Please download PDF using the link above for the full report

Key Points:

- Trump’s global tariffs setting seems reflect two considerations at least: one, reduce US trade deficits; two, reduce China’s role in global supply chain, particularly in Asia. A high tariff on China and larger gaps between US tariffs on China and on other economies will serve these purposes.

- With ASEAN economies largely getting 20% tariffs, a 40% tariffs on trans-shipping, and a pre-existing (roughly) 10% tariff gap between China and them, we think that the bottom level of potential US tariffs on China is about 30% and “ceiling” could be 40%. We expect a close to 40% tariffs on China.

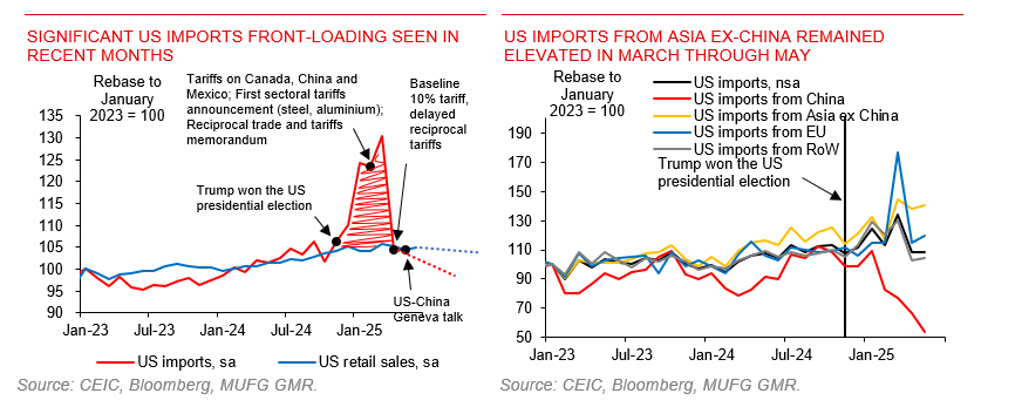

- Expect China’s exports growth to decelerate to -4%yoy in H2, due to 1) the pause and payback of Asia’s exports front-running, 2) trans-shipping crackdown, 3) potential weaker US demand caused by higher domestic prices, 4) and weaker global demand due to broad-based Trump tariffs.

- We estimate that 40% tariffs would reduce China GDP by 0.9%~1.2%. We expect real GDP to grow by 4.7%yoy in Q3, and 4.1%yoy in Q4, after a 5.3%yoy growth in H1, these imply a 4.85% growth for 2025, up from our previous forecast of 4.6%. The upward revision is largely due to the better-than-expected Q2 GDP growth.

- USD/CNY: positive surprises around US-China negotiations could send the USD/CNY lower to 7.10 in near term. However, still elevated tariffs on China and higher global tariffs are set to harm global demand, trade, we maintain our view of USD/CNY to reach 7.25 by Q3, and remain 7.25 by Q4.