US shutdown continues as BoJ Governor Ueda remains cautious

JPY: Ueda comments keep October hike open without a strong signal

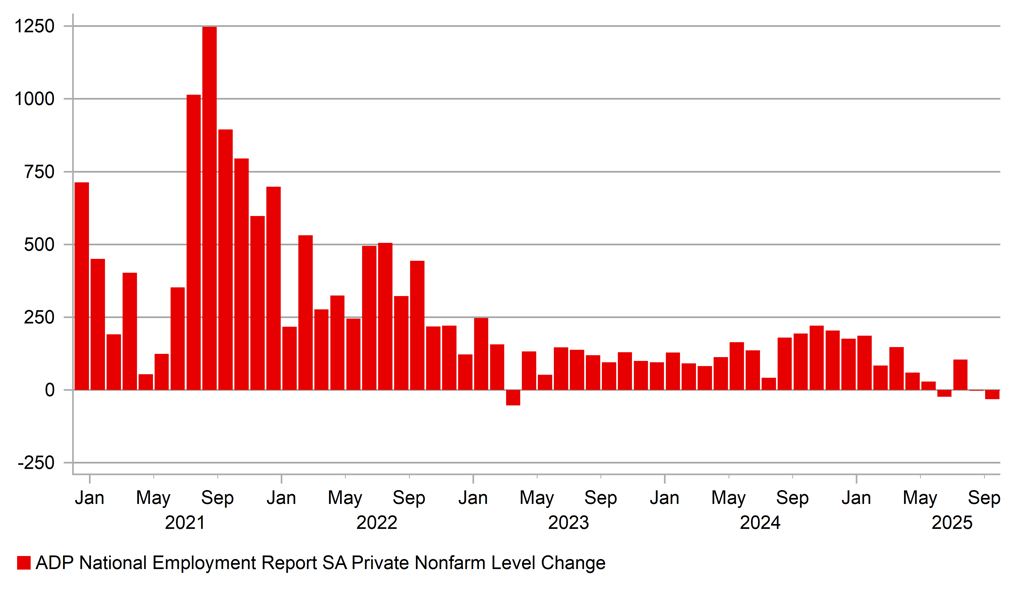

The government shutdown makes it highly unlikely that we will get the non-farm payrolls report today – since the shutdown began there has been no formal confirmation – which means this week will come to an end with shutdown politics in the US in focus. At present there doesn’t appear to be much in the way of momentum toward a deal and President Trump continues to threaten firing some government workers rather than placing them on furlough. All we have to go on for now is the ADP employment report that revealed a 32k decline in jobs underlining the worsening momentum for the labour market. The Director of the US Office of Management and Budget Russell Vought is meeting President Trump in order to determine which workers will be fired. This has been quoted as being in “the thousands” and hence doesn’t have much macro impact although the scale of firings remains unclear. Certainly if the White House follows through on the threats it will increase notably the risk of both sides digging in and prolonging the shutdown.

The impact in the financial markets has been marginal. The shutdown comes at a time when AI sentiment is helping fuel further equity market gains, reinforcing strong risk appetite. Numerous announcements of partnerships in the AI / tech space has lifted optimism of a further strong boost to earnings ahead. The Q3 corporate earnings season has kicked off although a lot of the big tech report toward the end of October.

So there has been only modest FX moves so far today but amongst these modest moves, the yen is the underperformer. The slightly weaker yen is down to the comments from BoJ Governor Ueda. Ueda spoke earlier at a business leaders meeting and again just now at a press conference. There is some disappointment that Ueda did not give a clear signal on the potential for a rate hike at the meeting on 30th October.

However, a strong signal from Ueda today was never a likely prospect ahead of the LDP leadership election tomorrow. But his comments did certainly include what we would class as indicating October is a live meeting. He stated that the Tankan report this week supported the BoJ views on the outlook for the economy. In the earlier speech Ueda stated that price increases “could last longer than expected” while adding that “prolonged inflation” could weigh on consumer spending. As expected Ueda also stated that whoever becomes the new PM, the BoJ would continue to pursue its goal of achieving price stability.

The pricing for an October rate hike has drifted a little lower – from 16bps yesterday to 14bps now. With no signal of an October move that’s understandable but the BoJ has ample time to shift current pricing more closely to a fully priced market and that, we think, is something that is likely to happen. The BoJ will of course be conscious of the fact that the FOMC could well be cutting the day before its meeting. A similar scenario last year in July (a dovish FOMC meeting signalling cuts were coming and a BoJ rate hike) triggered huge turmoil in Japan equities and FX. The BoJ won’t want that to happen and hence we’d expect after the LDP leadership election (we assume Koizumi wins, who would be more supportive of a BoJ rate hike) that the BoJ will provide a clearer message which would help to push USD/JPY lower, especially if the shutdown in the US drags on.

NFP OR NO NFP, DATA FROM ADP SIGNALS WEAK JOBS MOMENTUM

Source: Bloomberg, Macrobond & MUFG GMR

USD: Oil in focus ahead with no consistent FX implication

This Sunday OPEC+ will meet to agree next steps on production plans with expectations strong that another production increase will be agreed. Crude oil prices are down sharply this week with Brent dropping each day this week so far by a cumulative 8.6% (but slightly higher today so far). The close yesterday was the lowest since the beginning of June before the sharp spike higher on the concerns of an escalation in conflict in the Middle East following Israel’s attack on Iran.

The sharp drop this week is on concerns that OPEC+ could consider a faster path to increasing production going forward. The last announcement for October production was an increase of 137k bpd and the consensus had been for a similar increase for November. However, China has been absorbing substantial volumes to build up its strategic reserves that may result in OPEC+ being confident enough to increase production further. There remains around 1.6/1.7mn bpd of cut production to be brought back on line and Bloomberg reported one unnamed delegate stating that OPEC+ could consider a faster return of production by increasing in instalments of 500k bpd over a 3-month period. That would be considerably faster than expected. Given the IEA’s reported supply-demand surplus for 2026 and increasing concerns over economic growth in the US, a much bigger drop in prices could follow. Earlier in September, the IEA estimated 3.33mn bpd of surplus crude oil next year, which if we exclude 2020 due to covid, would be the largest ever calendar year surplus.

Saudi production has ramped up with 320k bpd increase in production in September and oil exports hit an 18-month high. The focus is now clearly on regaining market share and additionally Saudi Arabia and Mohammad bin Salman will view this as a way to foster relations with the US and President Trump.

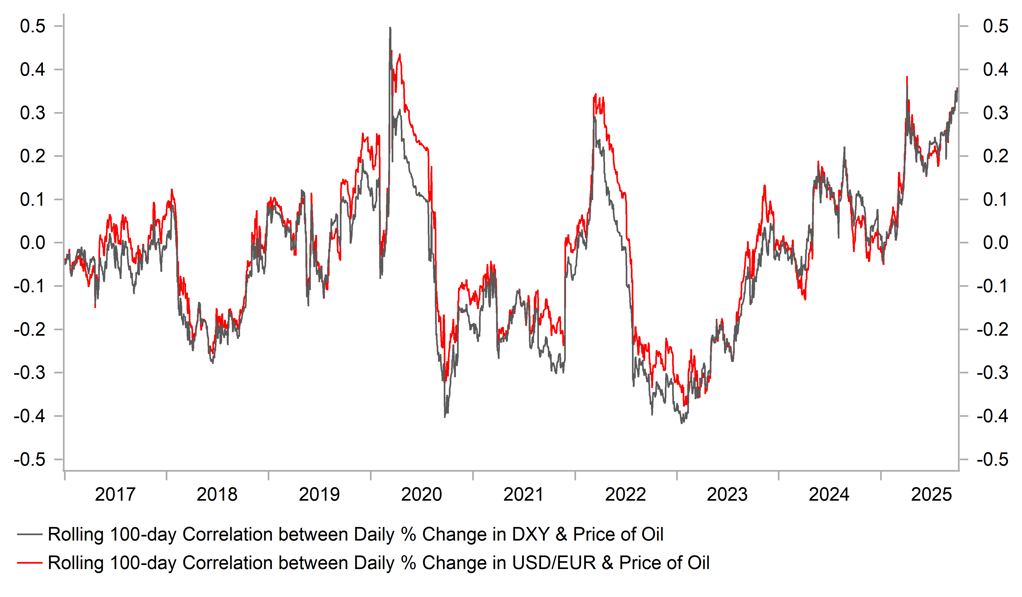

As can be seen above, the correlation between crude oil and the dollar has shifted back-and forth over the medium-term but with the US such a significant crude oil producer, a drop in crude oil prices can coincide with a drop in the dollar, especially if supply increase related. A risk-off demand shock would tend to coincide with a stronger dollar. On the other hand, from a euro-perspective a bigger than expected drop in crude oil prices would be positive from a real incomes perspective (the opposite of course of what happened when Russia invaded Ukraine) that could prove supportive for the euro although if the drop in crude oil was large enough it could also then lead to scope for the ECB to cut again, which isn’t fully priced.

POSITIVE USD CRUDE OIL CORRELATION HAS TRENDED STRONGER

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:45 |

French Industrial Production (MoM) |

Aug |

-- |

-1.1% |

! |

|

FR |

08:50 |

French S&P Global Composite PMI |

Sep |

48.4 |

49.8 |

! |

|

GE |

08:55 |

German Composite PMI |

Sep |

52.4 |

50.5 |

! |

|

EC |

09:00 |

S&P Euro-Zone Composite PMI |

Sep |

51.2 |

51.0 |

!! |

|

UK |

09:30 |

Composite PMI |

Sep |

51.0 |

53.5 |

!! |

|

UK |

09:30 |

Services PMI |

Sep |

51.9 |

54.2 |

!! |

|

EC |

10:40 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

EC |

11:00 |

PPI (MoM) |

Aug |

-0.1% |

0.4% |

! |

|

EC |

11:00 |

PPI (YoY) |

Aug |

-0.4% |

0.2% |

! |

|

US |

11:05 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

UK |

14:20 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!!! |

|

US |

14:45 |

S&P Global Composite PMI |

Sep |

53.6 |

54.6 |

!! |

|

EC |

14:50 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Sep |

51.8 |

55.0 |

! |

|

US |

15:00 |

ISM Non-Manufacturing PMI |

Sep |

51.8 |

52.0 |

!!! |

|

US |

16:00 |

Factory Orders (MoM) |

Aug |

1.4% |

-1.3% |

!! |

|

US |

18:40 |

Fed Governor Jefferson Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg & Investing.com