Week Ahead FX outlook:

Key FX views:

Asian currencies are likely to trade with a cautious tone in the week ahead, as regional macro data and global risk sentiment continue to shape FX direction. A hawkish tone by Fed Chair Powell has provided a supportive backdrop for the US dollar for now, with markets taking off some December Fed rate-cut bets.

Manufacturing PMIs from Indonesia, South Korea, Taiwan, Vietnam, and China will set the early tone. China’s RatingDog (formerly Caixin) manufacturing PMI is expected to ease to 50.5, while the official PMI has already slipped to 49.0 in October, from 49.8 in September, reflecting a slowdown in factory activity. Taiwan’s PMI remains in contraction, likely weighed down by weakness in non-electronics sectors, while India’s manufacturing momentum remains robust. This divergence underscores the uneven recovery across Asia.

Chinese export data for October will also be closely watched for signs of trade resilience. While exports to the US are expected to remain under pressure, diversification toward Africa and ASEAN markets could continue to support trade surplus and stabilise the Chinese yuan.

In Indonesia, we expect Q3 GDP to hold around 5%yoy, supported by resilient exports and accommodative macro policies. However, CPI could edge higher on food price inflation, and any upside CPI surprise may weigh on IDR.

Policy decisions will also be key: we expect Bank Negara Malaysia to keep the policy rate unchanged at 2.75%, supporting MYR, while persistent deflation in Thailand could prompt further easing by the Bank of Thailand, limiting THB upside.

Despite potentially constructive regional data, broader USD strength and the repricing of Fed rate cut expectations could keep most Asian currencies on the defensive in the near term.

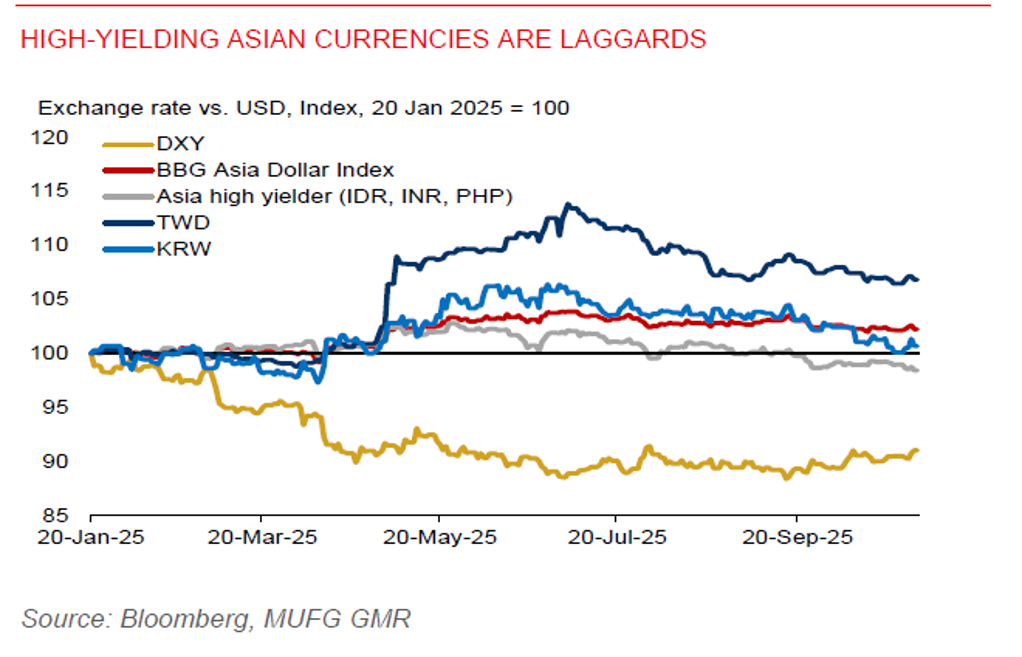

High-yielding Asian currencies are laggards