JPY weakens after BoJ remains cautious over resuming rate hikes

JPY: BoJ Deputy Governor remains cautious over further rate hikes

The yen has the biggest mover overnight resulting in USD/JPY rising back up closer towards the 148.00-level. The yen has weakened following the much anticipated speech from BoJ Deputy Governor Ryozo Himino to see if he would provide any clear signal over the potential timing of the next BoJ rate hike. However, those expectations were disappointed putting a dampener on speculation that the BoJ could resume rate hikes at upcoming policy meetings. Instead Deputy Governor Himino only reiterated that “it would be appropriate for the bank to continue, in accordance with improvement in economic activity and prices, to raise the policy interest rate and adjust the degree of monetary accommodation”. He stated that the “direction of policy is for gradually raising rates, and that the BoJ needs to “avoid being too early or too slow on policy”. He noted that there are risks on both sides for prices and the economy, and that the BoJ will watch to see if their base case will be realized without bias. He added that the US-Japan trade deal lowers uncertainty but that uncertainty remains for the global economy. It remains important to watch certainty of the outlook. At the moment he did caution though that “the risk of larger-than expected impact [on Japan’s economy from tariffs] may deserve greater attention”.

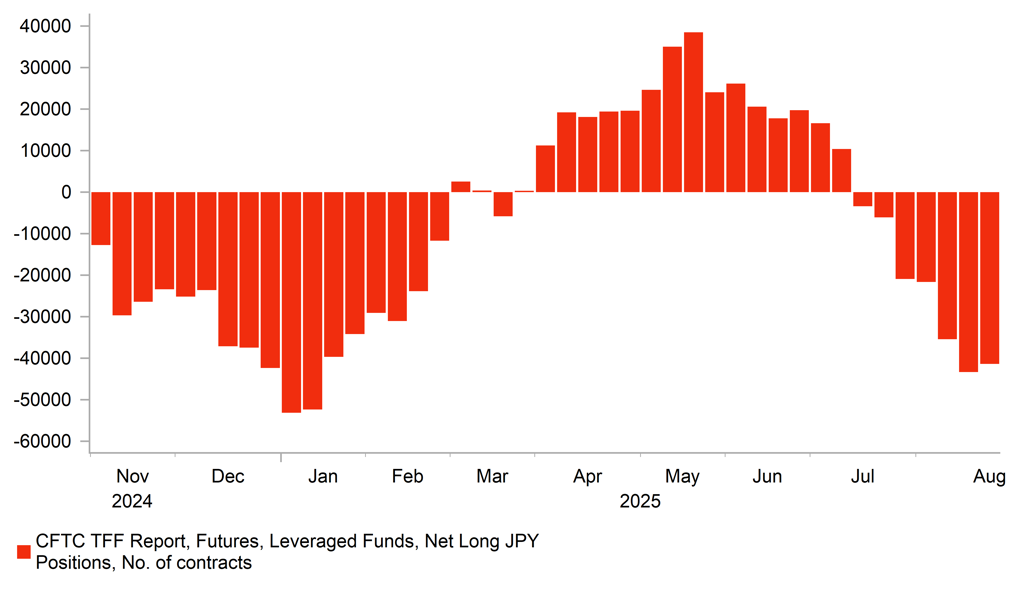

With regards to inflation he stated that “the underlying inflation rate remains below 2%, but is gradually rising and approaching 2%. The rise may experience some temporary halts, but the mechanism in which wages and prices rise in interaction with each other will be maintained and eventually push up the underlying inflation rate to 2%”. He added though that it was hard to pinpoint the level of underlying inflation. Overall, Deputy Governor Himino maintained a relatively cautious stance over tightening monetary policy further in the near-term. In response the Japanese rate market has pushed back expectations for the potential timing of the BoJ’s next rate hike. There now around 11bps of hikes priced in by the October policy meeting and 15bps for December compared to 13bps and 18bps as of yesterday. The lack of hawkish policy signal today from Deputy Governor Himino will encourage speculators to continue rebuilding short yen positions although upside for USD/JPY could prove short-lived if the release of the nonfarm payrolls report on Friday proves to be even weaker than expected. The latest IMM report revealed that leveraged funds have rebuilt short yen positions back to the highest level since the start of this year when USD/JPY peaked out at 158.87.

At the same time, heightened political uncertainty in Japan could also be continuing to weigh on the yen. Bloomberg has reported overnight that Prime Minister Ishiba has said he has no intention of clinging on to his post and will humbly accept any criticism, as LDP lawmakers weigh up whether to call for an early leadership election. He stated “I will accept any criticism, but it is also my responsibility to see things through for the party”. The LDP is disclosing its findings of the elections result in a report, which is likely to inform some lawmakers on whether to continue to support PM Ishiba’s administration. Bloomberg noted that if over half of LDP lawmakers and regional branch representative submit a writer request, the party is obliged to move up the leadership race. A Yomiuri newspaper poll of LDP parliamentarians and regional representatives released over the weekend revealed that 128 out of 342 would call for an early leadership contest, and about half were undecided whereas only 33 said they would not. In contrast, Prime Minister Ishiba’s popularity with the public appears to have improved recently in opinion polls. A Kyodo poll showed that 57.5% of respondents thought he should continue as Prime Minister compared to 40% who thought he should step down.

CAUTIOUS BOJ ENCOURAGES REBUILDING OF JPY SHORTS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB on track to leave rates on hold amidst French political uncertainty

The euro is continuing to trade close to recent highs against the US dollar at around the 1.1700-level. After a brief dip last week triggered in part by the pick-up in political uncertainty in France after Prime Minister Bayrou called a vote of confidence in his government to take place on 8th September, the euro has quickly recovered lost ground indicating that market participants are not currently anticipating that political developments in France will be sufficient to derail the bullish trend. Similar to last year, the French government is expected to lose another vote of confidence and then President Macron will have to either appoint a new prime minister to form a new government with the main aim to pass next year’s Budget, or he now has the option to call parliamentary elections in attempt to break the deadlock. Snap elections would create more political uncertainty. A defeat for the government on 8th September would indicate that there is no majority in parliament currently in favour of significant fiscal tightening. It appears more likely now that budget deficit will remain higher for longer at over 5% of GDP.

Unless there is a significant tightening of financial conditions in the euro-zone which is unlikely to be triggered by developments in France, then the ECB appears set to leave rates on hold at this month’s policy meeting. With inflation back at their target, the ECB is becoming more confident that their easing cycle is close to an end. Executive Board member Isabel Schnabel told Reuters today that monetary policy “may be already mildly accommodative and therefore I do not see a reason for a further rate cut in the current situation”. She added that there’s a “very high bar” for more easing, and is not concerned over the risk of inflation persistently undershooting their target after these “many years of too high inflation”. While we are still sticking to our forecasts for further ECB easing in the year ahead, we do acknowledge that there is a higher hurdle to justify further easing given the ECB has already cut the policy rate in half. In our latest monthly FX Outlook report (click here) released yesterday we raised our forecasts for EUR/USD lifting the Q2 2026 forecast up to 1.2500. It was mainly driven by our outlook for a weaker US dollar on the back of Fed rate cuts and President Trump’s intensifying attacks on the Fed’s independence.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

10:00 |

PPI YoY |

Jul |

-- |

3.9% |

!! |

|

EC |

10:00 |

CPI Estimate YoY |

Aug P |

2.1% |

2.0% |

!!! |

|

EC |

13:45 |

ECB's Muller Speaks |

!! |

|||

|

CA |

14:30 |

S&P Global Canada Manufacturing PMI |

Aug |

-- |

46.1 |

!! |

|

US |

14:45 |

S&P Global US Manufacturing PMI |

Aug F |

53.3 |

53.3 |

!! |

|

US |

15:00 |

ISM Manufacturing |

Aug |

49.0 |

48.0 |

!!! |

|

US |

15:00 |

Construction Spending MoM |

Jul |

-0.1% |

-0.4% |

!! |

Source: Bloomberg & Investing.com