Please download PDF using the link above for the full report

Key Points:

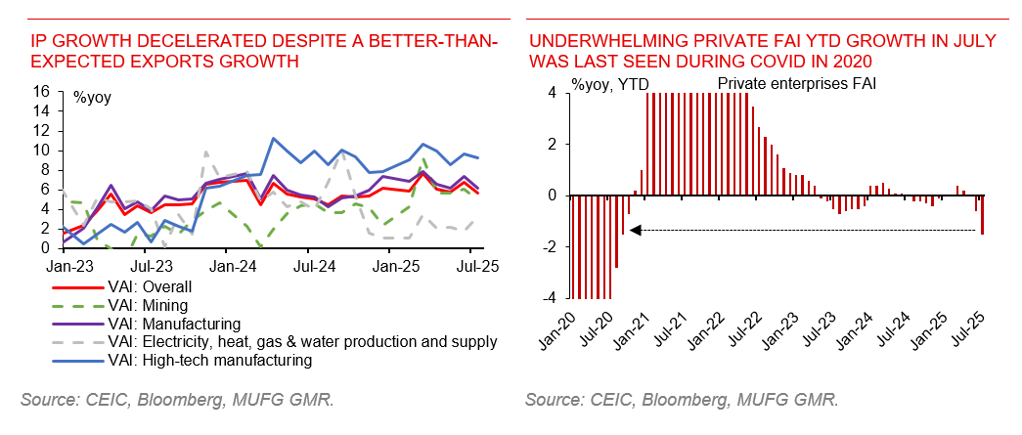

- Chinese economy displayed a broad-based weakness in July, despite an accelerated exports growth in the same period. Major indicators including retail sales, IP, FAI, and property sales/investment, all decelerated, consistent with recent release of July financial data (Link).

- July numbers imply a weakening effect of the trade-in policy. This, together with worsened labour market condition (the surveyed urban unemployment rate rose to 5.2% from June’s 5.0%) and the still struggling real estate sector, likely continue to weigh on domestic demand ahead.

- Recent Political Bureau meeting stated “macro policies should continue to exert force and increase force at the right time." We expect that the policy intensity in near term will be relatively restrained, more incremental fiscal policy may arrive in Q4 when the economy slows down more visibly. Fed’s rate cut ahead may open the window for PBOC to cut 7d reserve repo by 30bps in this cycle.

- Economic stress likely keeps USD/CNY at 7.20 by Q3 end and 7.25 by end of 2025.