Please download PDF using the link above for the full report

Key Points:

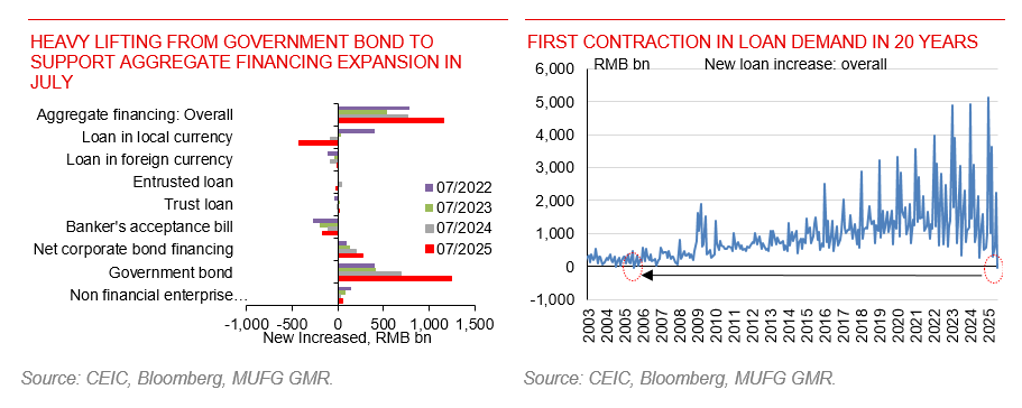

- July financial data indicated an insufficient financing demand by both households and enterprises, with households’ loan stock declining for the first time in 20 years.

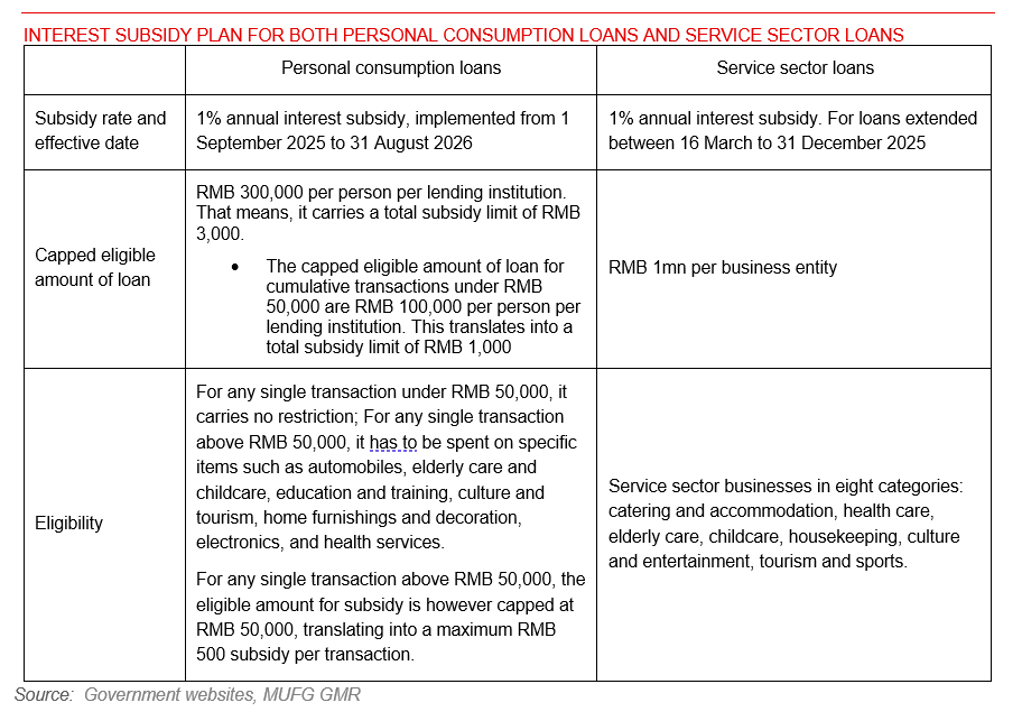

- Various policies were issued lately, ranging from kindergarten fee reductions, to interest subsidies for loans to consumers and service companies. This reflects government’s priority to boost consumption. Services industry is a good lever, as it is conducive to a better employment condition and expanding demand.

- The rising trend of deposit, in contrast of declining loan, suggest more support is needed. PBOC’s Q2 Banker Survey Report shows that bankers expected further loosening in Q3, we share same view. We expect further 30bps policy rate cut in this cycle, particularly as we only see some incremental fiscal support in Q4, and Chinese economic growth likely slows down due to weaker exports caused by global tariffs increase and payback of prior exports front-running.