Rising optimism of China-US de-escalation ahead of jobs data

USD: Key data to highlight initial tariff impact

Asian equity markets are higher following the positive US close yesterday but also helped today by the statement from the Commerce Ministry in China that revealed the Chinese authorities were “evaluating” recent messages sent by the US indicating a wish to commence talks. This news broke at 01:20am London time and hence the lack of denial by Washington could mean this development may be a credible sign of some thawing in the stand-off on commencing talks. The FX markets have seen only relatively marginal moves in G10 (but much bigger in Asia with USD/TWD -3.5%) but the high-beta global growth-sensitive G10 currencies are performing best this morning, consistent with an improvement in optimism. The optimism was further reinforced by the comments made by Maros Sefcovic, the EU’s trade commissioner in an FT interview today. Sefcovic stated that the EU was offering to increase purchases of US goods by USD 50bn as a way to address the issues in the trading relationship. Sefcovic added that “certain progress” was being made. There had already been multiple rounds of in-person and telephone meetings.

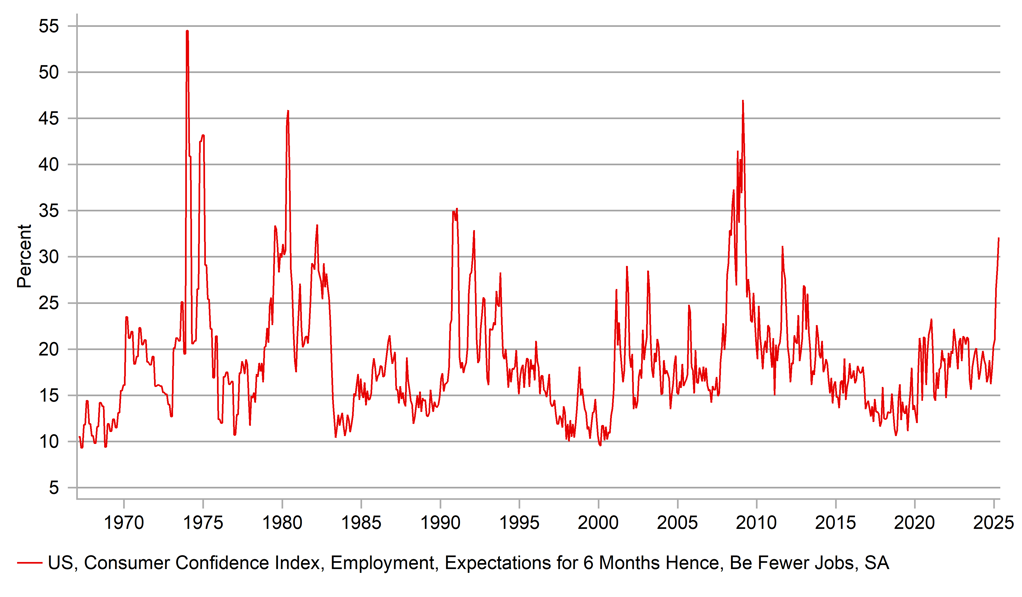

The issue of trade relations is likely to take a backseat later today with the release of the non-farm payrolls report for April. The consensus of 138k implies market participants are expecting a notable slowdown from the 228k gain recorded last month. That makes a lot of sense and there are numerous examples of other labour market data weakening. DOGE job cuts as well are certainly expected to impact government employment while the surge in uncertainty will surely undermine companies’ appetite to hire. That said, might it be too early to see labour market weakness? There was also a surge in trade activity in Q1 which may have supported current sentiment more than expected and the deterioration in confidence will become more apparent in the jobs reports over coming months.

The markets appear to be considering just that. The UST bond 10-year yield has jumped 11bps from an intra-day low yesterday so investors’ expectations may have adjusted somewhat. A figure around the consensus print of 138k will likely be greeted with relief given the flow of other negative jobs data that could see UST bond yields advance further. It would allow Fed Chair Powell next week to remain a bit more balanced in his views on current conditions. A print below 100k however would be hard to ignore and it would allow Powell to express a view of monetary easing ahead with much more confidence. A figure +/-25k around the consensus would likely mean limited broader financial market reaction. A much stronger print would more likely be dismissed by the markets with the view that weaker jobs data are still coming while a much weaker print would see recession being priced with more conviction. A much weaker print would therefore likely see the bigger market move and USD/JPY would likely drop sharply with EUR a big gainer as well.

US CONSUMER EXPECTING FEWER JOBS IN 6MTHS HAS SURGED

Source: Bloomberg, Macrobond & MUFG GMR

AUD: Australians head to the polls

On Monday Canada swung back behind the more left-leaning Liberals with PM Mark Carney achieving a victory on what appeared to be the decline in support for the Conservatives in favour of a government that was seen as more likely to stand up to President Trump. While Trump was far more important in the Canada election, a shift in polling ahead of the Australian general election on Saturday suggests there may have been an influence there too. Final polls released yesterday shows PM Albanese and the Labor Party widening its lead over the conservative coalition, led by Peter Dutton. A YouGov MRP poll predicts Labor will win 84 seats in the 150-seat parliament with the Liberal-National coalition winning just 47 seats. The poll predicts a 97.3% probability of a Labor majority. Dutton has described Trump as a “big thinker” and his policy ideas are similar to Trump’s plans to slash government spending and had to backtrack on a policy to scrap work-from-home and cut 41k government jobs (via an Australian version of DOGE).

So what might the implications be after the election, if as expected based on the polls, PM Albanese and the Labor Party wins another term in office? This election turned very much into a cost-of-living election with both parties promising give-aways to offset the negative impact. Labor have reduced the lowest tax rate from 16% to 14% over two years and promised a AUD 150 subsidy for energy bills to all households and 1mn small companies. The Labor tax cut will cost an estimated AUD 17bn and has already been passed by parliament although the conservative coalition has promised to repeal it. Both parties have announced policies to help support increased housing ownership.

The most plausible scenario in which we could see a financial market reaction would be for the conservative coalition to surpass expectations relative to what the polls imply to leave the Labor Party needing other support in order to govern. Even that though is unlikely to be too destabilising for the markets with that scenario unlikely to compromise Labor’s major policy plans.

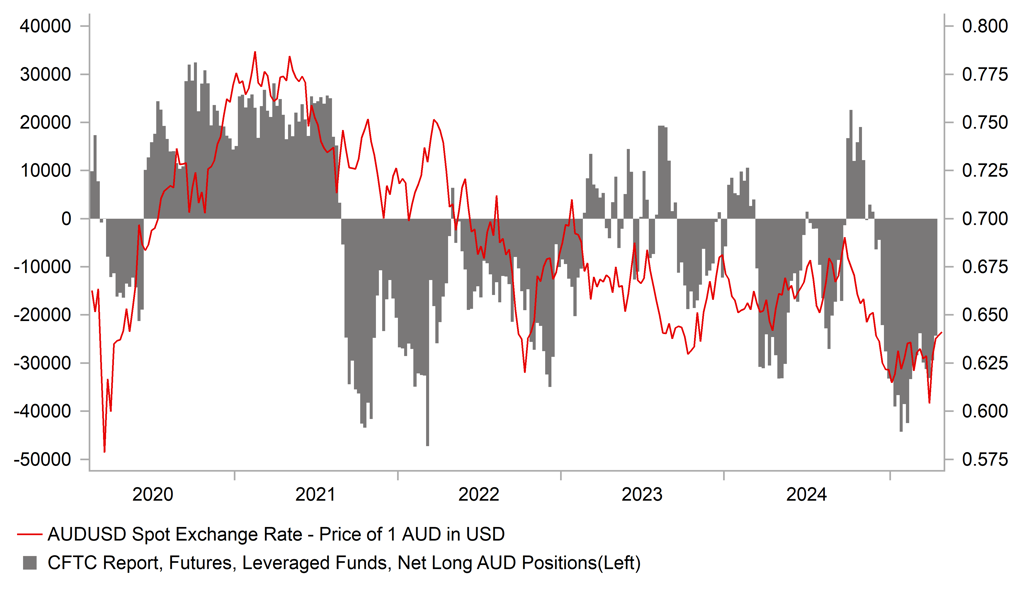

AUD remains vulnerable though in our view to the broader global backdrop and given the likely persistent uncertainty in relation to global trade, in particular between the US and China, AUD is set to underperform going forward. Since reciprocal tariffs were announced on 2nd April, AUD is the third worst performing G10 currency with only NOK and USD performing worse. We still see downside risks and higher volatility for AUD over the coming months and that won’t be altered by this weekend’s election result.

CFTC POSITIONING INDICATE CONVICTION AMONGST LEVERAGED FUNDS FOR AUD TO WEAKEN

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

08:45 |

Italian Manufacturing PMI |

Apr |

47.1 |

46.6 |

!! |

|

FR |

08:50 |

French Manufacturing PMI |

Apr |

48.2 |

48.5 |

!! |

|

GE |

08:55 |

German Manufacturing PMI |

Apr |

48.0 |

48.3 |

!!! |

|

EC |

09:00 |

Manufacturing PMI |

Apr |

48.7 |

48.6 |

!! |

|

EC |

10:00 |

Core CPI (MoM) |

Apr |

-- |

1.0% |

!!! |

|

EC |

10:00 |

Core CPI (YoY) |

Apr |

2.5% |

2.4% |

!!! |

|

EC |

10:00 |

CPI (YoY) |

Apr |

2.1% |

2.2% |

!!! |

|

EC |

10:00 |

CPI (MoM) |

Apr |

-- |

0.6% |

!!! |

|

EC |

10:00 |

HICP ex Energy & Food (YoY) |

Apr |

-- |

2.5% |

!! |

|

EC |

10:00 |

HICP ex Energy and Food (MoM) |

Apr |

-- |

0.8% |

!! |

|

US |

13:30 |

Nonfarm Payrolls |

Apr |

133K |

228K |

!!!!! |

|

US |

13:30 |

Unemployment Rate |

Apr |

4.2% |

4.2% |

!!! |

|

US |

13:30 |

Average Hourly Earnings (YoY) (YoY) |

Apr |

3.9% |

3.8% |

!!!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Apr |

0.3% |

0.3% |

!!!! |

|

US |

13:30 |

Average Weekly Hours |

Apr |

34.2 |

34.2 |

!! |

|

US |

13:30 |

Manufacturing Payrolls |

Apr |

-5K |

1K |

!! |

|

US |

13:30 |

Private Nonfarm Payrolls |

Apr |

124K |

209K |

!!! |

|

US |

15:00 |

Factory Orders (MoM) |

Mar |

4.4% |

0.6% |

!! |

Source: Bloomberg