Renewed trade tensions trigger uncertainty and US dollar selling

USD: Trade tensions hit risk appetite and the dollar again

Asian equity markets are nearly all lower today as investors pare risk in response to increased tensions between the US and China. After Trump accused China of breaching the de-escalation deal announced on 12th May, China today issued a statement denying it was in breach of the deal, instead accusing the US of introducing new guidelines on AI chip export controls and sales restrictions and cancelling Chinese student visas. The strong counter-claims following Trump’s accusations on Friday leaves the relationship fragile and it would appear the only way this gets resolved will be through a Trump-Xi one-on-one. Speeding up rare-earth exports and pulling back on some of the chip controls would be an obvious near-term solution to de-escalate the renewed tensions. Kevin Hassett, director of the National Economic Council said a call would take place this week. Until there is confirmation of this, financial market participants will likely maintain caution toward US assets. The increased risk aversion due to renewed trade tensions may well result in another day of ‘triple selling’ of US assets – the S&P 500 future is 0.5% lower, the 10-year UST bond yield is 2-3bps higher and the US dollar (DXY) is 0.3% lower. The worsening sentiment also follows President Trump’s decision on Friday to announce a doubling of the steel and aluminium tariff from 25% to 50%, effective 4th June. The American Iron and Steel Institute welcomed the doubling of the US import tariff and in a statement cited the fact that China steel exports to the world more than doubled since 2020, surging to 118mn tons in 2024 – more than total North American production and while direct steel imports from China is not as large as before, the risks from this over-production globally is why Trump appears to have taken this action. Canada imports of steel into the US are the largest followed by Brazil, Mexico, South Korea and Vietnam.

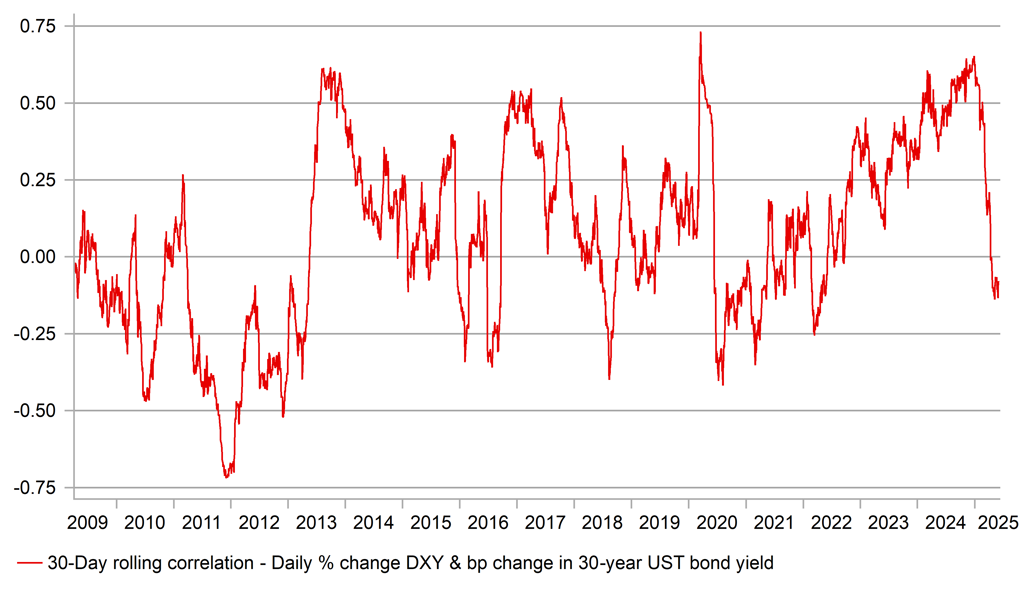

The flip-flopping on trade policy looks set to continue and it appears the uncertainty this creates does not bother President Trump at all. That is likely to give investors the reason to renew selling of the US dollar. The DXY index is back below the 99-level today and within 1% of the intra-day low on 21st April. Certainly if the Trump-Xi meeting goes badly or if it doesn’t take place at all, that low-point for the dollar could well be breached this week, taking us to levels not seen since March 2022. Fed Governor Waller confirmed his belief of rate cuts later in the year on expectations of higher unemployment. On Friday, the non-farm payrolls data for May will be released and we believe we are getting closer to the point when labour market weakness becomes more evident in the key official hard data. The risk that this could happen this week will likely add to dollar selling momentum, at least into the release of the data on Friday.

US YIELDS AND US DOLLAR CORRELATION HAS WEAKENED SHARPLY

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB to cut this week as inflation risks subside

There will be two G10 central bank policy meetings this week with the Bank of Canada meeting on Wednesday and the ECB on Thursday. Q1 GDP last week in Canada was a little stronger than expected (2.2% vs 1.7% expected SAAR Q/Q) but the breakdown revealed weak consumer spending and business investment with growth fuelled by net trade and inventories, which added 2.83ppts to overall GDP. That said, the BoC has been more active cutting rates than most other G10 central banks and can afford to hold off until there is greater clarity over US trade tariff policy. The OIS market implies a 20% probability of a cut – we expect the BoC to remain on hold.

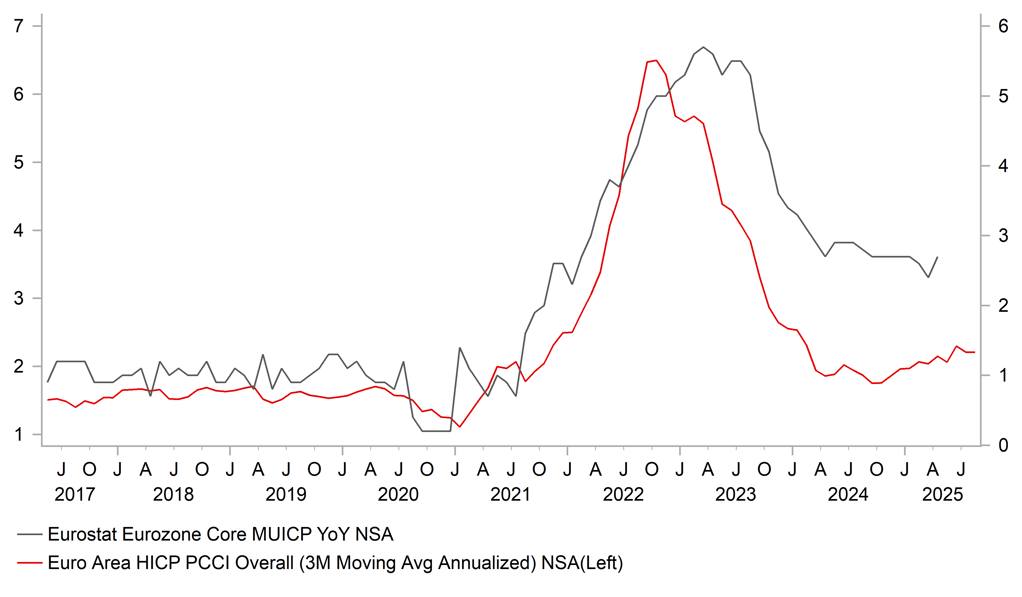

The bigger focus this week will be on the ECB meeting on Thursday. The OIS market implies a 100% probability of a 25bp cut and we expect the ECB to deliver that cut. French, Spanish and Italian CPI all revealed YoY declines that puts the annual rates all below the 2.0% ECB target with German CPI at 2.1%. The backdrop going into this meeting when we will have updated forecasts published by the ECB certainly should reveal an ECB Governing Council that is more confident about achieving its inflation goal. The changes in market variables used to help forecast inflation going forward (technical assumptions) are now more favourable for lower inflation. The ECB in March assumed a EUR EER-41 trade weighted index of 122.2 over the forecast period – that level today is now 4.0% stronger. The crude oil price today is trading below USD 65 p/bl, close to 15% below the level assumed for 2025 by the ECB in March. TTF natural gas price closed on Friday 33% below the price assumed for 2025.

So there is plenty of reason for optimism. However, we should also assume that President Lagarde, like other central bankers recently, will be cautious about giving any strong guidance going forward. The threat of a 50% tariff on EU imports recently cited by President Trump would likely force more aggressive retaliation by the EU that would create a difficult outlook to forecast for the ECB. In addition, the ECB, following the assumed cut on Thursday, will have taken the policy rate to the 2.0% level that is often assumed by the ECB to be the mid-point of the range for the neutral rate. Further reason for caution that could mean market participants consider the plausible scenario of the ECB halting its meeting-to-meeting approach to cuts and slow the pace back to once per quarter. We don’t think that would prompt any big moves given only 6bps are currently priced for July while 20bps are priced for September.

Still, at the margin that would help support the euro. We will also be watching closely for comments in relation to the euro and its future reserve currency status. In a speech last Monday, President Lagarde stated there was a “window of opportunity” for the EU to help increase the reserve currency status of the euro. We may hear more on that which would give the market the signal of the ECB welcoming EUR appreciation as a means for supporting better domestic demand growth.

PCCI (PERSISTENT & COMMON COMPONENT OF INFLATION) WILL REASSURE ECB OF PRICE STABILITY

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

08:45 |

HCOB Italy Manufacturing PMI |

May |

49.6 |

49.3 |

! |

|

FR |

08:50 |

HCOB France Manufacturing PMI |

May F |

49.5 |

49.5 |

! |

|

GE |

08:55 |

HCOB Germany Manufacturing PMI |

May F |

48.8 |

48.8 |

!! |

|

EC |

09:00 |

HCOB Eurozone Manufacturing PMI |

May F |

49.4 |

49.4 |

!! |

|

UK |

09:30 |

Net Consumer Credit |

Apr |

1.2b |

0.9b |

! |

|

UK |

09:30 |

Net Lending Sec. on Dwellings |

Apr |

1.4b |

13.0b |

! |

|

UK |

09:30 |

Mortgage Approvals |

Apr |

62.8k |

64.3k |

!! |

|

UK |

09:30 |

M4 Ex IOFCs 3M Annualised |

Apr |

-- |

5.60% |

! |

|

UK |

09:30 |

S&P Global UK Manufacturing PMI |

May F |

45.1 |

45.1 |

!! |

|

CA |

14:30 |

S&P Global Canada Manufacturing PMI |

May |

-- |

45.3 |

! |

|

US |

14:45 |

S&P Global US Manufacturing PMI |

May F |

52.3 |

52.3 |

!! |

|

US |

15:00 |

ISM Manufacturing |

May |

49.5 |

48.7 |

!!! |

|

US |

15:00 |

ISM Prices Paid |

May |

68.7 |

69.8 |

!!!! |

|

US |

15:00 |

Construction Spending MoM |

Apr |

0.20% |

-0.50% |

!! |

|

US |

15:15 |

Fed's Logan speaks |

!! |

|||

|

US |

17:45 |

Fed's Goolsbee speaks |

!! |

|||

|

US |

18:00 |

Fed Chair Powell speaks |

!!! |

|||

|

UK |

18:00 |

BoE's Greene speaks |

!! |

Source: Bloomberg & Investing.com