USD continues to weaken after fresh US tariff policy uncertainty

USD: More tariff policy uncertainty ahead of important NFP report

The US dollar has weakened modestly at the start of the week resulting in EUR/USD rising above the 1.1700-level as it moves back towards the year to date high of 1.1829 set on 1st July. Similarly, USD/JPY is testing support at the 147.00-level which has held over the past month. The US dollar has been undermined over the past week by the renewed decline in short-term US yields alongside President Trump’s continued attacks on the Fed’s independence which were stepped up further after he fired Fed Governor Cook. Market participants are now waiting to see if the decision will be upheld by the US courts or overturned if they judge the president has overstepped his powers. Short-term US yields have declined as market participants have become more confident that the Fed will resume rate cuts this month. Another 25bps cut is almost fully priced in (+22bps) now ahead of the September FOMC meeting, and a cumulative total of just over 125bps of Fed rate cuts by September of next year. The release of the nonfarm payrolls report for August at the end of this week would have to surprise significantly to the upside to discourage the Fed from resuming rate cuts this month. The current consensus forecast for nonfarm payrolls on Friday is 75k which is similar to the July reading of 73k and compares averages over the last 3 and 6 months of 35k and 81k respectively. On the other hand, another much weaker than expected nonfarm payrolls report on Friday could encourage expectations for the Fed to resume rate cuts with a larger 50bps cut weighing more heavily on the US dollar.

Potential limits on President Trump’s powers were in focus again at the end of last week when the US court of Appeals for the Federal Circuit issued it’s long-awaited decision in V.O.S Selections v. Trump. The appeals court largely affirmed the Court of International Trade’s decision that concluded the International Economic Emergency Power’s Act’s (IEEPA) grant of presidential authority to “regulate” imports does not authorize the fentanyl trafficking and reciprocal tariffs imposed by President Trump’s executive orders. According to reports, the IEEPA tariffs covered by the court’s decision account for approximately 50% of all tariff revenue collected so far this fiscal year which could rise up to 70% in 2026. However, the court’s ruling does not directly affect the IEEPA 50% tariff on Brazil and 50% tariff on India for purchases of Russian crude oil because they were implemented after the case was filed.

The Trump administration will now appeal the decision to the Supreme Court. Until then the IEEPA tariffs will remain in place which has helped to limit the initial market reaction. If the Supreme Court agrees to hear the case, the appeals court decision will remain paused pending a final decision by the Supreme Court. The appeals court has also remanded to the Court of International Trade consideration of whether the government would be required to refund the tariffs only to plaintiffs in the case or more broadly to all importers. The Supreme Court is expected to announce in early October whether it will decide to hear the case. Given the ongoing risk that the IEEPA tariffs could be legally overturned, the Trump administration will be looking into other legal authorities to achieve a similar tariff outcome. For example, the legality of the sector specific tariffs implemented under Section 232 of the Trade Expansion act are not being questioned. As a result even if the Supreme Court ruled against the Trump administration on IEEPA tariffs, it may prove to be only a temporary setback.

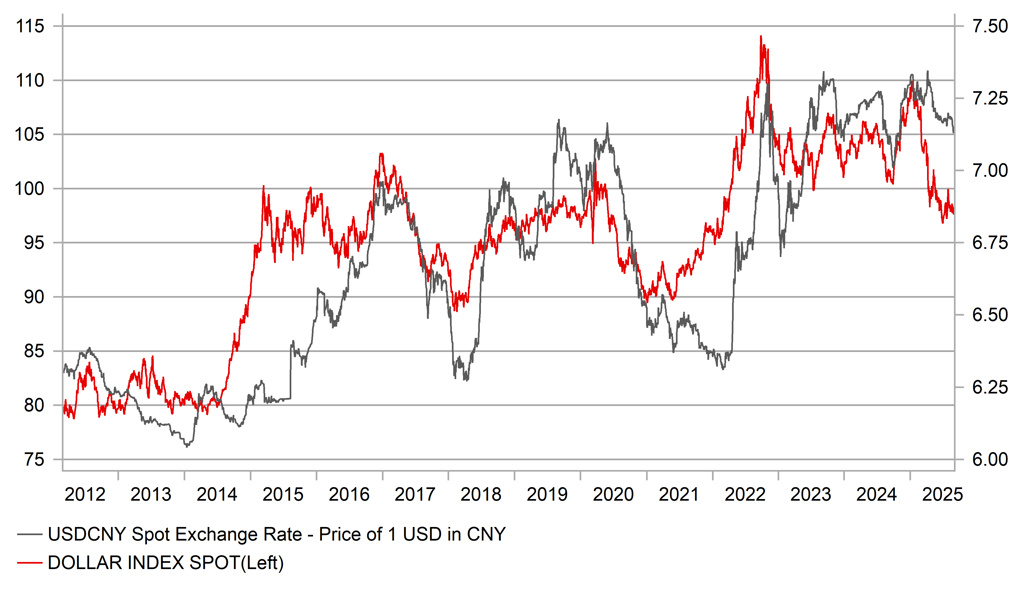

USD/CNY ADJUSTING LOWER WHILE USD REMAINS WEAK

Source: Bloomberg, Macrobond & MUFG GMR

CNY: Are Chinese policymakers becoming more tolerant of stronger CNY?

The other focus at the end of last week was the strengthening renminbi after USD/CNY dropped backed towards its lowest level since the US election victory for President Trump in early November of last year. USD/CNY has declined for six consecutive days encouraged by the PBoC setting lower daily fixes. The PBoC set the daily fix higher today at 7.1072. By setting the daily fixes lower, the PBoC has signalled that policymakers in China are more comfortable to allow the renminbi to strengthen in the near-term against the US dollar. For most of this year, Chinese policymakers have prioritized keeping USD/CNY stable even as the US dollar has weakened sharply against other major and regional currencies. It has resulted in the renminbi weakening sharply on a trade-weighted basis. The CFETS RMB index has declined by around -5.4% since the peak in early January.

The decision to allow the renminbi to strengthen more against the US dollar could be a reflection that Chinese policymakers are less concerned over downside risks to growth in the near-term. Economic growth has proven stronger than expected in the 1H of this year and remains on track to the meet the government’s target of “around 5 percent”. The release overnight of the latest manufacturing PMI survey from China for August revealed business confidence rose back above the 50.0-level for the first time sine March although Bloomberg states that the survey likely overstates the improvement in manufacturing activity. The weaker renminbi has helped to support a sharp widening in China’s trade surplus over the past year totalling USD1.16 trillion to July. By allowing the renminbi to strengthen modestly ahead of trade talks with the US in the autumn, it may help to create a more supportive backdrop for a deal.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:30 |

PMI Manufacturing |

Aug |

47.0 |

48.8 |

!! |

|

SZ |

08:30 |

PMI Services |

Aug |

-- |

41.8 |

!! |

|

IT |

08:45 |

HCOB Italy Manufacturing PMI |

Aug |

49.8 |

49.8 |

!! |

|

FR |

08:50 |

HCOB France Manufacturing PMI |

Aug F |

49.9 |

49.9 |

!! |

|

GE |

08:55 |

HCOB Germany Manufacturing PMI |

Aug F |

49.9 |

49.9 |

!! |

|

NO |

09:00 |

DNB/NIMA PMI Manufacturing |

Aug |

-- |

50.9 |

!! |

|

EC |

09:00 |

HCOB Eurozone Manufacturing PMI |

Aug F |

50.5 |

50.5 |

!! |

|

UK |

09:30 |

M4 Money Supply YoY |

Jul |

-- |

3.3% |

!! |

|

UK |

09:30 |

S&P Global UK Manufacturing PMI |

Aug F |

47.3 |

47.3 |

!! |

|

EC |

10:00 |

Unemployment Rate |

Jul |

6.2% |

6.2% |

!! |

Source: Bloomberg & Investing.com