Week Ahead FX outlook:

Key FX views:

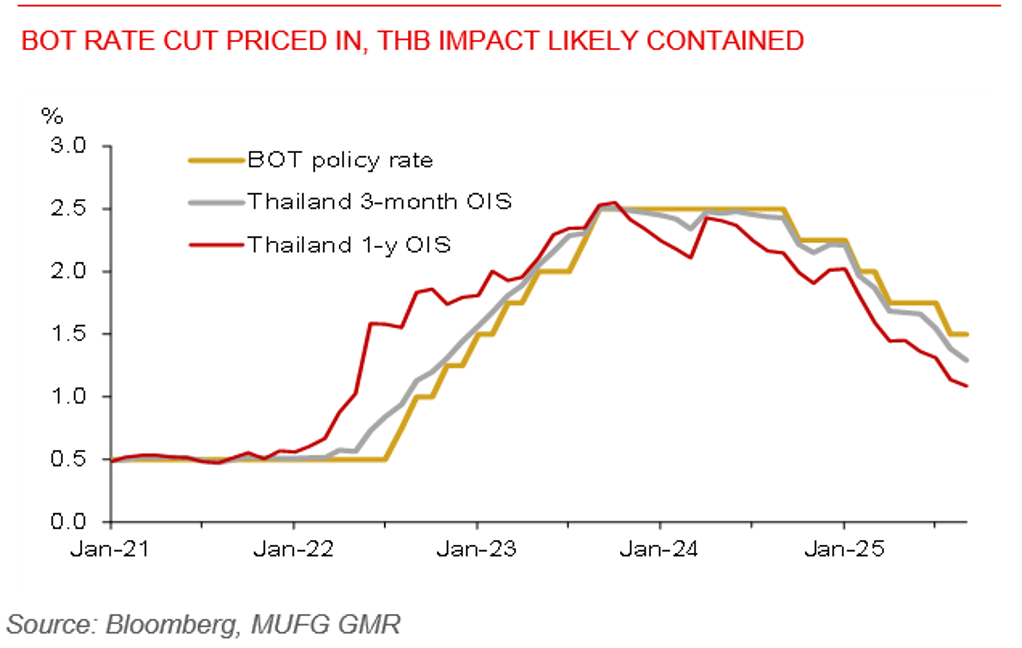

The spotlight next week falls on the upcoming monetary policy decisions from the Bank of Thailand (BoT) and the Bangko Sentral ng Pilipinas (BSP). We expect the BoT to deliver a 25bps rate cut, bringing the benchmark rate down to 1.25%, while the BSP is likely to hold its borrowing rate steady at 5.00%.

The BoT appears poised to shift toward a more accommodative stance, reflecting growing concerns over Thailand’s prolonged economic slowdown. Export sentiment in Thailand and South Korea has deteriorated to its lowest levels since 2023, while Singapore’s export optimism has also reversed since May. Domestically, Thailand’s growth momentum continues to falter. Private consumption was flat month-on-month, and private investment contracted by 0.2%mom. Tourist arrivals fell 12.8%yoy in August, reaching just 74.4% of pre-COVID August 2019 levels. Credit growth remains subdued, especially in SME and personal consumption, underscoring weak demand-side dynamics.

Thailand’s inflation remains in prolonged deflation, keeping real policy rates elevated relative to the 2015–2019 pre-COVID average. This provides the BoT with room to ease further. The upcoming meeting also marks the first policy decision under new Governor Vitai, and a rate cut would signal his dovish leanings. However, with markets largely pricing in the October rate cut, the immediate impact on the Thai baht may be contained. We expect the baht to remain around 32.50 against the US dollar.

In contrast, the BSP is expected to remain on hold, having already delivered successive rate cuts. The central bank has recently adopted a more cautious tone on further easing, particularly as the Philippine peso has weakened. This suggests a pause in easing as BSP monitors inflation and external vulnerabilities.

Meanwhile, uncertainty around the release of the US nonfarm payrolls report for September, due to the ongoing US government shutdown, could keep global markets on edge. With recent ADP data and hiring trends pointing to downside risks, any delay or disappointment in the jobs report could weigh on sentiment towards the US dollar.

BoT rate cut priced in, THB impact likely contained