Tankan survey provides support for JPY amidst trade policy uncertainty

JPY: Stronger Tankan survey offset by lack of progress in trade talks

The yen has strengthened modestly during the Asian trading session resulting in USD/JPY falling to low of 143.44. The yen has been supported by the release overnight of the latest Tankan survey from Japan for Q2. The survey revealed a surprise pick-up in business confidence amongst large manufacturers providing some reassurance that Japanese exporters are holding up better than expected from trade disruption. Business conditions for large manufacturers increased +1 point to 13 in Q2 beating consensus expectations for -2 point decline. However, the negative impact from tariffs was more evident for large automakers where business conditions fell by 5 points to +8. The overall improvement in large manufacturers business conditions was driven the materials sector. Going forward large manufacturers expect business conditions to decline modestly from +13 to +12 in Q3. Large manufacturers’ plans for capital investor for the current fiscal year also came in higher than expected at +11.5%. Other details from the survey revealed that business conditions for small manufacturers declined modestly by 1 point to +1 in Q2, and that the outlook for inflation for five years ahead remained unchanged at 2.3% remaining above the BoJ’s 2.0% target.

Overall, the survey will keep pressure on the BoJ to consider tightening monetary policy further when the current level of heightened trade policy uncertainty eases. President Trump has added to trade policy uncertainty overnight when he posted “they won’t take our RICE, and yet they have a massive rice shortage. In other words, we’ll just be sending them a letter, and we love having them as a Trading Partner for many years to come”. It has been previously reported that the Trump administration will be sending letters to countries who are unable to reach trade agreements/deals informing them of the new higher tariff rates that will be applied. According to the Census Bureau, Japan imported USD298 million of rice form the US last year. The US has previously complained under the Biden administration that Japan’s “highly regulated and non-transparent system of importation and distribution of rice limits the ability of US exporters to have meaningful access to Japan’s customers”.

Japanese officials have largely refrained from commenting directly on President Trump’s remarks overnight. Japan’s trade negotiator Akazawa stated he was aware of Trump’s comment but declined to comment. He did add though that the two sides are not on the same page on some matters, and they won’t sacrifice farmers in trade negotiations. He is still exploring if it is possible to reach a trade agreement. President Trump’s comments on rice imports from Japan follow quickly his comments made over the weekend to Fox News when he warned “Dear Mr Japan, here’s the story: You’re going to pay a 25% tariff on your cars” indicating that the current tariff is likely to remain in place. The lack of progress in US trade talks will put a dampener on BoJ rate hike expectations and the yen providing an offset to the stronger Tankan survey.

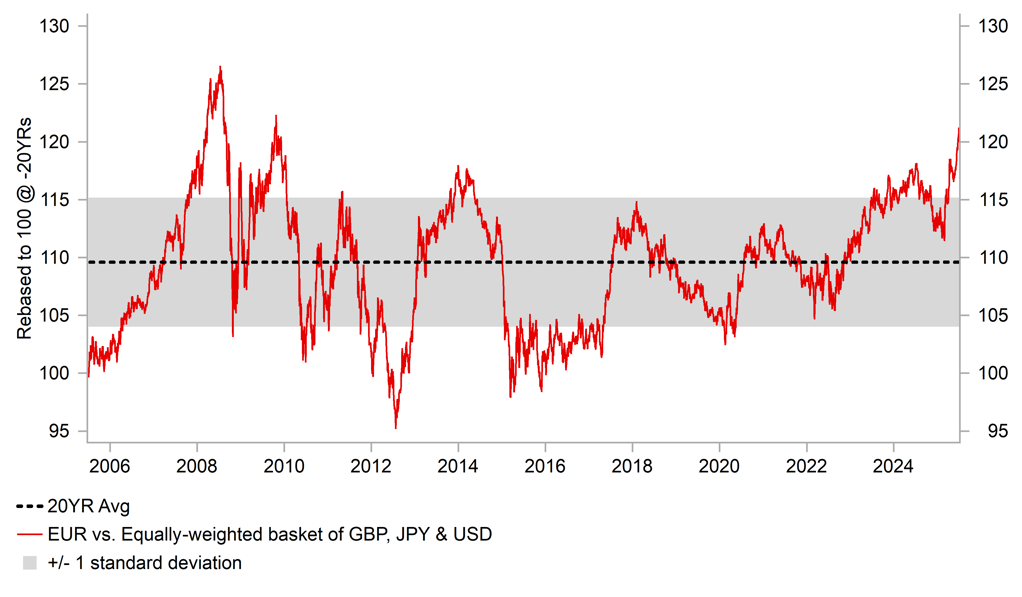

EURO STRENGTHENING SHARPLY AGAINST OTHER FX MAJORS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Stronger euro attracting more attention from ECB policymakers

The euro has continued to strengthen against the other major currencies hitting fresh highs yesterday against the US dollar, pound and yen. It has lifted EUR/USD back above the 1.1800-level, EUR/GBP up closer to the 0.8600-level and EUR/JPY to within touching distance of the 170.00-level. The euro has strengthened sharply by around 7.5% against an equally-weighted basket of the pound, US dollar and yen since the end of February. It is the strongest period of euro appreciation since between May 2020 and January 2021 during the initial strong global economic recovery from the COVID shock in early 2020. Recent strong gains for the euro are starting to attract more attention from ECB policymakers. Dovish Governing Council member Simkus stated that the “inflation outlook remains fragile”. He judges that there is a bigger risk of an inflation undershoot of the ECB’s target and stressed that they must monitor the speed of euro appreciation. In contrast, hawkish Governing Council member Nagel stated that “in the current situation, we are in calm waters”. He wants to wait to see the next round of ECB staff quarterly economic projections and incoming data before making a decision on whether to lower rates further in the autumn. He also downplayed the disinflationary impact from the stronger euro stating it is “only one factor”. He is hopeful that tariff negotiations with the US are “coming to a good end”.

The latest economic data releases from the euro-zone yesterday have encouraged expectations that the ECB will lower rates further this year although they are still expected to hold rates steady at this month’s policy meeting. It was revealed yesterday that headline inflation in Germany unexpectedly fell by 0.1 point to 2.0% in June, and German retail sales contracted by -1.6% in May. Inflation is still roughly in line with the ECB’s forecasts but disinflationary pressures support our forecast for two further cuts this year with the next one to be delivered in September. With the Fed expected to cut rates more than the ECB going forward, it is proving a tailwind for the euro to continue strengthening against the US dollar.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:40 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

IT |

08:45 |

HCOB Italy Manufacturing PMI |

Jun |

49.5 |

49.2 |

!! |

|

FR |

08:50 |

HCOB France Manufacturing PMI |

Jun |

47.8 |

49.8 |

!! |

|

GE |

08:55 |

HCOB Germany Manufacturing PMI |

Jun |

49.0 |

48.3 |

!! |

|

GE |

08:55 |

German Unemployment Change |

Jun |

18K |

34K |

!! |

|

GE |

08:55 |

German Unemployment Rate |

Jun |

6.4% |

6.3% |

!! |

|

EC |

09:00 |

HCOB Eurozone Manufacturing PMI |

Jun |

49.4 |

49.4 |

!! |

|

UK |

09:30 |

S&P Global Manufacturing PMI |

Jun |

47.7 |

46.4 |

!! |

|

EC |

10:00 |

Core CPI (YoY) |

Jun |

2.3% |

2.3% |

!! |

|

EC |

10:00 |

CPI (YoY) |

Jun |

2.0% |

1.9% |

!!! |

|

EC |

11:40 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

4.5% |

! |

|

UK |

14:30 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!! |

|

US |

14:30 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!! |

|

JP |

14:30 |

BOJ Gov Ueda Speaks |

-- |

-- |

-- |

! |

|

EC |

14:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

14:45 |

S&P Global Manufacturing PMI |

Jun |

52.0 |

52.0 |

!!! |

|

US |

15:00 |

Construction Spending (MoM) |

May |

-0.2% |

-0.4% |

!! |

|

US |

15:00 |

ISM Manufacturing PMI |

Jun |

48.8 |

48.5 |

!!! |

|

US |

15:00 |

JOLTS Job Openings |

May |

7.320M |

7.391M |

!!! |

Source: Bloomberg & Investing.com