Weaker US data but limited FX impact ahead of jobs data

USD: Selling can’t be sustained as yields supported

The US dollar selling that began the week yesterday predictably faded with the relief over the French parliamentary election result only going so far given the elevated level of uncertainty that will persist into the second round and Sunday and probably beyond. Today at 6pm is the deadline for submitting for Sunday’s election which will give us a better idea of the degree of alliance between Ensemble and NPF in order to ensure RN avoids gaining an overall majority. When the best case scenario is a hung parliament it’s easy to understand the lack of follow-through in EUR/USD buying yesterday.

The data will remain key – in particular the jobs data on Friday. However, the weaker data yesterday from the US failed to have much impact on yields – the 2-year yield was roughly unchanged while the 10-year yield advanced by 6bps. The 2s10s continues to steepen and has now steepened by 20bps since 26th June. Most of this move has happened since Friday, after the presidential TV debate and it certainly looks to us to be investors increasingly trading on the prospect of a Trump victory. More fiscal stimulus and trade tariffs is inflationary and could be putting upside pressure on longer-term yields. The Constitutional Court decision yesterday that a President is immune from prosecution when carrying out his/her “official” duties is another development that will increase expectations of a Trump victory on 5th November.

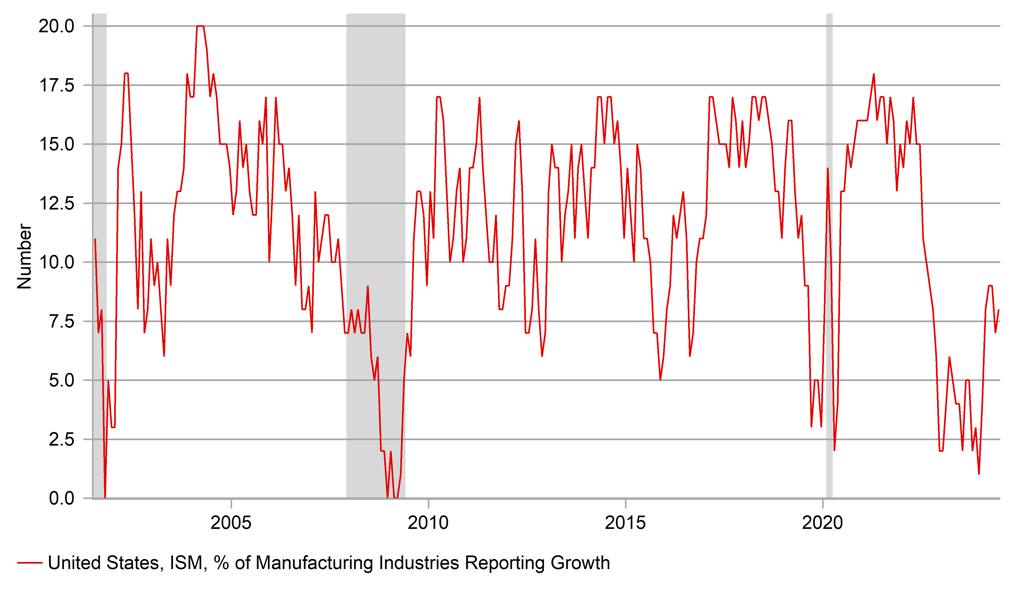

The lack of a notable move lower in US yields after yesterday’s ISM data helped support the dollar but the data certainly pointed to ongoing weakness in the manufacturing sector that could be joined by the services sector given the signs of slowing consumer spending. The ISM Employment index fell back below the 50-level while there was a notable drop in the Prices Paid index. The economy is slowing and inflation risks are receding and Fed officials could soon look like being excessively cautious and slow to shift it’s rhetoric.

Of course, any shift in tone or rhetoric will only come after the key jobs report on Friday. There is plenty of data between now and the jobs report, some of which will give us a further gauge of the health of the labour market.

We will also have an upturn in central bank comments from today with the ECB Forum on Central Banking in Sintra Portugal commencing. A speech on inflation by ECB Vice President Luis de Guindos will start shortly (0830 BST) but the key focus today will be on the Policy Panel event at 14:30 when ECB President Lagarde and Fed Chair Powell will speak. We don’t expect too much in the way of market-moving comments and we are likely to see EUR/USD and FX in general consolidating and remaining in relatively narrow trading ranges ahead of the US Independence Day holiday on Thursday before the jobs report on Friday and the French elections at the weekend.

ISM MANUFACTURING - % OF INDUSTRIES REPORTING GROWTH

Source: Macrobond & Bloomberg

JPY: Inflation expectations support BoJ July rate hike

USD/JPY has bounced noticeably further again, to new multi-decade highs helped by that move higher in US yields discussed above. It’s testament to the fact that the US remains crucial in USD/JPY direction and even with possible changes in policy happening soon (this month in our view) the pace of change and the continued signs of uber-caution by the BoJ continues to send a green-light signal to the financial markets to carry on selling the yen.

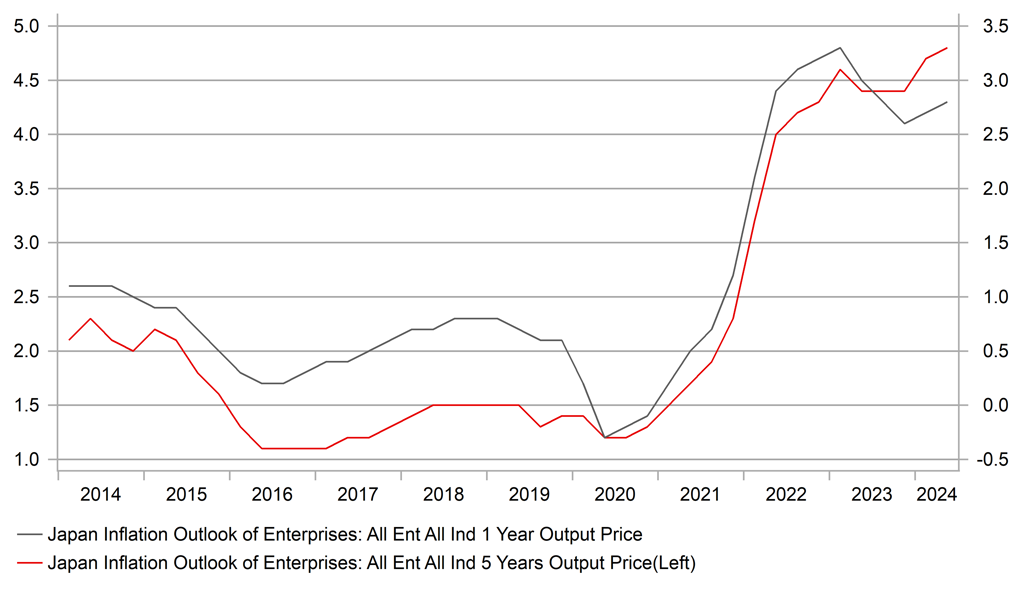

The Q2 Tankan report released yesterday certainly contained details that should act to encourage BoJ policymakers of the evidence pointing to the scope to raise the key policy rate as well as layout plans on slowing the pace of JGB purchases that has already been signalled. The BoJ places a lot of importance on the inflation expectations measures and the 5yr output price index increased again, to another record high in the series of 4.8%. The 1-year measure increased to 2.8%. In terms of market-related inflation expectations, the 10-year breakeven rate is consistent with the survey data as well. The 10-year breakeven rate hit a new high of 1.59% on 27th June, the highest level in the current data series back to 2004 when inflation-linked paper was first issued.

High actual inflation (relative to yields), high survey inflation expectations and high market-based measures of inflation expectations will continue to weigh on yen performance for now. A well-known former BoJ executive director (Atsushi Miyanoya) gave an interview to Bloomberg yesterday and argued that the BoJ is set to remain very cautious over the pace of slowdown in JGB buying. Governor Ueda spoke of a “considerable” reduction in the pace of buying but it’s feasible in our view that the pace of slowdown in purchases could be just around JPY 1trn-1.2trn which is unlikely to send 10yr JGB yields suddenly higher. We expect the 10yr US-JP spread to narrow further which will at some stage prove more supportive for the yen but we really need to see a more compelling slowdown in US jobs growth, which underlines the importance of Friday’s jobs report for USD/JPY. The yen is the worst performing G10 currency year-to-date which highlights the fact that it is the yen suffering most from the Fed’s ‘higher-for-longer’ stance.

TANKAN 5YR OUTPUT PRICE EXPECTATION HITS A NEW CYCLICAL HIGH

Source: Bloomberg & Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

|

EC |

08:30 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

|

IT |

09:00 |

Italian Monthly Unemployment Rate |

May |

6.9% |

6.9% |

! |

|

|

EC |

09:30 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

|

EC |

10:00 |

Core CPI (MoM) |

-- |

-- |

0.4% |

!!!! |

|

|

EC |

10:00 |

Core CPI (YoY) |

-- |

2.8% |

2.9% |

!!!! |

|

|

EC |

10:00 |

CPI (YoY) |

Jun |

2.5% |

2.6% |

!! |

|

|

EC |

10:00 |

CPI (MoM) |

-- |

-- |

0.2% |

!!! |

|

|

EC |

10:00 |

Unemployment Rate |

May |

6.4% |

6.4% |

!! |

|

|

EC |

11:30 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!!! |

|

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

5.3% |

! |

|

|

US |

14:30 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!!!! |

|

|

CA |

14:30 |

Manufacturing PMI |

Jun |

50.2 |

49.3 |

! |

|

|

EC |

14:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!!! |

|

|

US |

15:00 |

JOLTs Job Openings |

May |

7.860M |

8.059M |

!!! |

|

|

US |

15:00 |

Total Vehicle Sales |

-- |

15.90M |

15.90M |

! |

|

|

US |

15:10 |

IBD/TIPP Economic Optimism |

-- |

41.2 |

40.5 |

! |

|

Source: Bloomberg