from the US and on to other countries and when viewed over the year-to-date, the 30-year UST bond yield is up the least – by 24bps. The 30-year UK Gilt yield is up 56bps while the 30-year Bund yield is 80bps higher. For the UK, the Gilt yield was already at more elevated levels at the start of the year and the yield is at a level not seen since 1998. In Germany there is a growth element to this rise given the EUR 1 trillion infrastructure and defence spending announcement in March fuelled a big rise.

But it is the 30-year JGB yield that has risen the most this year – by 100bps (after today’s 7bp move) underlining the unfavourable fixed income backdrop in Japan. This is not just a fiscal sustainability issue given relative to the other key countries, Japan has the highest inflation level and the BoJ is the only G10 central bank in the middle of a hiking cycle. But the political backdrop is now not helping either. Speculation of PM Ishiba’s resignation intensified yesterday following the resignation of four senior executives within the LDP and this speculation has persisted today and it remains unclear at this stage whether PM Ishiba will survive.

The results of a current survey of LDP lawmakers and prefectural heads on whether to bring forward the LDP leadership election will be key in determining whether Ishiba is forced to step down. The Yomiuri newspaper is reporting that there is a “growing movement” within the party to support bringing forward the presidential election. Former PM Aso is the most senior LDP member to publicly state he will support an early election while a number of vice finance ministers have also indicated support. Sanae Takaichi also strongly hinted her support for a leadership election and would be one of the candidates to take over. A Nikkei poll revealed that Takaichi was viewed as most “fitting” to take over.

Key for the JGB market and the yen is how this all might play into fiscal and monetary policy. Uncertainty will help fuel selling given the increased risks of a larger fiscal spending package if a new leader is elected who supports that (Takaichi would). Ishiba supports increased spending but of a size that avoids any increased issuance of JGBs. We had initially assumed that the departure of senior LDP officials would ultimately help deflect blame from PM Ishiba and that he would survive. However, momentum seems to be shifting and it is a close call now on whether we have a leadership election that brings with it uncertainty and additional reasons to sell the yen. It may also throw up some doubts over a BoJ rate hike in October that would certainly reinforce near-term downside risks for the yen.

30-YEAR UST BOND YIELDS REMAIN BELOW YEAR-TO-DATE HIGHS

Source: Bloomberg, Macrobond & MUFG GMR

GBP: UK fiscal concerns in the spotlight again

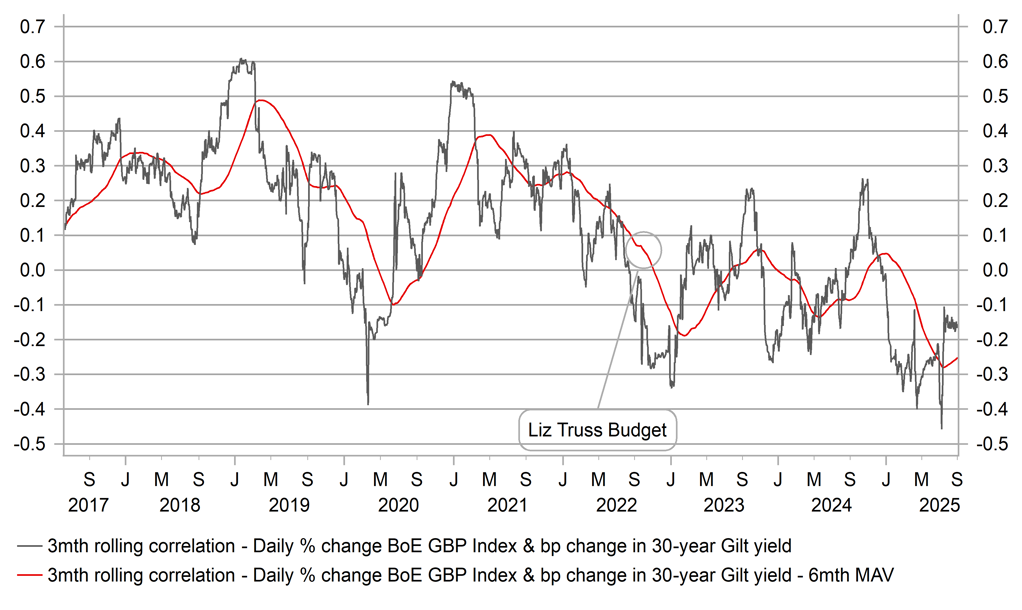

The broader move higher in longer-term yields yesterday certainly highlighted the fact that there are numerous countries where fiscal risks and debt sustainability concerns are increasing. The US, Japan, France all have metrics that in many examples are worse than the UK but it was the pound that was the clear under-performer within the G10 space. GBP/USD had its biggest one-day percentage drop (1.12%) since the period of FX volatility in April when President Trump first announced his global tariff plans on Liberation Day.

Yesterday was somewhat different with steepening yield curves and debt sustainability the driver which again prompted investors to consider the UK as the biggest risk. Not only was the pound the under-performer but the 30-year Gilt yield increased by marginally more than in Germany or the US. The 30-year JGB yield jumped 7bps today. The chart above also indicates the same evidence of increased investor concern with the negative rolling correlation between GBP TWI and 30-year Gilt yields. If debt measures like overall debt-to-GDP, or net debt, or the outlook for fiscal deficit or primary deficits are not as bad in the UK as elsewhere why does the UK look more vulnerable to these episodes of increase debt sustainability concerns?

The compelling evidence of much stickier inflation in the UK than in the euro-zone or the US is certainly part of that. The ECB has cut by 200bps from a lower peak compared to the 125bps from the BoE. While the Fed has cut by a little less – 100bps – the OIS curve shows much more easing expected in the US than in the UK. So monetary policy and the stronger inflation and wage growth is certainly part of that. Secondly, no other key central bank has been outright selling bonds as part of QT. That may change this month when we get an update of QT plans going forward but this factor hasn’t helped. Finally, the government’s approach to fiscal policy has not instilled confidence amongst investors. Two attempts to restore fiscal credibility (October last year and March this year) failed and a third attempt is coming. In hindsight the Labour election manifesto commitment not to raise VAT, income tax and national insurance was a mistake. Rumours of the latest tax rising plans (wealth tax, inheritance tax, property tax increases) have not helped restore confidence.

Still, these factors didn’t stop a record raising GBP 14bn in a 10-year Gilt syndication yesterday suggesting investors may be viewing these higher yields as attractive levels to buy. While we do not expect any crisis-type scenario in the UK, the risks from fiscal uncertainty will persist into the budget later in the year and in that scenario, we assume pound underperformance will continue. EUR/GBP has quickly retraced the drop triggered by the cautious BoE rate cut and we see scope for further gains ahead – 0.8769 is the recent intra-day high which we see being broken.

GBP / 30-YEAR GILT CORRELATION MORE NEGATIVE THAN SIMILAR CORRELATIONS IN OTHER KEY COUNTRIES

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

GE |

08:55 |

German Composite PMI |

Aug |

50.9 |

50.6 |

!! |

|

GE |

08:55 |

German Services PMI |

Aug |

50.1 |

50.6 |

!! |

|

AU |

09:00 |

RBA Gov Bullock Speaks |

-- |

-- |

-- |

!!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Aug |

51.1 |

50.9 |

!! |

|

EC |

09:00 |

Services PMI |

Aug |

50.7 |

51.0 |

!! |

|

UK |

09:15 |

BoE Breeden Speaks |

-- |

-- |

-- |

!!! |

|

UK |

09:30 |

Composite PMI |

Aug |

53.0 |

51.5 |

!! |

|

UK |

09:30 |

Services PMI |

Aug |

53.6 |

51.8 |

!! |

|

GE |

10:30 |

German 10-Year Bund Auction |

-- |

-- |

2.690% |

!!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-0.5% |

! |

|

UK |

14:15 |

BoE MPC Treasury Committee Hearings |

-- |

-- |

-- |

!!! |

|

US |

15:00 |

Durables Excluding Defense (MoM) |

Jul |

-2.5% |

-2.5% |

! |

|

US |

15:00 |

Factory Orders (MoM) |

Jul |

-1.3% |

-4.8% |

! |

|

US |

15:00 |

JOLTS Job Openings |

Jul |

7.390M |

7.437M |

!!! |

|

US |

18:30 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

Beige Book |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com