Week Ahead FX outlook:

Key FX views:

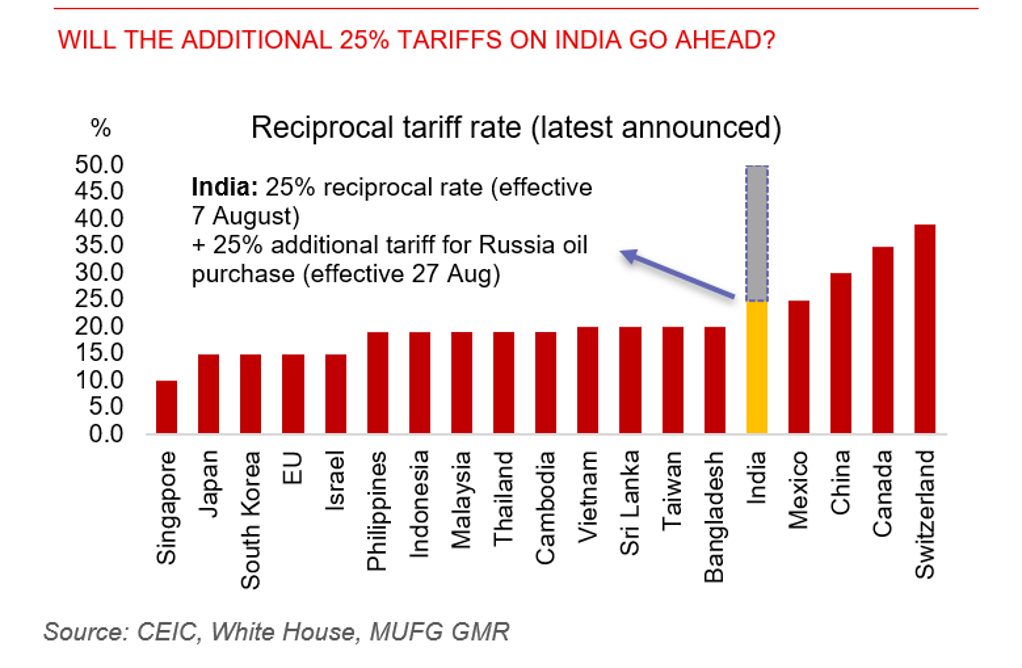

The week ahead will be shaped by trade tensions, central bank decisions, and high-level diplomacy. In the immediate term, the aftermath of Powell’s speech from the Jackson Hole symposium will be key for the direction of markets. Trade frictions may intensify as uncertainty abounds around whether the Trump administration will impose 50% tariffs on India, currently slated to start Aug. 27. Against this backdrop, President Trump will meet South Korean President Lee Jae Myung at the White House on Aug. 25, following Lee’s visit to Japan. The key for markets will be the tone of the meeting between President Trump and President Lee, and whether we get any details on trade deal implementation.

In Asia, monetary policy takes center stage. We think the Bank of Korea is still inclined to cut its policy rate next week on Aug. 28, with concerns over export slowdown outweighing financial stability concerns. We forecast the Philippines central bank to cut its benchmark rate by 25 bps to 5.00%, with benign inflation and slowing growth providing room. We are also forecasting BSP to ultimately cut rates by another 25bps, bringing rates to 4.75% by end-2025.

Meanwhile, India’s GDP growth may also be important for markets. We expect some slowing in GDP growth, but also note that the high frequency indicators we track shows some rebound in activity in August, helped by better rural consumption and investment activity. More broadly, there are multiple push and pull factors for the path ahead for India’s macro and markets. For one, the uncertainty around whether tariffs of up to 50% will be imposed on India come 27 August will be key in the near-term, and this will matter for many employment intensive sectors such as textiles and gems and jewellery. Second, any potential offsetting reforms will also be key, and we take India Prime Minister’s announcement of GST reform as a positive factor for INR and India’s economy. Globally, investors will watch US PCE inflation and GDP data, alongside earnings from Nvidia, Alibaba, and BYD, for cues on growth and policy direction.

Will the additional 25% tariffs on India go ahead?