Week Ahead FX outlook:

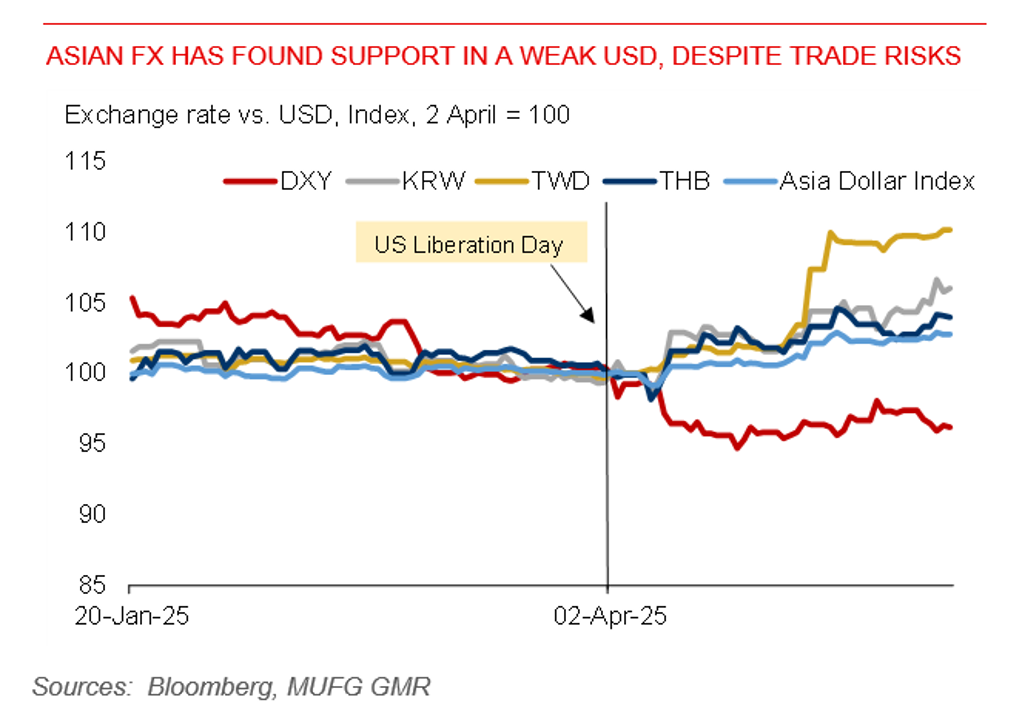

Asian currencies have continued to find support in a weaker US dollar. Markets have seemingly perceived that President Trump is looking for a weaker US dollar versus several Asian currencies as part of bilateral trade negotiations. Bloomberg news recently reported that the Taiwanese authorities had allowed the TWD to appreciate sharply earlier this month. The deputy governor of CBC has said that this strategic move is to allow market expectations for TWD gains to play out. But this is apparently at odds with the Taiwan central bank’s past preference to intervene in the FX market to smooth out volatility. The Korean won has also advanced sharply on the news that the US-South Korea finished the second technical discussions on 22 May. The Thai baht is also a notable gainer against the US dollar this week, though Thai commerce minister has denied that FX policy will be part of the trade talk. References to FX manipulation by Trump and US Treasury Secretary Scott Bessent have likely helped to fuel market speculation for lower USD/Asia pairs.

Based on the last currency manipulation report in November, several Asian economies were “under monitoring” for FX manipulation, including South Korea and Taiwan, where their currencies have notably rallied, as well as China, Vietnam, and Singapore. It thus bears watching whether market determined exchange rate will remain the underlying principle of US trade policy. Any signs of FX discussion with the US could be an upside risk to Asian currencies.

The key highlight for Asia in the week ahead is the Bank of Korea policy rate decision and India’s Q1 GDP. We look for the BoK to cut the policy rate by 25bps to 2.50%, given slowing domestic growth and tariff headwinds. The 25% levies on autos and steel, as well as the baseline 10% tariffs, will hurt Korean exports. In addition, with South Korea’s inflation relatively contained at 2.1%, the BoK has room to ease further to help support growth.

Asian FX has found support in a weaker USD, despite trade risks