Week Ahead FX outlook:

Key FX views:

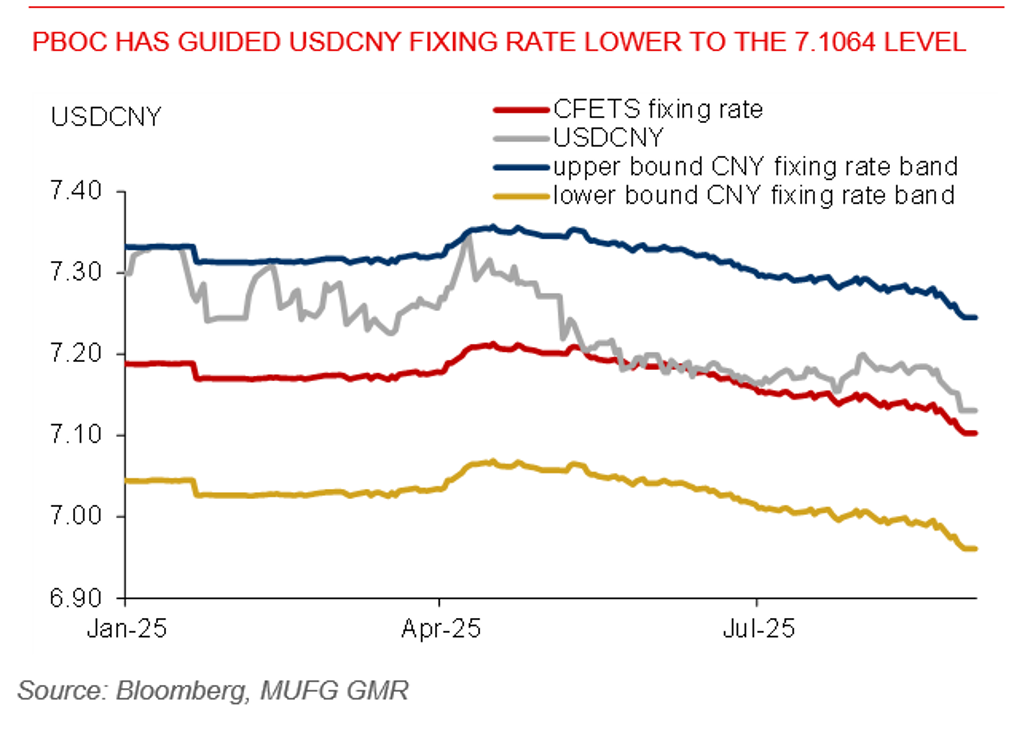

This week, market started with an increased uncertainty as the US Court of Appeals ruled that Trump’s use of the International Emergency Economic Powers Act (IEEPA) exceeded the limits of the law in his imposition of the tariffs. Fed issued its Beige Book this week, and it indicated that the US economic activity has been largely flat in recent weeks with prices rising modestly. US long-term 10-year bond yield declined 6bps this week, ahead of nonfarm payrolls release later this evening, while the US dollar displayed a mild volatility only and delivered a mild 0.4% appreciation. In Asia, political uncertainty lingered in Indonesia and Thailand, but the recovery was seen in both stock market performances and currencies. Good stock market performance has been a main supporting for CNY’s strength in past weeks. In the earlier part of this week, China’s benchmark CSI 300 index experienced a three-day selloff, before a bounce back as investors mulled the stronger China’s ties with North Korea and India. PBOC’s USD/CNY fixing setting was largely market driving, the implied strength of CNY from the fixing numbers was consistent with market sentiment and portfolio flow conditions.

Looking ahead, China’s trade, credit and price data are the main focus. We continue to expect weaker exports on US tariffs, soft loan demand, and near-zero CPI inflation, but potential narrower decline in factory-gate prices due to recent anti-involution campaign. Key data releases in Asia include India’s CPI print which will be crucial for the RBI’s rate path ahead. Further inflation moderation would give the bank room to ease policy rate. Japan’s final Q2 GDP will be released on Monday and private capex could be key to watch. Outside of Asia, August US CPI data next week will be crucial to understand the pace of passthrough of tariffs to US inflation. So far, only a modest pickup in goods inflation was seen in June-July. A stronger-than-expected CPI print could lead to markets paring back some of their rate-cut expectations. Meanwhile, the ECB is likely to hold interest rates steady. The Standing Committee of China’s National People’s Congress meets in Beijing next week to review several draft laws.

PBoC has guided USDCNY fixing rate lower to the 7.1064 level