Week Ahead FX outlook:

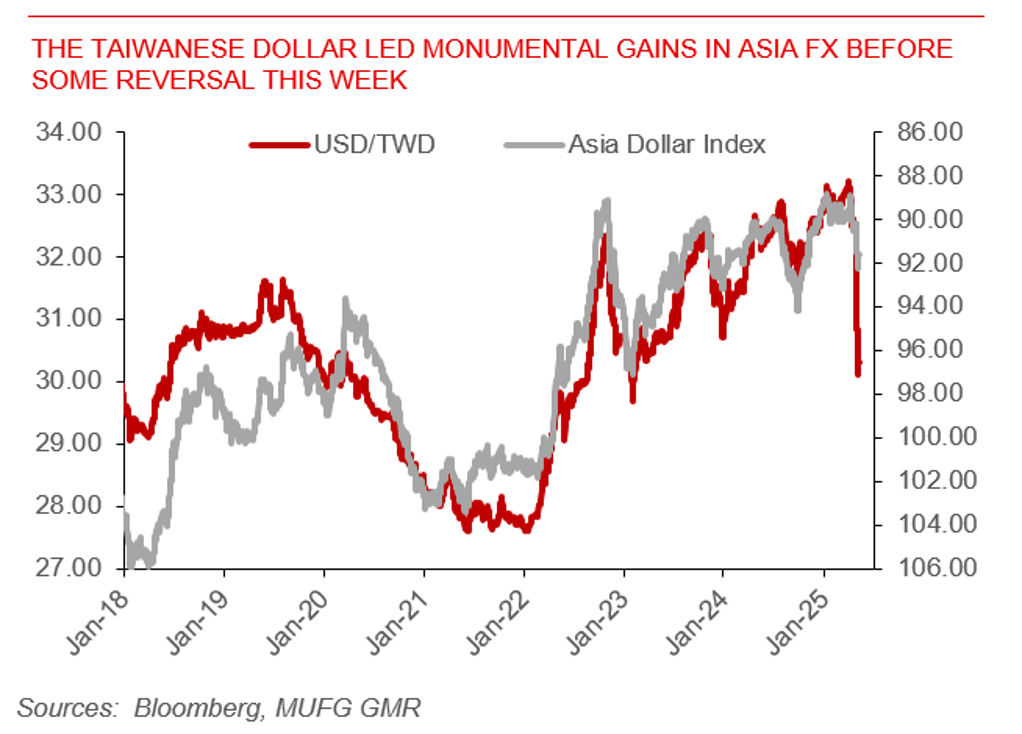

This past week brought many key developments including monumental moves and strength in Asian FX led by the Taiwanese Dollar at the start of the week, before some reversal in Asian currency strength as the US Dollar rebounded. To put things in perspective, we had the largest 2-day gain in TWD against the US Dollar since at least 1983, while at the same time this helped to pull the likes of KRW, MYR and SGD stronger at least in the 1st half of the week. The drivers for Taiwan are to some extent specific to the currency including exporters converting their accumulated FX proceeds (from exports) amidst a weaker S dollar and Taiwanese life insurers’ catchup in hedging, but the big question for the rest of Asia as well is whether this could signify a more fundamental structural shift in Dollar hoarding trends and re-allocation away from US assets.

Meanwhile, developments on trade deals were also key for markets this week, with President Trump announcing a trade framework with the UK, which provides some clues on the path forward for deals with other countries. Importantly, it seems the 10% base tariffs are mostly here to stay, while second, the US is showing some flexibility on sectoral tariffs, which could have important implications for how other countries including Japan, South Korea and India negotiate moving forward.

The key for markets moving forward will also be the upcoming US and China talks this week in Switzerland between China’s Vice Premier He Lifeng and US Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer. Reuters reported that the negotiating teams in Switzerland are expected to discuss reductions to the broader tariffs, with talks covering duties on specific products, export controls, and Trump’s decision to end de minimis exemptions on low-value imports. The NY Post meanwhile reported that the Trump administration is weighing a plan to reduce the 145% tariff on Chinese imports by more than half – effective as soon as next week – to between 50% and 54%. Meanwhile, trade taxes on neighbouring south Asian countries (presumably including Vietnam) will be cut to 25% according to the NY Post article.

The Taiwanese Dollar led monumental gains in Asia FX before some reversal this week