JPY support from positive Tankan and BoJ signals

JPY: Further progress toward an October rate hike

The evidence has been building pointing to an increased prospect of a rate hike at the next BoJ policy meeting on 30th October, which remains our view. The BoJ places a lot of importance on the quarterly Tankan report and hence the details released today for the three months to September were always going to be crucial. The details certainly appear to us to be supportive of the BoJ following through with a rate hike. The June survey had forecast that the Large Manufacturing diffusion index would drop 1ppt to 12, but in fact the result today was an increase to 14. Lumber & wood product companies and iron & steel companies were two areas of weakness reflecting tariff uncertainties. Fixed investment plans picked up from 6.7% to 8.4% across all enterprises which is similar to a the year ago level (8.9%). The employment conditions indices across all sized enterprises generally showed unchanged levels of tightness or some modest further tightening in labour market conditions.

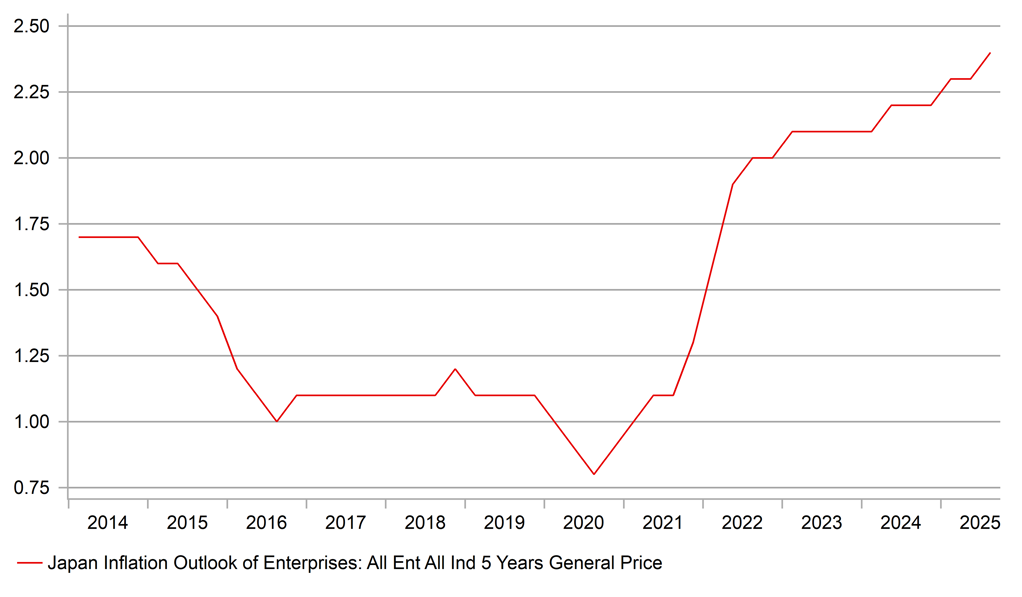

And the crucial measure for the BoJ – the inflation outlook for enterprises – showed some softening of output price inflation over a one-year period but for three and five years all the indices either remained unchanged or increased further from the June levels. In terms of general prices (final consumer prices) all enterprises anticipated an inflation level of 2.4% in five years, 0.1ppt higher than in June and above the BoJ’s inflation target. So there is certainly no evidence of any softening in long-term inflation expectations across Japan’s businesses. That will encourage the BoJ when assessing the medium-to-long-term outlook for inflation. The predicted levels for the yen revealed little change in the expected USD/JPY rate but there was about a 2-big figure increase in projected levels for EUR/JPY.

The Tankan will add to the conviction that looks to be growing within the BoJ to hike. Yesterday, the Summary of Opinions from the September policy meeting revealed the comment that “we can return to a stance of raising interest rates again” while another suggested the time could be approaching but after “checking the data a little more” before hiking. Of course with the US government shutdown, the BoJ may not be able to do that to the extent desired but we doubt that alone would deter the BoJ from acting. The Tankan report clearly suggests that the US-Japan trade deal has lowered the level of uncertainty and that has helped improve business sentiment.

The yen is the outperformer in the G10 space, advancing against all other G10 currencies with the pricing for a BoJ hike in October at 15bps. The government shutdown uncertainty could curtail speculative positioning for a hike but BoJ communications suggest there is enough evidence for the BoJ to be confident in hiking. There will be two crucial speeches before the end of the week. Tomorrow, Deputy Governor Uchida speaks at 07:35 (BST) at the National Securities Convention of Japan and then we think the more important speech will be on Friday (02:05 BST) by Governor Ueda at a meeting with business leaders in Osaka. With the leadership election on Saturday it may curtail his messaging but he could still use this opportunity to hint at a shift taking place within the BoJ toward a hike.

JAPAN TANKAN – EXPECTED GENERAL INFLATION (2.4%) AT NEW RECORD

Source: Bloomberg, Macrobond & MUFG GMR

USD: Shutdown begins as consumer confidence declines

A few hours ago (12:01 EDT) the government shutdown began – the first since Trump’s last term in office in Dec-Jan 2018-19 with no indication as of yet on who will back down in order to get a stop-gap bill agreed to re-commence government funding. The last shutdown lasted 35 days and I doubt many would be surprised at this stage if this shutdown was to last a considerable length of time as well. Still, as of now the financial market fallout is marginal. The S&P 500 finished up 0.4% while the 2-year Treasury yield fell just 1bp. The shutdown from 2018-19, which furloughed workers, was estimated by the Congressional Budget Office to have taken 0.1% Q/Q from GDP (non-annualised) in Q4 2018 and a further 0.2% Q/Q in Q1 2019. When the rebound in growth is then factored in the CBO estimated the permanent loss to GDP from the shutdown was 0.02% on calendar year growth in 2019. This explains the current degree of indifference to the start of this shutdown.

A few differences though are worth considering that could mean the markets do respond at some stage going forward if this shutdown gets extended. Firstly, President Trump is in his second term in office and is likely a lot more determined to get his way. His 2nd term in office so far has gone well and he has been a lot more aggressive in implementing his policies. He may not be willing to compromise like he did in the last shutdown. Secondly, and partly a reflection of this more aggressive approach, President Trump has threatened to fire rather than furlough government employees. In 2013 about 850k workers were furloughed in a shutdown that lasted 16 days while in 2018-19 the number furloughed was a little less, 800k but included workers working without pay. The 2013 episode was seen as impacting more workers. There is the potential then for this to be as large as the last examples but on this occasion the White House Office of Management and Budget could follow through with its threat and fire workers – likely ensuring a bigger drag on growth this time.

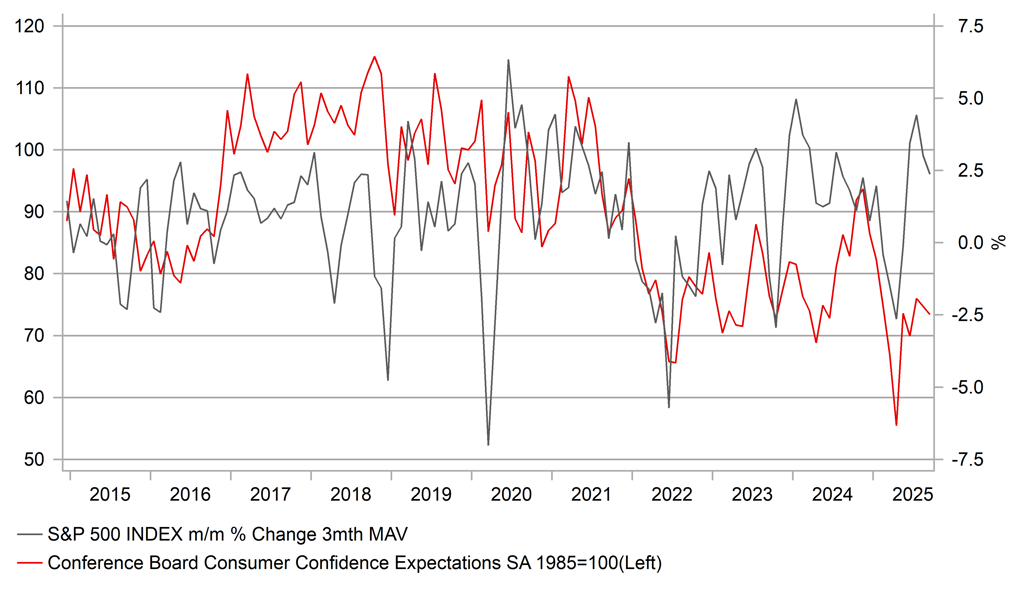

So the markets will be monitoring the risk of this more aggressive action. The economy also appears to be in a weaker position than in 2018-19. The 6mth average of payrolls growth into the October 2013 shutdown totalled 204k, in 2018-19 shutdown the same average was 146k while currently the 6mth average is a mere 64k. Another wave of unemployed workers would be entering a much weaker labour market. Consumer confidence is also fragile. In November 2018 consumer confidence was at 136.4, close to the highest level since 2000. Consumer confidence was lower in 2013 than the level reported yesterday, 94.20, but yesterday’s level remains well below the average over the last ten years (110.20).

If Trump does follow through with firing workers and the shutdown becomes prolonged, the rates market will at least look to price a greater prospect of a rate cut in October and December, a scenario still not fully priced, which will likely weigh on dollar performance over the short-term.

US CONSUMERS DEPRESSED – EQUITY GAINS NOT HELPING

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:55 |

ECB's Guindos speaks |

! |

|||

|

EC |

09:00 |

HCOB Eurozone Manufacturing PMI |

Sep F |

49.5 |

49.5 |

! |

|

UK |

09:30 |

S&P Global UK Manufacturing PMI |

Sep F |

46.2 |

46.2 |

! |

|

EC |

10:00 |

CPI Estimate YoY |

Sep P |

2.20% |

2.00% |

!!! |

|

EC |

10:00 |

CPI MoM |

Sep P |

0.10% |

0.10% |

!!! |

|

EC |

10:00 |

CPI Core YoY |

Sep P |

2.30% |

2.30% |

!! |

|

UK |

10:55 |

BoE's Mann speaks |

!!! |

|||

|

US |

13:15 |

ADP Employment change |

Sep |

51k |

54k |

!!! |

|

US |

14:45 |

S&P Global US Manufacturing PMI |

Sep F |

52 |

52 |

! |

|

US |

15:00 |

ISM Manufacturing |

Sep |

49 |

48.7 |

!!! |

|

US |

15:00 |

ISM Prices Paid |

Sep |

62.9 |

63.7 |

!!!! |

|

US |

15:00 |

ISM Employment |

Sep |

-- |

43.8 |

!!! |

|

US |

17:15 |

Fed's Barkin speaks |

!! |

Source: Bloomberg & Investing.com