Paring back of long JPY positions after cautious BoJ policy update

JPY: BoJ expresses more caution over delivering further rate hikes

The yen has weakened overnight following the BoJ’s latest policy meeting. It has helped to lift USD/JPY back above 144.50 as the pair moves further above the low of 139.89 set on 22nd April. It follows the BoJ’s decision to leave the policy rate unchanged at 0.50% while the updated economic projections and risk assessment signalled more caution over delivering further rate hikes. The BoJ’s first updated economic projections since President Trump’s “Liberation Day” tariffs announcement revealed that the forecast for GDP growth in Japan for the current fiscal year was revised lower by 0.6ppts to 0.5% and for the next fiscal year by 0.3ppts to 0.7% before growth is expected to pick back up to 1.0% in FY2027. At the same time, the BoJ’s updated projections for core inflation (excluding fresh food) were revised lowered by 0.2ppts to 2.2% for the current fiscal year and 0.3ppts for the next fiscal year after which it is expected to be close to the BoJ’s target at 1.9% in FY2027. It supports the BoJ’s decision to maintain guidance that it “will continue to raise the policy interest rate and adjust the degree of monetary accommodation” if its growth and inflation outlook materializes.

While the BoJ is still signalling that it likely to raise rates further, it now judges that risks are skewed to the downside to both growth and inflation for the current and following fiscal years. The BoJ emphasized that they were facing “extremely high” uncertainties ahead. In the accompanying press conference, Governor Ueda stated that he expected the price trend improvement to stall temporarily and judged that that likelihood of their economic outlook materializing is not as high as before. He believes it is hard to say when they will have more confidence in the outlook which will be needed to hike rate again. The comments reinforce our perception of increased BoJ caution over raising rates further this year.

The updated economic projections and risk assessment has further encouraged market participants to push back expectations for the timing of the BoJ’s next hike until the end of this year at the earliest. There are currently around 10bps of hikes priced in by year end. A quick trade deal/agreement between Japan and the US to reverse/water down tariffs imposed on Japan would help to ease downside risks for Japan’s economy directly although the BoJ would still likely remain concerned over downside risks to growth outside of Japan setting a higher hurdle for the BoJ to resume rate hikes this year. A slower pace of BoJ policy normalization will help to dampen yen strength in the near-term but is unlikely to reverse the current strengthening trend if global growth continues to slow and other major central banks including the Fed cut rates further resulting in yields spreads continuing to narrow between Japan and overseas.

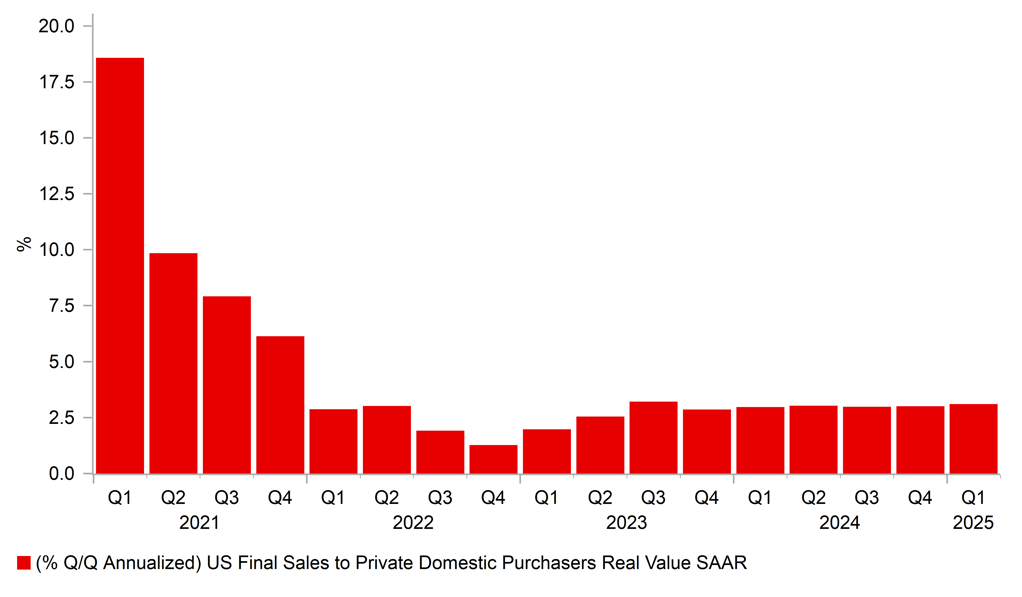

UNDERLYING DOMESTIC DEMAND REMAINED STRONG AHEAD OF TARIFFS

Source: Bloomberg, Macrobond & MUFG GMR

USD: US economy contracts ahead of nonfarm payrolls report

The US dollar has continued to rebound ahead of tomorrow’s nonfarm payrolls report for April. It has resulted in the dollar index rising back above the 100.00-level overnight although US dollar gains are mainly against the yen. The release of the latest nonfarm payrolls report tomorrow will be scrutinized closely to assess the initial negative impact on the US labour market from President Trump’s “Liberation Day” tariffs announcement. Trade policy disruption alongside heightened policy uncertainty at the start of President Trump’s second term is expected to make businesses become more cautious over hiring new employees in the near-term and has raised fears that they could go further and cut back if the US economy slows sharply in response to the negative trade shock. The release of the ADP survey was consistent with slowing employment growth estimating that private payrolls increased by just 62k in April.

The US economy was already being impacted by changes in US trade policy even before tariffs were implemented. The GDP report for Q1 revealed that the US economy contracted marginally in Q1 by an annualized rate of -0.3%. It was the first quarterly contraction since Q1 2022. The biggest drag on growth in Q1 was net trade as imports surged ahead of the tariff hikes and businesses built up inventories providing some offset to the hit to growth. Net trade subtracted an outsized -4.83ppts from growth in Q1 while inventories added 2.25ppts. At the same time, household consumption slowed in Q1 adding 1.21ppts to growth following on from robust growth recorded during the 2H of last year when the average quarterly contribution was 2.59ppts. While some slowdown in household consumption following robust growth in 2H 2024 was always likely, the sharp plunge in consumer confidence measures in recent months driven by inflation fears and angst over job security have since made it more likely that weaker growth will continue. Those concerns over much weaker growth are more than offsetting the near-term upside risks to inflation from tariff hikes when market participants weigh up the implications for Fed policy. The US rate market has moved to price in over 100bps of Fed rate cuts by the end of this year with the next cut expected by June or July. The upside surprise for the core PCE price index for Q1 coming in at 3.5% did not deter building Fed rate cut expectations. A much weaker nonfarm payrolls report tomorrow poses the main downside risk for the US dollar‘s recent tentative rebound.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

BoE Consumer Credit |

Mar |

1.200B |

1.358B |

! |

|

UK |

09:30 |

Manufacturing PMI |

Apr |

44.0 |

44.9 |

!!! |

|

US |

12:00 |

Dallas Fed PCE |

Mar |

-- |

3.00% |

! |

|

US |

12:30 |

Challenger Job Cuts |

Apr |

-- |

275.240K |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

224K |

222K |

!!! |

|

CA |

14:30 |

Manufacturing PMI |

Apr |

-- |

46.3 |

! |

|

US |

14:45 |

Manufacturing PMI |

Apr |

50.7 |

50.2 |

!!! |

|

US |

15:00 |

Construction Spending (MoM) |

Mar |

0.2% |

0.7% |

!! |

|

US |

15:00 |

ISM Manufacturing Employment |

Apr |

-- |

44.7 |

!! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,727B |

!! |

Source: Bloomberg