Week Ahead FX outlook:

FX view: In Asia this week, one of the more consequential macro developments was the announcement by Trump through social media on a trade deal between the US and Vietnam. This was only the third official agreement that was announced by the Trump 2.0 administration - after the UK and China - and is important not just for Vietnam itself but potentially for its read-through to Asia and possible trade deals with the US more broadly. Specifically, Trump said that a 20% tariff rate will be placed on "any and all goods" from Vietnam to the US, with a 40% tariff rate on "any Transshipping". While this is lower than the 46% reciprocal tariff announced on Liberation Day, it is still higher than tariffs imposed pre-Trump 2.0. The most concerning question is the definition of "transshipment", and whether this heralds an entirely new definition of rules of origin, and on a related note how China may respond to these moves by the US. In particular, if transshipment is defined and enforced solely for the most egregious practices of plain diversion of trade to avoid US tariffs, these moves are understandable and the impact may be more limited. Conversely, if there is a stricter or alternative definition of transshipment defined as a certain threshold of foreign value added, or perhaps even a threshold of foreign value added from a specific country such as China, how that sliding scale is defined and calculated could matter greatly for not just for Vietnam’s exports but also trade relations with the rest of Asia.

There are already news reports of the US trying to enforce these differentiated tariffs on foreign content on other countries such as India, though these efforts have met with pushback. All these could herald a new approach to trade and also raises fascinating questions around what exactly is "Chinese" or "foreign" content in today's globalised supply chains, and whether all these will incentivise countries to perhaps localise and also regionalise their supply chains further. There is also a related and important question of how China will respond in practice to these changes, and whether it would perceive these moves as unfairly targeting its exporters and companies.

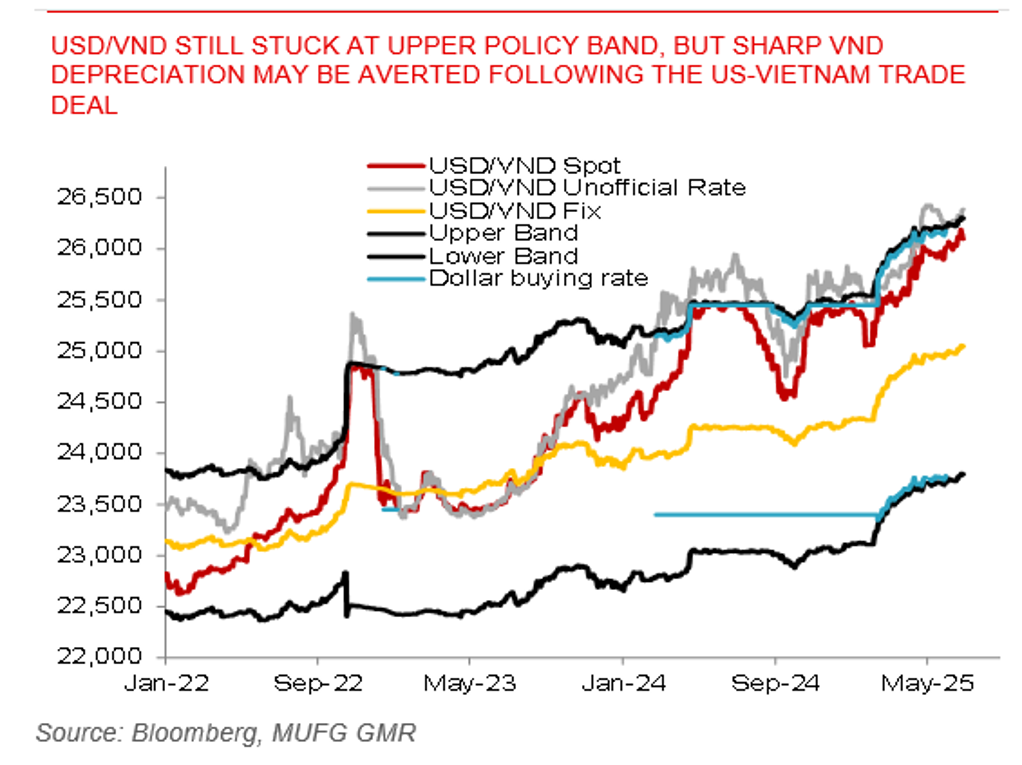

USD/VND still stuck at upper policy band, but sharp VND depreciation may be averted following the US-Vietnam trade deal