USD is trading on stronger footing ahead of FOMC meeting

USD: Stronger ECI reinforces expectations for hawkish Fed policy update

The US dollar has continued to trade on a stronger footing ahead of tonight’s FOMC meeting. It has resulted in USD/JPY rising back up to within touching distance of the 158.00-level. The US dollar regained upward momentum yesterday after the release of the latest US Employment Cost Index for Q1. The report revealed that the ECI rose more strongly than expected in Q1 by 1.2% up from 0.9% in Q4 2023. After stripping out the more volatile impact from benefit costs, wages and salaries increased by 1.1% for the third consecutive quarter. The Q1 ECI print is the last US economic release the Fed received before today’s FOMC meeting and it has reinforced market expectations for a hawkish policy update alongside the upside surprises for US inflation and GDP growth in Q1. Nevertheless the trend for employment costs has still slowed over the past year. Wages and salaries for private industry workers in service occupations increased by an annual rate of 4.2% in Q1 compared to a reading of 6.5% in the previous twelve months, and has moved back closer to the rate of growth in place in the year prior to the COVID shock when the annual rate of growth was running between 3.7% and 4.2%. Leading indicators such as the quits rate also continue to signal a further slowdown is likely in the year ahead.

For the Fed though the stronger Q1 ECI is more disappointing news that will encourage them to signal today that it will take longer to begin cutting rates. The US rate market has already reacted to the recent run of stronger US data and pushed back the timing of the first rate hike until later this year. The first Fed rate cut is now not fully priced until the December FOMC meeting. In light of the hawkish repricing that has already taken place in the US rate market, it provides a much higher hurdle for hawkish policy surprise today that injects fresh upward momentum into the US dollar. However, the dollar’s index’s close proximity to year to date highs in the run up to today’s FOMC meeting does increase the risk of another lurch higher. For an even bigger US dollar rally, the Fed would have to seriously cast doubt on the need for rate cuts at all this year which seems like too large a leap after still planning three cuts at the March FOMC meeting. At the same time, the Fed is expected to announce a detailed plan for slowing down the pace of QT. The Fed has already indicated that it is likely to half the pace of UST roll offs from the current rate of USD60 billion//month. While a slower roll off should help to ease upward pressure on US yields, the impact is unlikely to be sufficient to significant to weaken the US dollar.

The stronger US dollar has contributed to USD/JPY reversing around 60% of the abrupt move lower on Monday from a high of 160.17 to a low of 154.54. The BoJ reported yesterday that its current account will probably fall by JPY7.56 trillion today. It was much bigger than a drop of about JPY2.1 trillion estimated by private money brokers providing a strong signal that Japan intervened to support the yen on Monday. The report suggests that yen purchases totalled around JPY5.5 trillion which is similar in size to intervention undertaken on 21st October 2022. Price action in recent days highlights that it will be difficult for Japan to swim against the tide when fundamental drivers continue to encourage a higher USD/JPY in the near-term. It will keep pressure on Japan to intervene again if the pace of yen selling picks up again in the coming weeks and months.

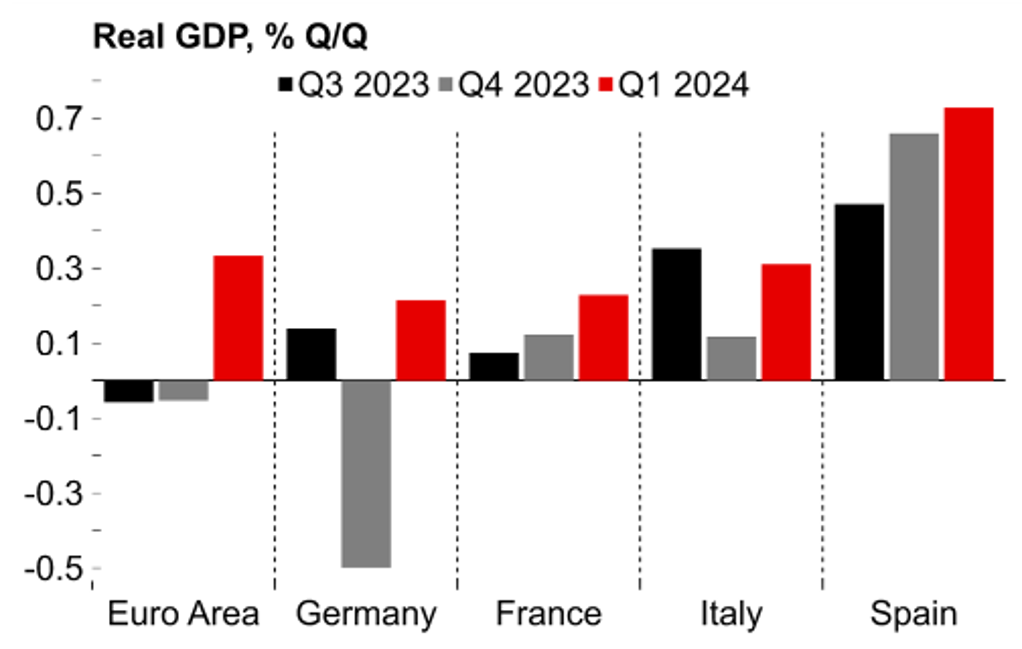

IMPROVING CYCLICAL MOMENTUM IN EURO-ZONE

Source: MUFG European Research Office

EUR: Slowing inflation & stronger growth keeps ECB on track to cut in June

The stronger US dollar has helped to drag EUR/USD to a low overnight of close to 1.0650 as yield spreads between the euro-zone and US continue to move in favour of a stronger US dollar. While the US rate market has been pushing back the timing of the first Fed rate cut, the euro-zone rate market remains confident that the ECB will begin to cut rates at their next policy meeting in June. There is currently around 17bps of ECB rate cuts priced in by the June ECB policy meeting. Those expectations were supported yesterday by further evidence of slowing inflation in the euro-zone. The report revealed that core inflation slowed by a further 0.2ppt to 2.7% in April. The ECB will have been reassured to see evidence that services inflation stepped down as well. Services inflation slowed to an annual rate of 3.7% which followed five consecutive months at 4.0% which is another step in the right direction. The favourable underlying inflation developments should give the ECB more confidence that inflation is heading back towards their target, and provide a green light to begin cutting rates in June.

The fading of the negative energy price shock in Europe appears to be bringing an end to the period of economic stagnation that has been in place since the end of 2022. The release yesterday of the latest GDP report from the euro-zone revealed that economic growth picked up more strongly than expected by 0.3% in Q1. It was the strongest quarterly growth since Q3 2022. Our European economist believes these Q1 GDP figures could be an inflation point for the euro-zone (click here) with stronger growth likely to continue through the rest of this year. The improving cyclical outlook for the euro-zone economy is one reason why the ER/USD has proven more resilient this year even as expectations for ECB and Fed policy divergence have widened.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Manufacturing PMI |

Apr |

48.7 |

50.3 |

!!! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Apr |

179K |

184K |

!!! |

|

CA |

13:15 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

CA |

14:30 |

Manufacturing PMI |

Apr |

50.2 |

49.8 |

! |

|

US |

14:45 |

Manufacturing PMI |

Apr |

49.9 |

51.9 |

!!! |

|

US |

15:00 |

Construction Spending (MoM) |

Mar |

0.3% |

-0.3% |

!! |

|

US |

15:00 |

ISM Manufacturing PMI |

Apr |

50.0 |

50.3 |

!!! |

|

US |

15:00 |

JOLTs Job Openings |

Mar |

8.680M |

8.756M |

!!! |

|

US |

19:00 |

Fed Interest Rate Decision |

-- |

5.50% |

5.50% |

!!! |

|

US |

19:30 |

FOMC Press Conference |

-- |

-- |

-- |

!!! |

|

CA |

21:15 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg