Please download PDF using the link above for the full report

Key Points:

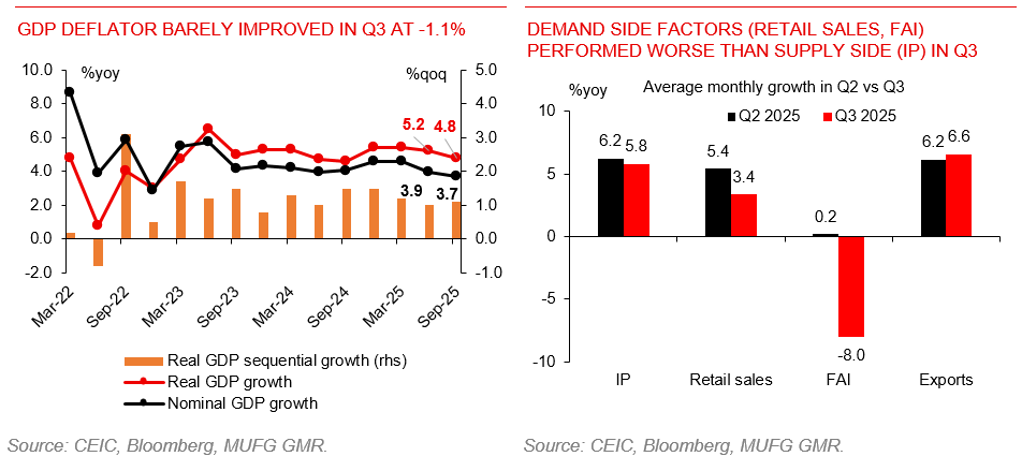

- Chinese economy expanded by 4.8%yoy in Q3. Q3 and September numbers indicate a decelerating Chinese economic performance and intensified divergent performances among different aspects of the economy. While resilient exports helped to push up IP growth lately, retails sales decelerated on the diminishing effect of trade-in programs, FAI YTD even contracted by -0.5%yoy and property investment contraction became even worse in September. Deflation was entrenched suggested by September CPI/PPI and Q3 GDP deflator. Recent credit data also confirmed a reality of insufficient demand and weak expectation.

- There seems a gap, recent monthly data looks more chilling than Q3’s 4.8%yoy GDP growth, why? This is because that China’s quarterly GDP accounting uses the production method, it is more biased towards supply, rather than demand side of measurement.

- In terms of near-term policy outlook, as it is likely achieve the 5% annual growth target for 2025, as long as a minimum 4.4%yoy GDP growth can be delivered for Q4, we expect only incremental policy support, particularly, as the implementation of RMB500bn policy-based financial instruments and RMB500bn special bonds is expected to drive the investment in remaining part of this year. Uncertainties are there, including effects of these “two RMB 500bn”, external environment, outcomes of US-China trade talks, and details of China’s 15th Five-Year Plan, these would matter for policy decisions in early 2026.

- USD/CNY: Recent China’s exports diversification straightens our existing views of moderate decline of the pair to 7.10 by end of Q4. While admitting the risks exist for both side, upside risk for CNY still appears large than downside risks, with China’s entering its 15th Five-year period.