Week Ahead FX outlook:

It has been a particularly volatile week both in global and Asia FX markets, with some reversal of Dollar weakness and with that Asian currencies have generally weakened last week. The confluence of global factors includes significant volatility in the JGB markets with reported shifts in issuance resulting in a global bond rally and consequent US dollar strength. Meanwhile the ruling by the US Court of International Trade against Trump’s IEEPA tariffs during Liberation Day also resulted in some knee-jerking repricing in Asian FX, although we note that this ruling has subsequently been paused by the Court of Appeals pending further consideration at least until 9 June.

Looking ahead, Asian markets will focus next week on South Korea’s Presidential Elections, RBI’s monetary policy meeting, coupled with US non-farm payrolls. 3 June will see South Korea go to the polls to vote a new President, with two leading candidates – Lee Jae-myung of the Democratic Party of Korea, and Kim Moon-soo of the People Power Party. While latest indications still point to a win by Lee Jae-myung of the DP as the most likely scenario, the polls show a tightening race between the top 2 candidates. Both candidates are generally supportive of fiscal easing, but we note that there will likely be a larger fiscal stimulus if Lee Jae-myung were to win. This is both because the DP is generally more supportive of fiscal expansion and bigger government, with Lee Jae-myung proposing an extra budget worth 1.2% of GDP to prop up the economy for instance, and also because a Lee victory would result in both the presidency and parliament under the same party, making it easier for a supplemental budget to get through.

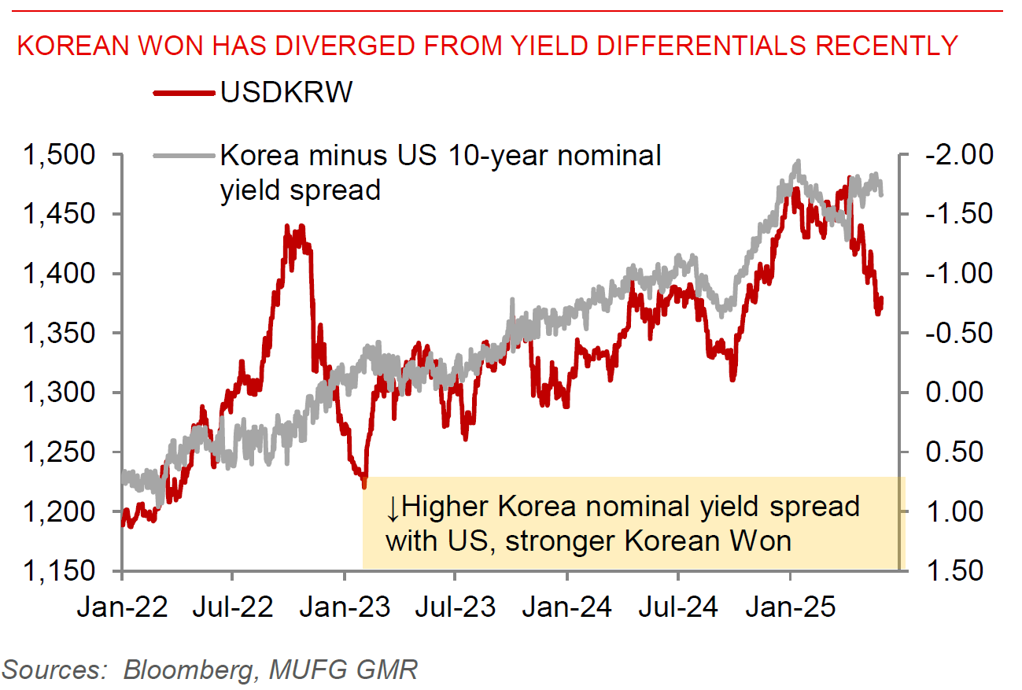

From a macro and markets perspective, we still think the dominant factor for KRW will be the negative impact of tariffs and also the underlying structural weakness of South Korea’s economy including its soft property market and weak domestic demand. As such, we are neutral on KRW and forecast USD/KRW at 1400 by 1Q2026 (see KRW – will it catch up to TWD’s recent gain).

Korean Won has diverged from yield differentials recently