USD reprieve could be coming but economy will be key

USD: OBBB passes Senate with trade ‘deals’ coming

There was a lot going on yesterday from a Senate deal on Trump’s One Big Beautiful Bill (OBBB) to positive noises on trade deals ahead of the reciprocal tariff suspension expiry on 9th July to a positive JOLTs report and comments from Fed Chair Powell speaking on a panel hosted by the ECB at its annual event in Sintra Portugal. Despite all the speculation in both directions in regard to the passing of the OBBB and the extent of trade deals that could be done ahead of 9th July, it was the data and the comments from Powell that were most relevant in moving the markets. Labour market data is always in focus days ahead of the NFP but the job openings increase to 7,769k was the second increase in a row to the highest level since November last year. The ISM Manufacturing Employment index did drop to 45.0 but that level has been hit numerous times in the last 12mths without signalling anything notable.

Fed Chair Powell also repeated the Fed view that inflation is likely to pick up in the coming months and the scale needed to be assessed before deciding on policy and hence decisions would be taken meeting-by-meeting. The data, Powell’s comments and the OBBB being passed in the Senate all combined to lift UST bond yields and help put a halt to notable dollar selling.

But market participants were very much in the camp that this tax cutting legislation would ultimately get passed. Of the two bills (the House vs the Senate), the Senate bill adds more to US debt over the next 10yrs and if this Senate version gets through the House could see an even bigger debt impact. The CBO estimates a USD 2.8trn increase to debt in 10yrs time (up from USD 2.3trn previously) for the House bill while the CBO estimates a USD 3.3trn increase for the Senate bill. The Senate bill voted through yesterday may have put some modest upward pressure on yields given it has a slightly larger debt impact but overall getting a deal done was widely expected.

The US dollar did advance slightly in reaction to the confirmation of the bill passing the Senate but by then the dollar had gained about 0.5% from the low in London trading. The focus on the OBBB meant news that the Trump administration is downgrading their objectives in trade negotiations and aiming to reach “phased deals” according to the FT, who quote people familiar with the talks. That makes a “deal” with countries like India and the EU more likely. These “phased deals” would allow those countries to avoid their original reciprocal tariff rates and allow for negotiations to continue.

This is important from a Fed policy perspective. Inflation is still likely to feed through to some degree from the baseline tariffs and sector-specific tariffs but the risks to higher inflation will be notably diminished if a number of phased deals are agreed. That will leave the FOMC more open to cutting rates if/when the data allows. We doubt the OBBB will alter the growth outlook dramatically given the vast bulk of the cost was extending the 2017 tax cuts and hence the status quo. In that regard, the phased trade deals we believe is more important from an inflation perspective and hence is a dollar negative development given the Fed will be more open to cuts. But weaker economic data is still ultimately needed for that and the JOLTs data throws up further doubts over the timing of a more pronounced labour market downturn that would encourage the Fed to restart monetary easing.

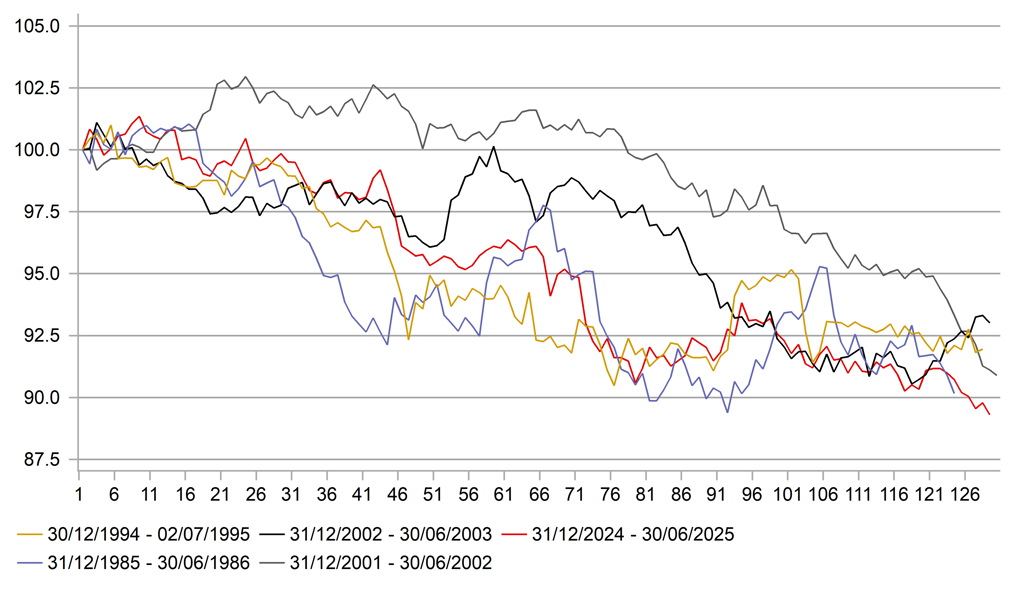

1H 2025 - THE WORST 1ST 6MTH PERIOD IN FLOATING EXCHANGE RATE ERA

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Trump criticises Japan indicating risks of no deal

Moves in FX this morning have been relatively modest but the yen is underperforming modestly given US yields have held on to yesterday’s gains and given increased investor concerns over the outcome of trade negotiations between the US and Japan. President Trump was again criticising Japan and suggested Japan may need to “pay 30%, 35% or whatever the number is that we determine” adding that the US has “a very big trade deficit with Japan”. The current reciprocal tariff rate for Japan is 24% - a level that would be damaging so an even higher rate would likely hit confidence and see growth expectations revised lower. The Topix and Nikkei both closed lower today. Trump stated that he doubted a deal would be reached calling Japan “very spoiled”.

Of course market participants are unlikely to trade a view on this and a deal could be done prior to the deadline but there seems at this stage a bigger risk of failure that would prompt a bigger market reaction. The BoJ would be unable to consider additional rate hikes which could prompt a move higher in USD/JPY, especially if deals are done with a large number of other trading partners. In that scenario the broader markets would be more risk-on and the bad news would be more Japan specific – a move higher in USD/JPY is therefore much higher.

The yen is less vulnerable if a deal is not done and the market is disappointed by the lack of deals and the reciprocal tariffs globally are more widespread than expected – global growth expectations would take a hit and if equities fell notably then the yen would be more likely to outperform. There was some good news for Japan – the MoF released its final fiscal accounts for the year ended in March and Japan raised a record JPY 75.2trn in tax revenues, JPY 1.8trn more than expected. With other non-tax revenue also larger than expected, the total surplus was JPY 2.3trn. Half of his will be used to pay down debt and the other half to bolster defence spending. At least Trump will be happy with that!

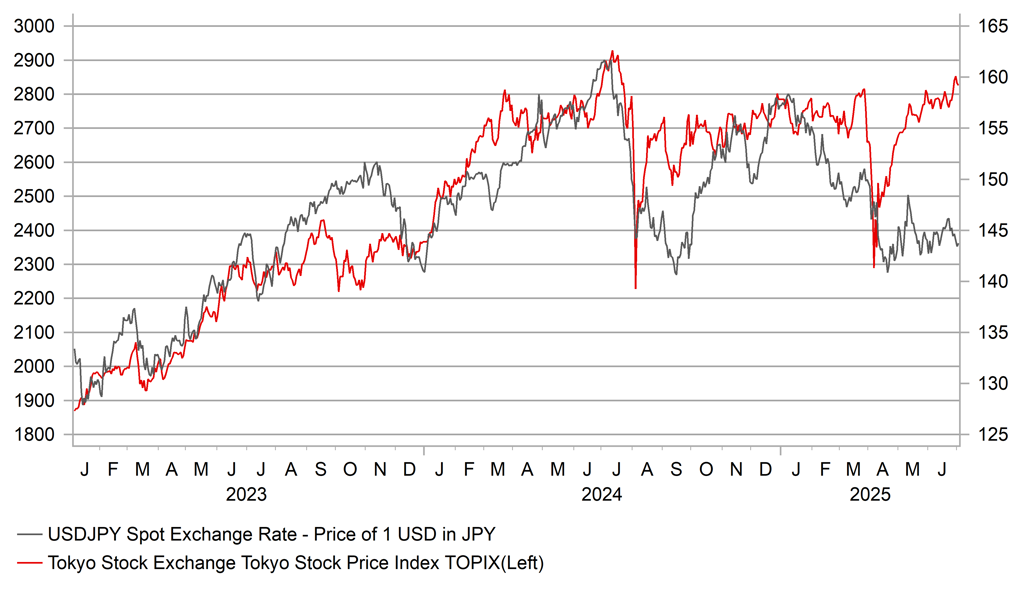

USD/JPY HAS FAILED TO REBOUND WITH JAPAN EQUITIES

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Monthly Unemployment Rate |

May |

6.0% |

5.9% |

! |

|

EC |

09:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Unemployment Rate |

May |

6.2% |

6.2% |

!! |

|

EC |

11:30 |

ECB's Lane Speaks |

-- |

-- |

-- |

!!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

1.1% |

! |

|

US |

12:30 |

Challenger Job Cuts |

Jun |

-- |

93.816K |

!! |

|

US |

12:30 |

Challenger Job Cuts (YoY) |

-- |

-- |

47.0% |

!! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Jun |

99K |

37K |

!!!! |

|

CA |

14:30 |

S&P Global Manufacturing PMI |

Jun |

-- |

46.1 |

! |

|

EC |

15:15 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

CA |

16:00 |

Budget Balance |

Apr |

-- |

-23.88B |

! |

Source: Bloomberg & Investing.com