Week Ahead FX outlook:

Key FX views:

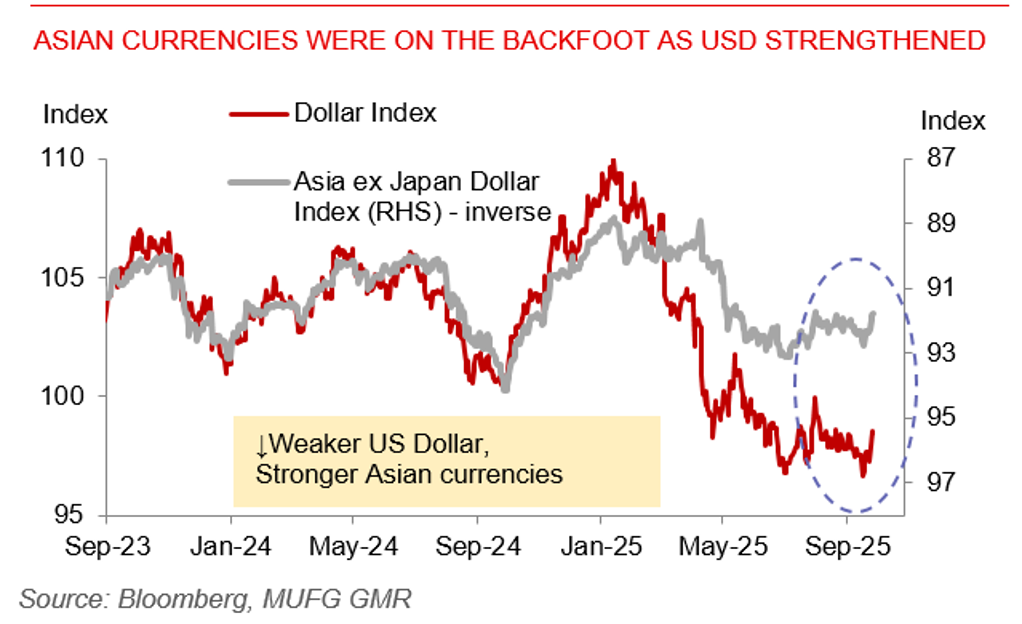

The week has been dominated by a stronger US dollar which spilled over into regional Asian currencies as well, underpinned by better US macro data and higher Treasury yields. Beyond the macro, sentiment was also tempered by new US tariffs targeting pharmaceuticals, heavy trucks, and furniture, alongside geopolitical tensions and uncertainties around a possible US government shutdown. These developments have kept Asian currencies under pressure, with high-yielders like INR and IDR looking more vulnerable, while the yen remains weaker than yield differentials suggest amid Japan’s ongoing political uncertainty ahead of the LDP leadership vote. Regionally, India continues to face headwinds from H-1B visa policy confusion and tariff risks, reinforcing expectations for INR underperformance. Meanwhile, Singapore’s exposure to US pharma tariffs adds another layer of uncertainty, given its high-end pharmaceutical exports.

This coming week in Asia will be dominated by China’s September PMIs and industrial profit data, both of which are expected to show soft macro momentum in China. China’s Golden Week begins on October 1, and markets will also watch the Chinese holiday spending indicators closely as a potential gauge of consumer trends. Elsewhere, we expect the Reserve Bank of India to cut rates by 25bps to 5.25% amid below-target inflation and tariff headwinds. While the consensus expectation is calling for a hold in RBI’s policy rate, it is quite split with 9 out of 27 economists calling for a rate cut. We think lower CPI inflation in India, better monsoon outturns, uncertainties around tariffs, coupled with a still uncertain global environment and US policies will tilt the balance towards a rate cut. Markets will also watch for export data out from South Korea for the month of September, which would be the first indication of how exports from Asia are performing post implementation of the US tariffs, notwithstanding the fact that some goods are still exempt from tariffs.

On the global front, attention will turn to the US September jobs report on Friday. A weak print could cement expectations for further rate cuts. Other key US releases include ISM manufacturing and services surveys, job openings, and consumer confidence. Political risks also loom, with the US government facing a potential shutdown if funding talks fail by September 30. The results and details of Japan’s Tankan survey will also be important in shaping expectations for a BOJ rate hike, and ahead of the upcoming LDP Presidential Elections on 4 October.

Asian currencies were on the backfoot as USD strengthened