Mixed news for the USD as government shutdown continues

USD: Fed rate cut expectations & threats to Fed’s independence in focus

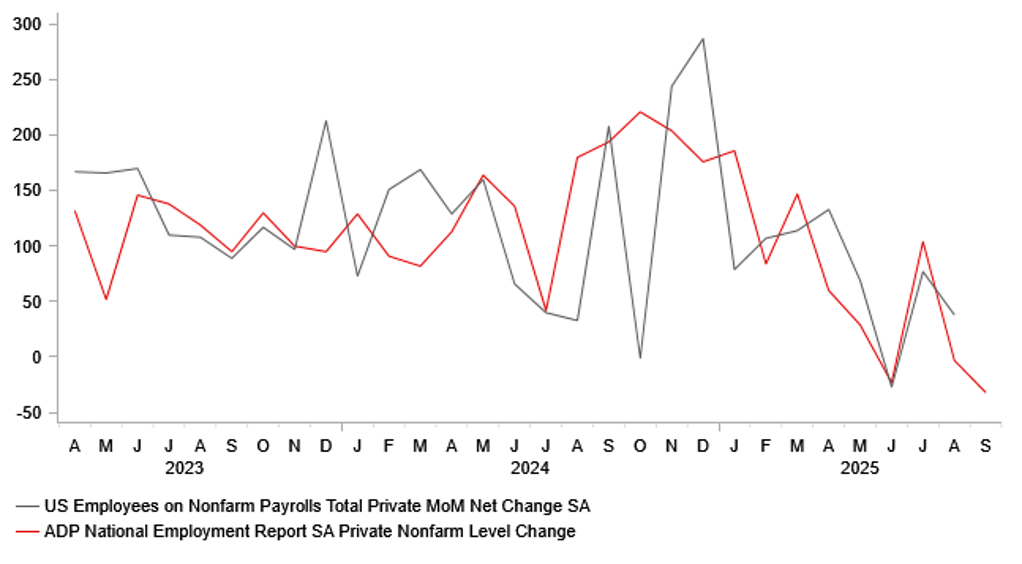

The US dollar has continued to trade at weaker levels undermined in part by the ongoing US government shutdown in the near-term. It has contributed to USD/JPY falling back towards the 147.00-level after failing to break back above the 150.00-level at the end of last week. There was mixed news for the US dollar yesterday. At first the US dollar sell-off was reinforced by the release of the latest ADP survey for September revealing private sector employment contracted by -32k following a downwardly revised contraction of -3k in August. As a result, the ADP estimate of private sector employment has contracted in three out of the last four months. The survey has reinforced expectations that the US labour market remains weak providing justification for the Fed to lower rates further. The 2-year US Treasury yield dropped sharply by 8bps as market participants moved to price back in more Fed easing in the coming years. The US rate market is now fully pricing in a 25bps rate cut at the end of this month and around 47bps of cuts by the end of this year. President Trump’s threat to fire federal workers during the government shutdown has added to downside risks for the US labour market. White House Press Secretary Karoline Leavitt told reporters yesterday that layoffs would happen within “two days, imminent, very soon” but declined to give any details about what agencies or positions would be targeted. According to media reports, a group of moderate Republicans and Democrats huddled on the Senate floor to search for a way out of the shutdown that could offer face-saving concessions to both parties and allow the government to re-open, at least temporarily.

The release of the ADP survey yesterday had more market impact than normal given that the nonfarm payrolls report for September is likely to be delayed due to the government shutdown which will limit further insights into the health of the US labour market. In recent months the ADP survey has provided a closer estimate of nonfarm private employment growth overestimating by an average of around 19k in July and August. Overall, the current estimate for September of -32k does suggest that employment growth remined weak even if the ADP survey is not always the most reliable forward indicator.

On the other hand, the US dollar received support yesterday from the Supreme Court’s decision that Fed Governor Lisa Cook can remain in her position ahead of oral arguments due to be heard in January regarding President Trump’s efforts to fire her. The court’s decision to block President Trump from ousting Fed Governor Cook at least temporarily eases concerns a little over threats to the Fed’s independence, and reduces the risk of sharper US dollar sell-off before year end. Risks to the Fed’s independence have not been completely removed and will continue to linger as a headwind for US dollar performance. Without an open Fed Governor seat, President Trump will now likely need to use Stephen Miran’s seat to potentially bring in his candidate to be the next Fed Chair unless he picks an existing Fed Governor to be the next Fed Chair. The likelihood of further Fed rate cuts and ongoing threats to the Fed’s independence from the Trump administration are important reasons why we continue to expect further US dollar weakness in the year ahead (click here).

ADP SURVEY VS. NFP PRIVATE EMPLOYMENT

Source: Bloomberg, Macrobond & MUFG GMR

JPY: BoJ rate hike speculation ahead of LDP leadership election

The yen has weakened modestly at the start of today’s European trading session following a closely watched speech from BoJ Deputy Governor Uchida. The Japanese rate market has moved recently to price in a much higher probability of the BoJ resuming rate hikes at the end of this month. There are currently around 15bps of hikes priced in compared to only 6bps a month ago. Market expectations for the BoJ to resume rate hikes were encouraged by the release of the latest Tankan survey for Q3 which continued to signal that Japanese businesses remained resilient in the face of higher tariffs while inflation expectations continued to pick-up. However, Deputy Governor Uchida refrained from providing a stronger signal today that the BoJ is planning to raise rates as soon as this month. Instead he reiterated that the BoJ will raise rates if the economic outlook is realized. He described Japan’s economy as recovering despite some weakness. With regards to tariffs he stated that the picture of US tariffs is getting clearer and concerns are fading. Overall business sentiment was described as at a favourable level. On a cautionary note he believes that uncertainty is “still high” over the global economy and tariff impact.

Market participants will now switch their focus to tomorrow’s speech from BoJ Governor Ueda to see if he provides a clearer signal over the timing of the next BoJ rate hike. The yen has strengthened this week alongside the broad-based US dollar sell-off resulting in USD/JPY falling back towards the 147.00-level. However, market participants are likely to remain reluctant to chase the yen higher for now until there is more clarity over the political situation in Japan. Similarly, the BoJ may remain reluctant to provide a stronger signal of the timing of the next rate hike until after this weekend’s LDP leadership election. We still believe that Shinjiro Koizumi is best placed to become the next LDP leader/ Prime Minister of Japan which if confirmed would open the door to more yen upside.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Unemployment Rate |

Aug |

6.2% |

6.2% |

!! |

|

US |

12:30 |

Challenger Job Cuts |

Sep |

-- |

85.979K |

! |

|

US |

15:00 |

Durables Excluding Defense (MoM) |

Aug |

-- |

1.9% |

! |

|

US |

15:00 |

Factory Orders (MoM) |

Aug |

1.4% |

-1.3% |

!! |

|

US |

15:00 |

Total Vehicle Sales |

Sep |

16.20M |

16.10M |

! |

|

US |

15:30 |

Fed Logan Speaks |

-- |

-- |

-- |

! |

|

US |

19:30 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,608B |

!! |

Source: Bloomberg & Investing.com