Sharp sell-off for GBP ahead of NFP report

GBP: Renewed UK fiscal & political instability concerns trigger sharp sell-off

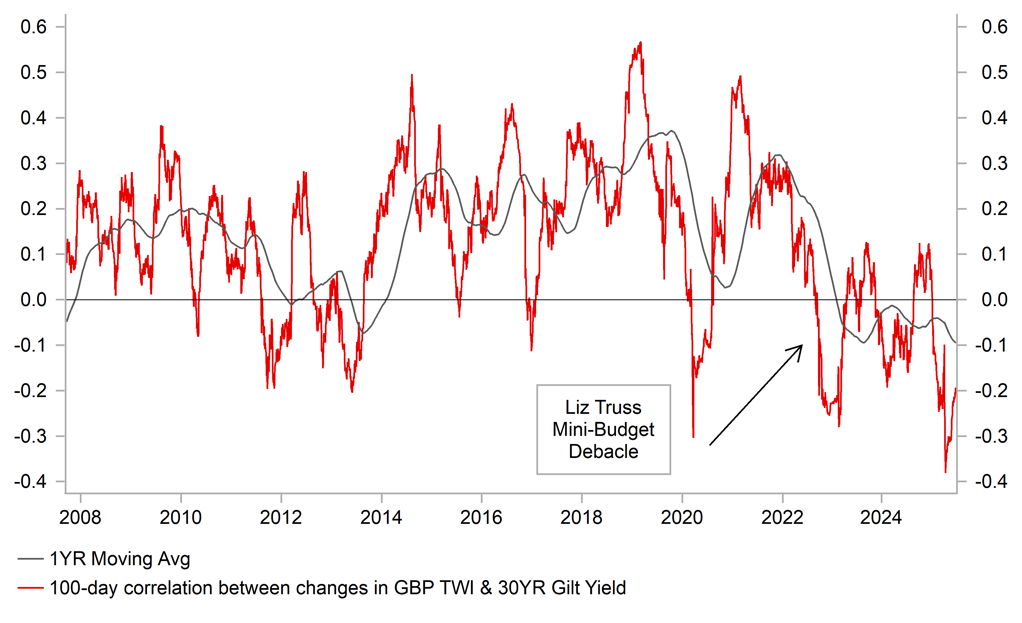

The pound has continued to trade at weaker levels overnight following yesterday’s heavy sell-off which resulted in EUR/GBP rising from around 0.8580 up to a high of 0.8670. The main trigger was heightened speculation that UK Chancellor Rachel Reeves could be replaced or step down creating additional uncertainty over the outlook for government’s fiscal policy. It follows another fiscal policy u-turn from the UK government after they were forced by Labour rebels into watering down plans for welfare reform and had previously reversed their decision to scrap the winter fuel allowance. The policy u-turns have undermined confidence in the Labour leadership while raising doubts over how serious the Labour party is about fiscal policy consolidation. It has created more unease in the Gilt market where the 30-year yield jumped yesterday by almost 20bps moving it back into the middle of the recent range between 5.20% and 5.60%. The sell-off in the Gilt market then spilled over the FX market when the pound came under selling pressure as well. As you can see in the chart below, there has been a negative correlation between pound performance and long-term Gilt yields since the ill-fated mini Budget from autumn 2022 which brought down former Prime Minister Liz Truss. While we don’t believe Prime Minister Keir Starmer is currently facing a similar fate at least not immediately, the unfavourable market reaction will increase pressure on the government to take action to restore confidence.

The initial response from the government has been to try to downplay speculation over the Chancellor’s position. Prime Minister Starmer told the BBC that Chancellor Reeves will stay as chancellor “for many years to come”. If confidence fails to improve, the government may find itself having to take further action such as reinforcing its commitment to their fiscal rules. In light of recent policy u-turns which have reduced the scale of planned spending cuts, there is building speculation that the government will have to announce tax hikes in the autumn Budget. The government may need to show that it is willing to make difficult decisions without backing down. The government looks like it may get some help as well from the BoE. Governor Bailey has indicated recently that the BoE is considering slowing down the pace of QT from September. The current pace of QT is running at around GBP100 billion per year which would include outright sales of Gilt holdings totalling GBP13 billion in the year to September. According to Bloomberg, in order to maintain the current pace of QT in the following year the BoE would have to step up outright sales to around GBP50 billion which could potentially be more disruptive.

The looming prospect of tax hikes has the potential to act as a dampener on growth in the UK if businesses and households curtail spending in anticipation of measures set to be announced in the autumn. After a strong start to the year the UK economy has slowed sharply in Q2 with recent weakness in the labour market attracting more market attention. The government’s decision to tax employers by raising employer NICs is contributing to weaker demand for labour. A further loosening of the labour market would encourage the BoE to speed up rate cuts. MPC member Alan Taylor yesterday who was one of the three doves voting for a rate cut in June stated that he favours three more rate cuts this year which would be a step up from the currently quarterly pace of cuts. Overall, the latest developments support our view that downside risks have been increasing for the pound. Our latest forecasts (click here) announced at the start of this month had already shown some relative underperformance for the pound even before yesterday’s flare up in UK political uncertainty/renewed fiscal concerns. Unless confidence is quickly restored the pound will continue to trade on an even weaker footing than we had expected. Please see our latest Macro Focus report for more details (click here).

NEGATIVE CORRELATION BETWEEN GBP & LONG-TERM GILT YIELDS

Source: Bloomberg, Macrobond & MUFG GMR

USD: ADP survey adds to labour market concerns amidst trade uncertainty

The next key event risk for the FX market will be the release today of the latest nonfarm payrolls report for June. Market speculation over a weaker nonfarm payrolls report was reinforced yesterday by the release of the latest ADP survey which revealed that private employment contracted by -33k in June. One caveat is that the ADP has not been a very accurate leading indicator for nonfarm payrolls recently. While the ADP survey has been pointing towards a sharper slowdown in employment growth, there has only been a gradual slowdown in nonfarm employment growth so far this year. Having said that negative ADP readings do not happen very often and tend to only happen during US recessions. The US rate market is not yet putting too much weight on the negative ADP reading and is still only pricing in 6bps of rate cuts for the July FOMC meeting. It leaves the US dollar vulnerable to another leg lower today if weakness in the ADP survey is replicated in the nonfarm payrolls report. The worst case scenario for the US dollar would be a negative NFP print and jump in the unemployment rate above 4.2% which could even encourage speculation over a larger 50bps cut. In contrast, further evidence of a modest slowdown should provide only limited relief for the US dollar. As a result, we believe that risks are more skewed to the downside for the US dollar going into today’s nonfarm payrolls report.

The other main development yesterday was the announcement from the Trump administration that it has agreed another trade deal with Vietnam. According to details released so far, the trade deal appears to be heavily skewed in favour of the US perhaps reflecting the lopsided nature of the trading relationship. US imports from Vietnam totalled around USD137 billion last year compared to US exports to Vietnam of just USD13 billion. President Trump stated that as part of the deal the US will implement a higher 20% tariff on imports from Vietnam while Vietnam has agreed to drop all levies on US imports. President Trump had previously planned on Liberation Day to implement a 46% “reciprocal tariff” on Vietnam. The new lower 20% tariff will be viewed as small “win” for Vietnam but will still be disruptive for trade with the US. The US will also apply a higher 40% tariffs on goods deemed to have been transhipped through the country. A move designed to prevent/pushback more strongly against China which has been re-routing their trade through Vietnam and into the US. It adds credence to a Bloomberg report suggesting that the US will seek to shut out China in trade deals agreed with other countries. Please see our latest Asia FX Focus for more details (click here)

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

HCOB Eurozone Services PMI |

Jun |

50.0 |

49.7 |

!! |

|

UK |

09:30 |

BOE Credit Conditions Survey |

-- |

-- |

-- |

!! |

|

UK |

09:30 |

S&P Global Services PMI |

Jun |

51.3 |

50.9 |

!! |

|

EC |

12:30 |

ECB Publishes Account of Monetary Policy Meeting |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Jun |

0.3% |

0.4% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

239K |

236K |

!!! |

|

US |

13:30 |

Nonfarm Payrolls |

Jun |

120K |

139K |

!!! |

|

US |

13:30 |

Trade Balance |

May |

-69.90B |

-61.60B |

!! |

|

US |

13:30 |

Unemployment Rate |

Jun |

4.3% |

4.2% |

!!! |

|

CA |

13:30 |

Trade Balance |

May |

-6.00B |

-7.14B |

!! |

|

US |

14:45 |

S&P Global Services PMI |

Jun |

53.1 |

53.1 |

!!! |

|

US |

15:00 |

Factory Orders (MoM) |

May |

7.9% |

-3.7% |

!! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Jun |

-- |

50.0 |

! |

|

US |

16:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com