Please download PDF using the link above for the full report

Key Points:

- The better performance of May retail sales was helped by trade-in program and seasonal factors. The rest of main macro data including IP, FAI, inflation, and credit, as well as exports, portrays a negative picture for Chinese economy in May.

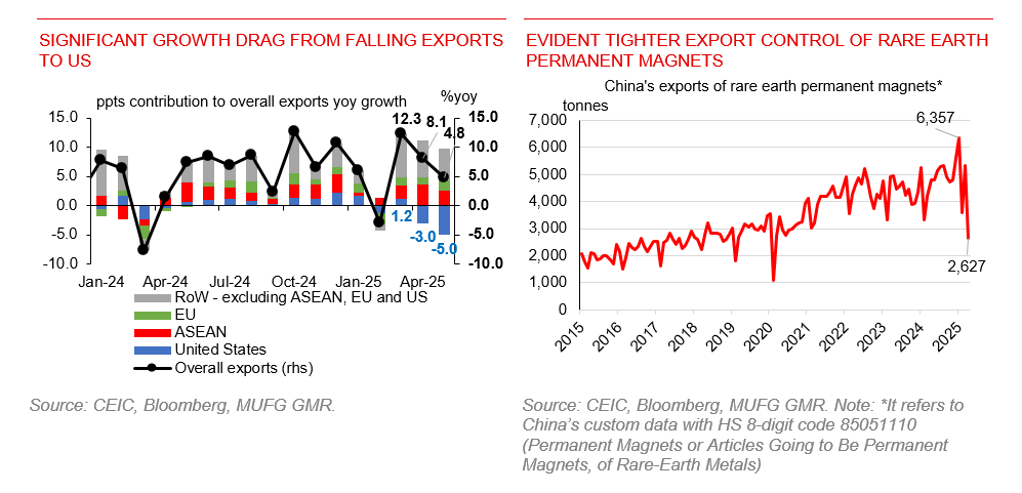

- A lower exports growth in May largely explains the weaker growths of IP and manufacturing FAI. We expect exports growth to further decelerate in 2H due to slower global growth, dissipating front-loading and reduced exports rerouting as some Asian economies likely are to be imposed with higher tariffs.

- Housing sector remained weak with property prices declining at accelerated pace. Private sector sentiment was weak too, indicated by a deceleration of private IP growth and a 0% growth of private FAI YTD growth.

- We expect 20bps policy rate cut in Q3 and measures to reduce the real cost of funding. While fiscal policy likely remains only reactive, the current weak condition and a challenging outlook require additional fiscal easing. Additional measures to stimulate property sector are needed to revive consumer sentiment and sustain an improving trend of retail sales.

- We maintain our growth of 4.6% for 2025, with a growth deceleration from Q1’s 5.4%yoy to Q4’s 4.2~4.3%, we maintain our USD/CNY forecasts of 7.20 for Q2, 7.25 for Q3 and 7.30 for Q4.