Week Ahead FX outlook:

Key FX views:

There were a flurry of trade announcements including more details on the trade deal between the US and Indonesia. Among others, the key market mover was the trade deal that was announced between US and Japan. Details are still somewhat sparse, but the headlines suggest a 15% reciprocal tariff on US imports from Japan (from 25% previously) including on auto sectoral tariffs, coupled with a US$550bn joint investment fund between the US and Japan.

There are a few key implications from the developments in trade announcements from our perspective. First, at face value the deal suggests Section 232 sectoral tariffs on autos between US and Japan fall from 25% to 15%. If this is right this would be an important win for Japan, and may also push other countries having ongoing negotiations to prod for sectoral concessions (eg. EU for autos, Singapore and India for pharma, Taiwan and South Korea for electronics etc).

Second, the trade agreement factsheet between the US and Indonesia seems very one-sided at face value with a wide range of non-tariff barriers highlighted. Nonetheless the wording leaves some space for negotiations for some areas such as tariffs on strategic goods, non-tariff barriers (nebulous terms such as "commit" and "work together"), and rules of origin. This could ultimately bring effective tariff rates down below 19% between the US and Indonesia depending on details.

Third, other countries such as India will view this factsheet between Indo and US with some concern, given the one-sided nature on paper. As such we think the negotiating team between US and India are still sorting through details including what exactly will be announced and put down on paper, most importantly sensitive sectors such as agriculture.

Lastly, the reference to discussion on rules of origin is important, and gives us greater confidence that "transshipment" for other countries including Vietnam will be defined as a certain percentage of foreign value added, perhaps from a specific country such as China. How exactly to define and enforce is still unclear.

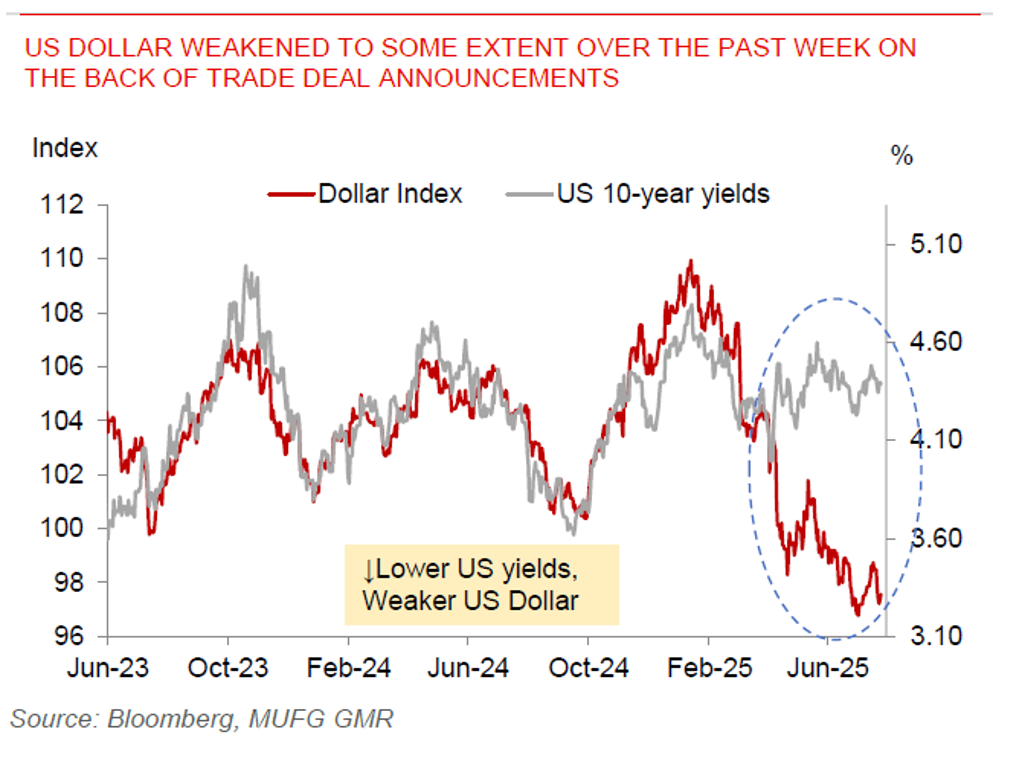

US dollar weakened to some extent over the past week on the back of trade deal announcements